| StockFetcher Forums · Stock Picks and Trading · Intraday Alerts | << 1 ... 1498 1499 1500 1501 1502 ... 1903 >>Post Follow-up |

| johnpaulca 12,036 posts msg #128156 - Ignore johnpaulca |

4/26/2016 1:43:34 PM QTM($0.46)...virtual trade. -Added to watchlist today. -Stock being accumulated -Bottom occurred about 3.5 months ago( common in pennies) - buy signal could be triggered this week, will post a virtual entry. FYI....I don't trade pennies. |

| four 5,087 posts msg #128158 - Ignore four |

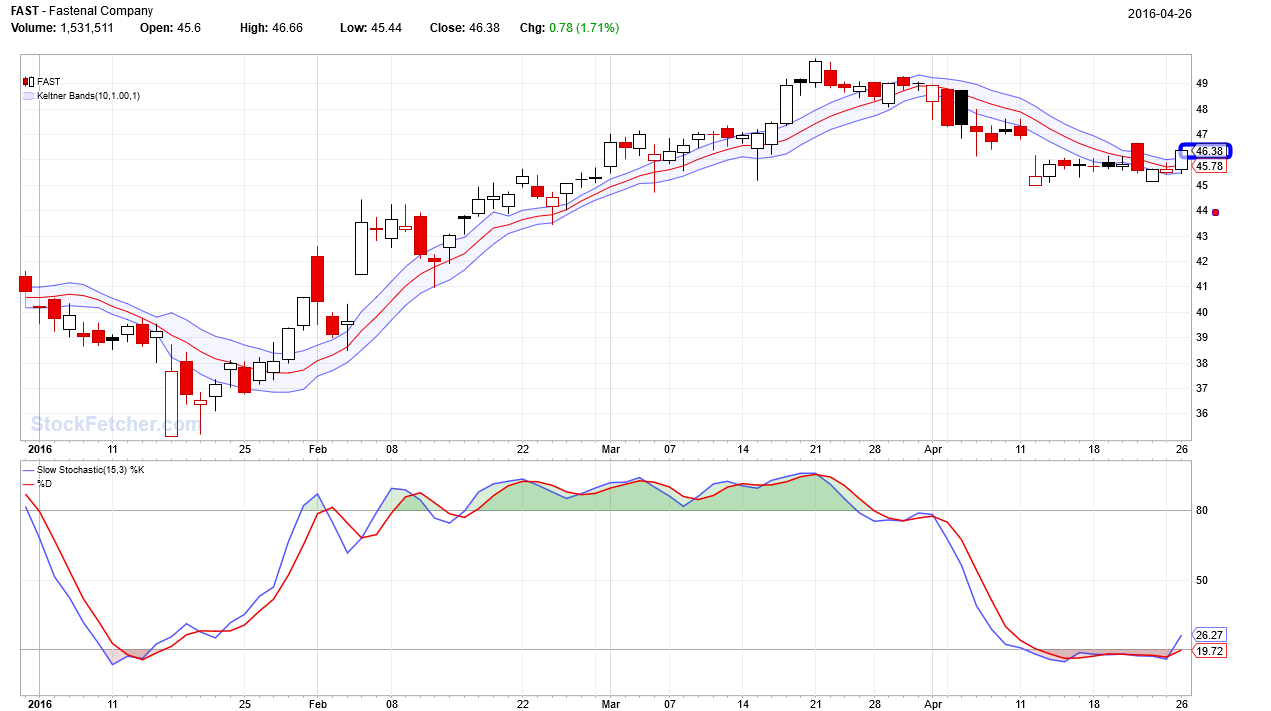

4/26/2016 2:35:22 PM Long  |

| johnpaulca 12,036 posts msg #128159 - Ignore johnpaulca |

4/26/2016 3:21:43 PM Nice setup Four!! |

| johnpaulca 12,036 posts msg #128160 - Ignore johnpaulca |

4/26/2016 3:24:15 PM @4....check out ROST |

| johnpaulca 12,036 posts msg #128161 - Ignore johnpaulca |

4/26/2016 3:30:14 PM SCO($99.69)....my buy price is around $98.22ish will have to try in ah, don't think it will get there before closing. |

| johnpaulca 12,036 posts msg #128162 - Ignore johnpaulca modified |

4/26/2016 3:42:58 PM JNPR($23.60)...buy signal( virtual trade) OHAI($2.96)...buy signal(virtual)....very low average volume |

| c1916 77 posts msg #128163 - Ignore c1916 |

4/26/2016 4:13:20 PM JP...what is telling you that SCO is a buy at this point? I don't see any indicator looking to signal a change that would cause me to be long at this time (MACD, Inverse Fisher, CCI, hell even the Aroon signal is pure negative). Curious as to what makes you think SCO long timing is (nearly) right? Is it the Kuwait news? |

| johnpaulca 12,036 posts msg #128164 - Ignore johnpaulca |

4/26/2016 4:35:56 PM JP...what is telling you that SCO is a buy at this point? I don't see any indicator looking to signal a change that would cause me to be long at this time (MACD, Inverse Fisher, CCI, hell even the Aroon signal is pure negative). Curious as to what makes you think SCO long timing is (nearly) right? Is it the Kuwait news? ***************************************************************************************************************************** I don't have a buy signal yet. $42.21 is support so shorting here is very Risky. Most of your indicators will trigger in after hours...again very risky. Now, fundamentally we still have an abundance of oil during a global contraction....little demand. Oil is probably the most manipulated commodity so only using stock indicators like MACD or Stoch will be difficult. Find areas where buyers and sellers battle it out and ride in the direction of the winner. I use the following ETF to trade oil...SCO, DWTI(short oil) and UWTI(long oil)...hope this helps some. |

| johnpaulca 12,036 posts msg #128165 - Ignore johnpaulca |

4/26/2016 4:36:52 PM SPY....saw some big dumps in ah |

| johnpaulca 12,036 posts msg #128166 - Ignore johnpaulca |

4/26/2016 4:44:35 PM OIL....$44.56 will see a small battle and a bigger battle at $47.21 SCO...$98.22 monthly support so most likely see oil getting rejected at those two resistance areas, but will have to wait and see tomorrow's oil futures. |

| StockFetcher Forums · Stock Picks and Trading · Intraday Alerts | << 1 ... 1498 1499 1500 1501 1502 ... 1903 >>Post Follow-up |