| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 25 26 27 28 29 >>Post Follow-up |

| sandjco 648 posts msg #153599 - Ignore sandjco modified |

8/16/2020 12:15:59 AM @Mac and Xarlor, Thank you; as, I always appreciate the kind words specially from both of you as you've been absolutely instrumental in my learning and both of you are just super kind individuals. RE: trade log It will be a challenge for sure. posting publicly made me mentally accountable. Can't wait for Mondays! P.S. @dash...if there is anything else I can do to help, don't hesitate. I know what it is like not having anyone to chat (till I found a few trading buddies who can relate). I may not be posting my usual updates but I will continue to help if i can. |

| miketranz 979 posts msg #153605 - Ignore miketranz |

8/16/2020 1:25:54 PM Sandjco I'm sure everyone on here appreciates your contributions.Thank you for sharing.Miketranz... |

| Mactheriverrat 3,178 posts msg #153607 - Ignore Mactheriverrat |

8/16/2020 3:39:45 PM Thank you Sandjco. I try most of the time to explain things that I post to HELP others learn . |

| sandjco 648 posts msg #153610 - Ignore sandjco modified |

8/16/2020 4:51:31 PM @miketranz...thank you! Appreciate you dropping by and helping me out by posting your thoughts over the years! @Mac...please don't ever leave like the other good ones! ;=P. I knew I was gonna kick myself after I posted what would have been my last post on this specific thread lol! I totally forgot one of the most important goal I had...to leave a trail for my kids to use so they can navigate SF so they can start playing the game in half the time it took their old man to get started! So, here is my attempt at an FAQ type post (and forgive me if I post again if I forgot something as SF won't allow me to edit after a certain time)... I was gonna call it the TEN Tips to Derp free Trading??? that i have learned thru this journey that made a HUMONGOUS impact in mindset and results. #1 NO ONE is INFALLIBLE. Yep, even the richest or most successful traders. News outlets will want to quote (e.g. Buffet sitting on a cash hoard = implying ...?) rock stars in the business to complete their narrative. The Market does not care how famous you are. Buffet refused to invest in Apple years ago or anything Tech...and ended up missing the massive runs over the past 10 years. Find yourself; find your own path. #2 You are only as GOOD as your LAST TRADE. Yep, when a trade is done; no need to go back and admire it thinking your next one is for sure going to end up the same exact way because it got triggered by the same exact system or indicator. Stay humble. Keep good detailed records (I am trying). #3 The Market plays its own tune; it does NOT care what you prefer, think or like. Either you want to dance with the prevailing tune or don't dance at all (and it is OK). The tunes? Uptrend, Downtrend and Sideways. Within those trends, there are mini trends as well - uptrend, downtrend and sideways!!! #4 It is never too late to join the party. IMHO, knowing "that you have to" leave is the important part. Calling the "top" or "bottom" IMHO isn't as important as asking yourself...how do I make money with the current situation? #5 Profit is profit. Wishing could've, would've, and should've is a waste of time (thanks Xarlor!). Move on to the next date! #6 Think in BETs. Thanks four!!!! If you haven't read the book; read it and apply. If you find yourself "hoping" a position will...you know it was a derp move! Think of it as like bringing a date home in your drunken state and waking the next morning hoping that...and despite seeing proof she ain't sleeping beauty, you are still "hoping" plastic surgery will fix the problem! Ummmm.... On using SF #7 The "holy grail" may not be a "system" at all. Maybe you've had it all along; you just needed to discover "you" (your brain) vis a vis money, "wins", "losses".... How you handle your demons will most likely dictate your success or lack of. While the XIV trade was my biggest loss; i was surprised at how fast my mind processed the the whole thing and decided to "moved on" - reasoned it was a black swan event that was difficult for me to avoid. If you cannot do this in a healthy manner; take a break. The market will always be there. #8 Learn to write the most basic of the SF codes. Why? You'll be surprised how often you'd come up with ideas because of it! What may work for others may not work for you and vice versa; being able to "tweak" SF filters is extremely useful. Remember, filters on their own isn't going to make you money - it is, after all, "YOU" pulling the trigger with a plan hopefully (entry, exit, position sizing and deciding what to do after the trade is made). #9 NEVER stop asking "why". Read, re-read, annotate and try to find a way to organize the massive treasure of info in SF (I have not done a good job at it yet!). Everything you need to learn about "trading" is right here. This mindset was huge when COVID hit. Why was the market climbing a wall of worry despite all the naysayers? Why were the Guppies showing the opposite to the general news feed? Ignorance on my part to dance with the music? Got lucky? #10 Help when you can; it comes back to you in spades more than you know. Is this what is called as "karma"? Would NOT posting during the past 3 years made me a better trader? Will I follow all of the above 100% of the time from this day forward? Probably not as I know i have a lot of flaws; but I will follow them more often than not to make sure I keep myself honest and out of trouble (e.g. earnings play = 1 contract only! lol). Posters and their thoughts that have helped me over time (not in any ranking order; my apologies if I missed anyone) are: - xarlor - Mactheriverrat - four - TRO - Kevin_in_GA - 13thFlloor - snappyfrog - pthomas215 - graftonian - miketranz - KSK8 - mahkoh - davesaint86 - johnpaulca - Safetrade - Village Elder - shilllihs - cheese - nibor100 - eman93 Set up: 2 monitors connected to a Mac Mini and 2 monitors to a generic PC that my son built. I use SF all thru the day, TradingView, and optionprofitscalculator.com. I don't do newsletters. I also try to avoid reading the "news" section of any finance site. I only try to read news releases on the companies I follow (preferably those with zero opinion on it). I hope I didn't forget anything else....! All the best and I do hope one day the ol good ones come back to the threads! i hope the above not only helps my kids but also anyone new to SF! For me, looking for the Holy Grail of filters is like looking for the "perfect spouse/girlfriend"! My next project - thinking of writing a book! ;=P oops I forgot...Kevin actually shared this with me when I first started! I wanted to include say... SET{LIMITEXIT, MIN(CLOSE, REVERSERSI(2,95))} but I am probably doing something wrong as it isn't working...too much beer today! |

| sandjco 648 posts msg #153618 - Ignore sandjco modified |

8/17/2020 9:10:54 AM

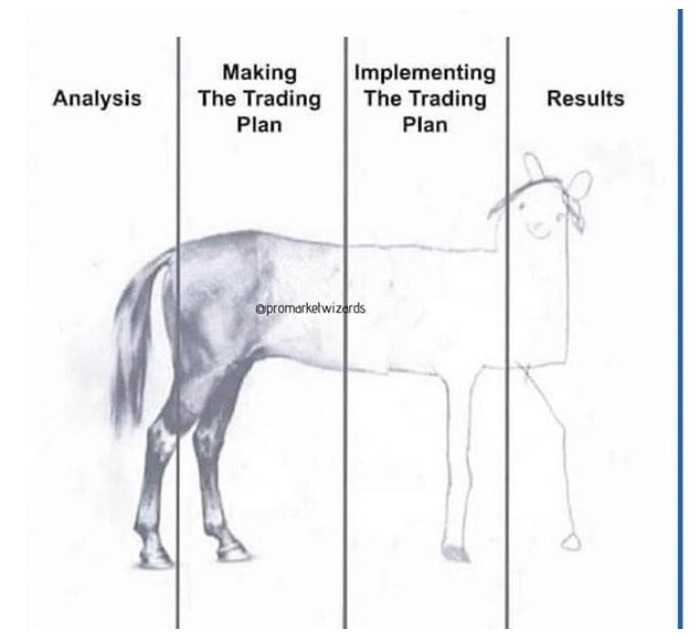

My son shared this with me. Guess I can take it that he is getting what I am trying to share? Or maybe I'm the behind...yapping too much! ;=P edit: pics uploaded using postimg.cc |

| SAFeTRADE 660 posts msg #153625 - Ignore SAFeTRADE |

8/18/2020 4:02:00 PM SET{LIMITEXIT, MIN(CLOSE, REVERSERSI(2,95))} set{limite, count(rsi(2) crossed above 94.9,1)} draw price line at limitexit symlist(spy,qqq,dia) add column limitexit draw limite draw rsi(2) line at 95 Seems like it works fine to me. |

| sandjco 648 posts msg #153629 - Ignore sandjco |

8/18/2020 10:28:32 PM thanks for dropping by and the help SAFeTRADE! guess this is where I get confused...as I thought the value in the column limitexit represents what the close would be if the stock hit RSI(2) at 95 level. As the script I am playing below shows...limitexit = close today hence i went huh? ;=] |

| nibor100 1,102 posts msg #153630 - Ignore nibor100 |

8/19/2020 6:56:24 AM Since you are using the MIN function which finds the lowest of 2 numbers the results are correct. Add this line to your filter to see for yourself: add column REVERSERSI(2,95) Ed S. |

| sandjco 648 posts msg #153631 - Ignore sandjco |

8/19/2020 10:02:16 AM Thanks nibor100! I understand now. @dash...not sure if you read my reply and tried looking at the set up I shared. TSLA hit the same look early this morning. Aug 28 2100C for $27. I will be out for a quickie; at least $8/contract right now. |

| Eman93 4,750 posts msg #153632 - Ignore Eman93 |

8/19/2020 11:00:56 AM Thanks for the mention! |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 25 26 27 28 29 >>Post Follow-up |