| StockFetcher Forums · Stock Picks and Trading · SHOWDOWN- Who Lags Who? Guppy vs. Weinstein ROUND 1 | << 1 2 >>Post Follow-up |

| nibor100 1,102 posts msg #153196 - Ignore nibor100 |

7/18/2020 12:14:35 PM Off and On over the past couple of years there have been a few comments about how Weinstein approach lags the Guppy approach too much to be pursued.... So I figured let's do some actual comparisons and see if either has good signals faster than the other. The filter below is from one of Mactheriverrat's recent posts and I added a daily 150 day Weighted Moving Average to simulate the Weinstein preferred 30 week WMA. and I chose NFLX since its familiar to all of us as the first comparison candidate. a. Looking at the chart it appears to me that Price crosses above an upward sloping Weinstein moving avg on Mar 23rd and stays above it until now b. And the Guppy short term trading group of mov avgs moves above the long term group on Apr 2nd with a slight recompression of the 2 groups in early Jun that experienced Guppy traders would have probably rode out expecting the stock to continue to rise as it did to now. My scorecard shows Round 1 goes to Weinstein, though most fights require 3 judges... Comments and other comparison stocks are welcome and needed to make this a fair and complete test. Thanks, Ed S. |

| Cheese 1,374 posts msg #153197 - Ignore Cheese |

7/18/2020 1:31:52 PM @nibor100 Firstly, I want to thank you for your recent posts on Weinstein, and your past studies and backtests of Guppies. They are very helpful. I also want to thank graftonian and Mactheriverrat for their works first on Guppies then on Weinstein. Learning from the above and from past works on mMAs by alf44 dn chetron, I think of Weinstein as strategic and Guppies as tactical. NFLX is a hot stock so Guppies and Weinstein tend to move fairly quickly to give similar directions. So I use stocks like CAT or CSCO to see the complementary value of Weinstein and Guppies. If Guppies say bullish and Weinstein is not ready to signal Stage 2, then stock prices can only move up so far, hit Weinstein resistance, pull back, then try again if bullish sentiment is real. The right thing to do here may be to scale in with Guppies, and stay nimble in case of head fake. When Weinstein and Guppies both say bullish, then I can be more aggressive. Just my two cents' worth |

| nibor100 1,102 posts msg #153198 - Ignore nibor100 |

7/18/2020 2:51:04 PM 1. Per Cheese Round 2 and 3 go to Guppies on fairly close scorecards: a. CSCO has a Guppy near term crossover of the 2 groups of moving avgs on 5/8 vs Weinstein on 5/14 b. CAT has a Guppy near term crossover of the 2 groups of moving avgs on 5/29 vs Weinstein on 6/2. 2. In both of those 2 stocks there was actually an earlier upward cross of the Weinstein 150 Weighted Moving Avg, quickly followed by a downward cross and then another upward cross, to finally stay above the 150WMA until now. I'm trying to consistently only count the Weinstein upward crosses that close above the 150 WMA and stay above it until current day. Thanks, Ed S. |

| Mactheriverrat 3,178 posts msg #153199 - Ignore Mactheriverrat |

7/18/2020 4:31:47 PM I like looking at the charts sometimes using line instead of candles. Give a better picture what the guppy 2 groups are doing and saying . I add 2 purple boxes where the 2 groups separate. The ema 5 / 13 is subject to change like finding a better mouse trap.  |

| graftonian 1,089 posts msg #153218 - Ignore graftonian |

7/20/2020 3:26:15 PM My present indicators of choice, the Hull MA 10 and 50 crosses, and Schaff Trend Cycle resulted in: In to NFLX on Mar24 @ 345, and out on Apr29 @ 410 In Jun15 @ 427, and probably out tomorrow @ 500(mas o menos) |

| Cheese 1,374 posts msg #153223 - Ignore Cheese |

7/20/2020 8:17:01 PM @graf Thank you for sharing your current indicators of choice. Great idea! But you may get into a little trouble with the tournament organizer. Weinstein and Guppy were competing on grass, and you show your Hull play on clay. Just kidding |

| graftonian 1,089 posts msg #153227 - Ignore graftonian modified |

7/21/2020 9:07:04 AM @Cheese, OK, I'll just sit on the sideline. Don't know who I'll cheer for :-) |

| Cheese 1,374 posts msg #153228 - Ignore Cheese |

7/21/2020 10:22:00 AM @graf I may get in trouble with nibor100 too, for disruption But for the record, your NFLX forecast was correct. You favorite indicators worked. We need all four to do better trading, so all four are winners Thanks again for Hull and STC. |

| nibor100 1,102 posts msg #153234 - Ignore nibor100 |

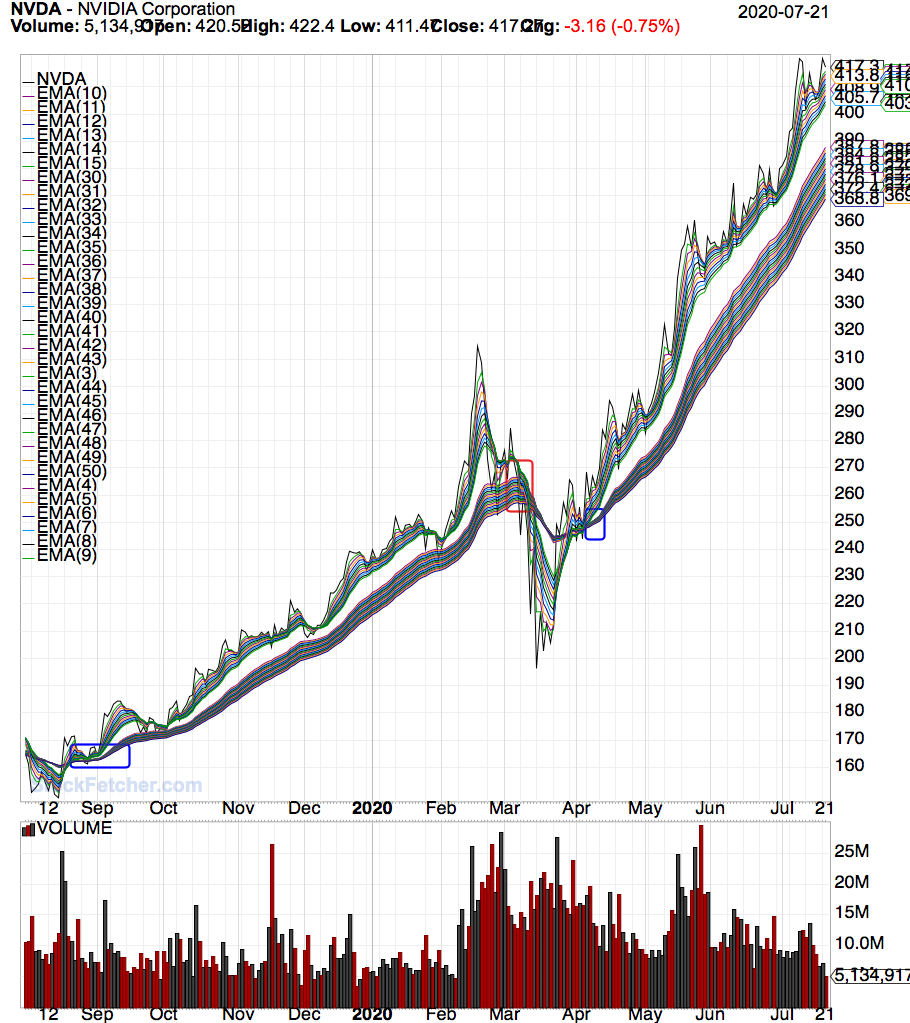

7/21/2020 11:11:48 AM Round 4, goes to Weinstein as NVDA had a Guppy near term crossover of the 2 groups of moving avgs on 4/7 whereas the Weinstein WMA(150) cross occurred about 2 weeks earlier on 3/24. Following either signal for NVDA would probably have worked well, Ed S. |

| Mactheriverrat 3,178 posts msg #153244 - Ignore Mactheriverrat |

7/21/2020 2:52:40 PM IMHO. Like Guppy said in one of his Video's I posted. Not every setup will go up as a stock will not go up every day. Its catching the trend.  |

| StockFetcher Forums · Stock Picks and Trading · SHOWDOWN- Who Lags Who? Guppy vs. Weinstein ROUND 1 | << 1 2 >>Post Follow-up |