| StockFetcher Forums · General Discussion · Stop loss ideas | << >>Post Follow-up |

| shovel52 18 posts msg #84891 - Ignore shovel52 |

12/23/2009 8:51:57 PM I tried searching this topic. Could we get some input on favorite stop loss techniques? This is far harder than entering. Any special indicators, or pivots? anyone? |

| miketranz 979 posts msg #84893 - Ignore miketranz modified |

12/23/2009 10:47:34 PM Good subject Shovel.The number one reason people lose money in the markets is they don't know how,or are not mentally capable of taking a small loss.My advice is when you enter a position,ask yourself,who much am I willing to lose.Place a stop loss order at that dollar amount.You can also use size or share amount to minimize risk.You always want to enter a trade at a point where if you're wrong,you'll know it,and you can get out right away.When a stock moves against you,learn to take a small loss.If I enter a position on a breakout above 10.00,lets say at 10.10.I know automatically what I'm going to risk on that trade & where my stop loss is going to be placed.If the stock reverses from a false breakout,I'm out at 9.98.I have no reason to be there at that point,unless I want to lose more money.If I enter a trade on a moving average line crossover,if the stock reverses and falls back under the moving average line,I'm gone.If you enter a trade .10 above the previous days high,if the stocks falls below the previous days high,you scratch the trade.Use tight stop losses,preserve your capitol for another day.Don't fall into the percentage loss,stop loss theory.You won't have much money left in your account,taking 5% hits on a regular basis.Hope that helps.Good luck.Mike....... |

| stocktrader 294 posts msg #84894 - Ignore stocktrader |

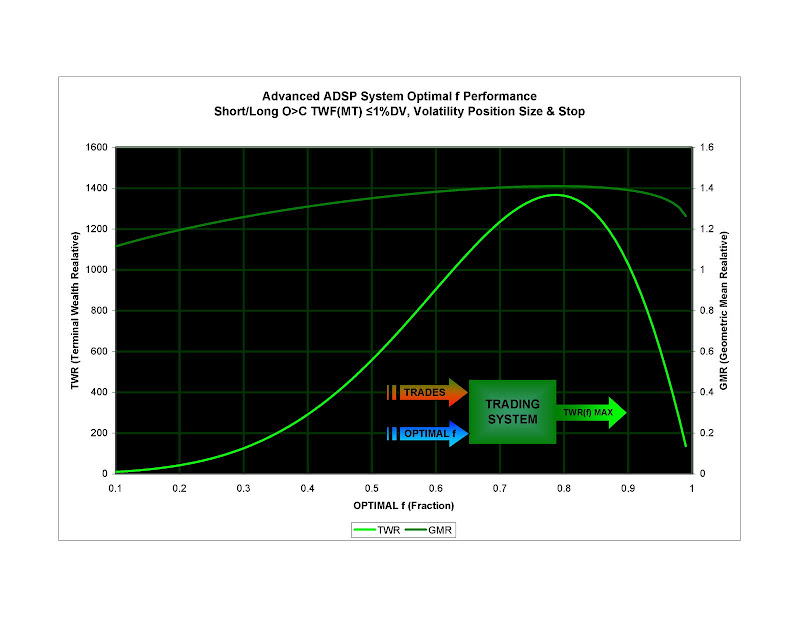

12/23/2009 11:53:57 PM Google Homework: 1) Optimal f Position Sizing 2) Volatility Risk Position Sizing |

| stocktrader 294 posts msg #84896 - Ignore stocktrader |

12/24/2009 12:25:00 AM Excel charts of my own trading system analysis for example. Adjust data accordingly. One of the benefits is psychological (mechanical) for smoothing out the up/downs and reducing greed/fear.

|

| Eman93 4,750 posts msg #84897 - Ignore Eman93 |

12/24/2009 1:52:13 AM It all depends on your time frame, for a day trade only a few pennies that means you need to find the perfect entry.... not easy to do.... I was on a short bias today so I was looking at going short as the market topped out this am so I was in SDS at 34.72 with a stop at 34.67 I sold it at 35.... The market did not sell off strong so it was a normal gap trade... What I have been doing lately is moving my stop up to break even (covering all my costs) as quick as I can.... if I get stoped out on a pull back I wiil watch for a bounce again and may re enter.... what I have found if it dosent head your way quickly your most likley wrong... so take what you can get. On longer term trades use just below last support.... again entry is everything.... what is your trigger, what is your target? The way I have started to look at it....... if you risk a nickel and made .30 you just made 500% profit... 1000 shares risk is 50 and reward is 300... |

| Eman93 4,750 posts msg #84901 - Ignore Eman93 |

12/24/2009 2:48:26 AM It seems you are just starting out........ I would say your number one mission is not to lose any money.. get out if your wrong fast.... Mike gave great advice, but let me tell you from exper that those 10 cent hits plus trade costs add up.... |

| miketranz 979 posts msg #84913 - Ignore miketranz |

12/24/2009 11:31:37 AM Great advice also Eman.Thank you for your kind words.True,those .10 hits also add up,you just have to adjust your position size and take volatility into consideration.When you start trading size in the 2500-5000 range,you're right,you need even tighter stops,like a few cents under your entry.I always think in terms of how much money I want to risk on a trade,before I pull the trigger.If you want to stay in the game,your risk should be at least half of what you intend to gain.But like you said,you take what the market gives.Nobody knows what that figure is.That's one of the reasons I became a singles hitter.You'll hit a lot more of them on a consistent basis than anything else.All The Best,Happy Holidays,Mike........... |

| StockFetcher Forums · General Discussion · Stop loss ideas | << >>Post Follow-up |