| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 33 34 35 36 37 ... 48 >>Post Follow-up |

| shillllihs 6,102 posts msg #145259 - Ignore shillllihs |

11/13/2018 2:32:06 PM Sandjco, in my opinion if someone is trying to get wealthy with stocks, they are making a mistake and or they just do not have enough money to do it the right way in real estate. I literally only play around with 2% of my net worth and the rest in properties and cds. It’s a desperation game for those without the means. I just do it for fun now that I’m living off of 16 rentals. In fact I have too much free time it drives me mad. Might take a trip to Greece next June and stay for 2 months, It’s great not working but I think people are meant to stay active. The one thing I can say about the market is there will be down times but can you stick it out until it rebounds and or add to the position to lower your cost basis. This should only be done if you are convinced your decision is correct. As I’ve gotten older, it’s much easier to ride out the storms, you know why? Because you start to see that we’re all going to be worm food soon anyway and things don’t really matter. |

| sandjco 648 posts msg #145261 - Ignore sandjco modified |

11/13/2018 11:35:55 PM Thanks shillihs! Always appreciate whatever useful advice I can take. For sure: 1. Don't "risk" what you cannot afford (and yes, sometimes like gambling...it CAN be a desperation move for some without the means). 2. Yes, there will be "down" times (like now); stick with it or add (only if you are "sure" - this is the part that is the most difficult). So far, I've followed my plan. And so far, I broke my plan to sell (Oct 17th) at $60.85 ($53.31). Therefore I'll be looking for the next rebound to sell (assuming I follow the "plan"). TQQQ has stayed below its 200MVA of $58.26. Am I risking $50K to get "wealthy"? Nope. I've been fortunate enough to do well buying great companies when my own financial advisor and parents told me that I was nuts buying certain tech companies that sometimes showed zero profit and nosebleed P/E's. I am doing this because I'm fascinated: 1. with the volatility and how it may be used to "compound" returns. 2. with the psychology of the market and its players. 3. I'd like to be able to leave my kids with a trail of what their old man was up to and how he did it (good or bad). 4. I can only travel so much every year before my wife drives me nuts! 5. is there a better way to make money using compounding vs B&H over time? You also may be right...that as we get older (I'm not there yet), our patience to ride out the storm is better as we've seen these crap before. Have a good night everyone. I picked up UWT at $18.50  |

| sandjco 648 posts msg #145271 - Ignore sandjco |

11/15/2018 6:54:49 AM The world is ending.../s         Or is it just a flash sale? Trump has the Senate; Dems got the house. Midterm Election = best buying op? Upside trigger? China spat resolution?  Oil anyone?  Apple suppliers reporting low guidance has spooked the market. Haven't we seen this before?https://seekingalpha.com/article/488771-apple-stop-comparing-apples-to-oranges Is this time really gonna be any different? Ah what a great time to be alive and kicking! |

| sandjco 648 posts msg #145273 - Ignore sandjco |

11/15/2018 9:08:25 AM What is going on?  |

| nibor100 1,102 posts msg #145278 - Ignore nibor100 |

11/15/2018 1:11:03 PM I recently watched a video of a weekly strategy for equal parts of TQQQ, TNA, and UPRO, long only, using 2 period and 5 period EMA crossovers and a 10% trailing stop, that gained 36% in 2017 and 27% thru Oct 1st this year. That way undershoots the potential gains of ~$2.4 million in 2018 of trading TQQQ alone on a daily basis with perfect timing and direction starting with initial principal of $1,000 on Dec 29th.. Buy and Hold of TQQQ thru Oct 1st would have netted 54.4%. Would be nice if there was a high probability way to end up somewhere between the 54% and the +2M... Ed S. |

| sandjco 648 posts msg #145280 - Ignore sandjco |

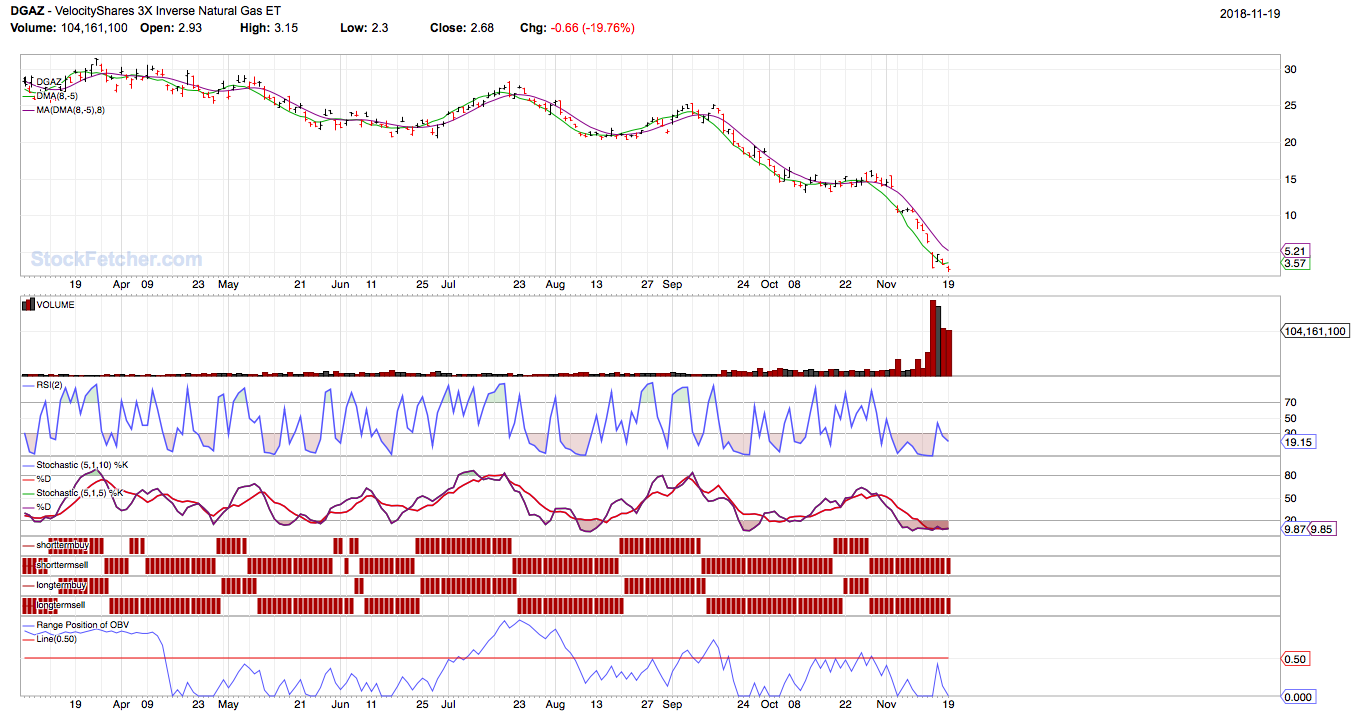

11/15/2018 6:19:25 PM Hi Ed, Thanks for dropping by. I've seen variations of rebalancings and in the end, all the backtesting may not end up working out as it should either because of (a) our own doing, or (b) some black swan event takes place (ala XIV implosion). As I really don't know "what type" of player I am in the market, I am just trying to find my way with the goal of being able to "trade" naturally based on the data (price and volume) that I am seeing. Except for this portfolio, all my other accounts are B&H from since the days I was still excited to see a Playboy mag under wraps in a bookstore! Right now, I'm experimenting in building a base with TQQQ and then selling a % (or all..still unclear or unsure) of it when it hits certain target levels (price or ?) and then adding back again during dips. Of course, this assumes the overall trend is up. What if it continued to go down? I don't know...I've pre-set my stops. The goal...is to "compound" the wins. So far: TQQQ $50.20 (cost $50.75) UWT $19.47 (cost $18.50) Picked up DGAZ; i'll use close $4.70 Cheers |

| sandjco 648 posts msg #145289 - Ignore sandjco |

11/16/2018 8:07:00 AM NVDA disappoints...a pickle after hours!  What will the market do next? |

| sandjco 648 posts msg #145318 - Ignore sandjco modified |

11/20/2018 8:25:15 AM Is it different this time? More to go?  Will we have an Xmas run? Ain't a loss till you sell apparently! Catching a falling knife? Added at $44.89 using close. Stubbornly sitting on DGAZ currently at $2.68  Only UWT is working out so far. |

| sandjco 648 posts msg #145320 - Ignore sandjco |

11/21/2018 1:13:27 AM Stopped out of UWT using $15.98. Ouch!  |

| shillllihs 6,102 posts msg #145321 - Ignore shillllihs |

11/21/2018 1:36:18 AM I like UWT, and so does Ron Popeil, set it and forget it. |

| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 33 34 35 36 37 ... 48 >>Post Follow-up |