| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 2 3 4 5 ... 48 >>Post Follow-up |

| sandjco 648 posts msg #136640 - Ignore sandjco |

7/6/2017 1:32:52 AM Holding on...  New purchases...    Watching...  |

| sandjco 648 posts msg #136658 - Ignore sandjco |

7/7/2017 7:40:50 AM Sold INDL. Using the close price of $77.07....squeaked out a 4%. Holding on to the rest. In hindsight, buying on "green" didn't work for this batch. Watching TSLA  |

| sandjco 648 posts msg #136662 - Ignore sandjco modified |

7/7/2017 9:42:39 AM Picked up TSLA $310.30; stop loss at $305....hmmmm |

| lonehand 9 posts msg #136672 - Ignore lonehand |

7/7/2017 2:37:46 PM This is just my two cents take it for what it is worth. You are trading stocks and 3xs with too much volatility. Using a 4% stop on a stock that moves 5 to 10 % a day will just get you chopped up. Tsla has an ATR of $13. using a 5 dollar stop is just asking to get stopped out with noise even if you are right with the direction. ( can be used for inter day trading say with 5 min chart) Need to investigate stops using volitility and sizing position on amount you want to risk. Fixed dollar amounts and fixed % may work on low beta stocks, but WILL NOT WORK on these high beta instruments. For your info. SCO is on my do not trade list for good reason. My stops are on the end of too many wicks!!!! (Stops are hunted ) |

| sandjco 648 posts msg #136685 - Ignore sandjco |

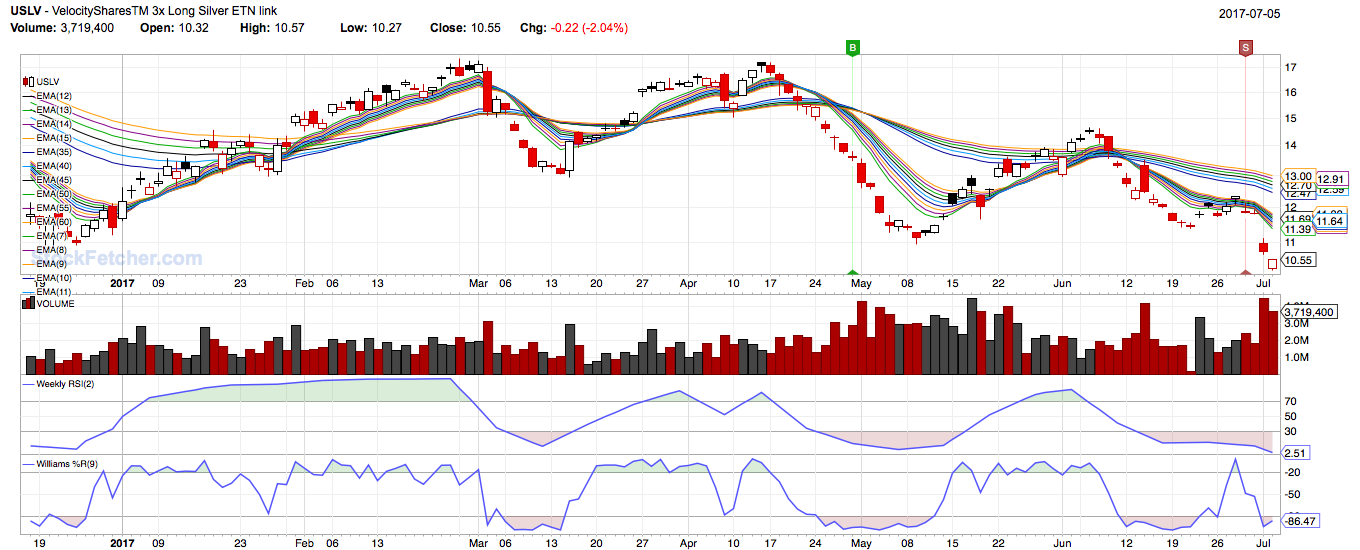

7/10/2017 10:49:45 AM Thank you for your time and feedback lonehand! I'm here to learn; therefore, any tips is always appreciated. What stocks would you trade and how would you find them? I did get stopped out of TSLA today. Luckily (or by design), position sizing minimized the loss. In hindsight, I placed the stop because I thought it may drop further (which begged the question why I was not more patient in my entry). I am seriously considering re-entry today at twice the size I had. RE: 3x leveraged ETF the logic behind this is that they are market baskets (most of them). the commodity based ones are the ones I'm more conservative on when it comes to position sizing. INDL - went up more....bruh...the one that got away; too eager to take a profit! SCO - up today again XIV - up today again SMH - up today; will most likely close this slow mover today... Watching NUGT and USLV |

| four 5,087 posts msg #136686 - Ignore four modified |

7/10/2017 10:55:49 AM I am seriously considering re-entry today at twice the size I had. -- Do not trade with "I am going to get back at you and win this time." What is your plan and trade your plan. Inspiration from... |

| sandjco 648 posts msg #136687 - Ignore sandjco |

7/10/2017 11:19:31 AM Thanks four! My Mac cannot seem to open or view your picture or video post lol.... In hindsight on TSLA... - I broke my "plan" by using the stop loss. - if I didn't use the stop loss, I would have added 3% of my position today if the stock was down today near market close for a 5% total position. Now, I see TSLA recovering...and you are bang on correct that my mind is saying *&^%$#@! However, my "plan" says....do not enter. My mind is now thinking....enter if it breaks $320. Picked up initial position for NUGT; my stink bid on USLV didn't get filled and it is running away from me....to chase or not to chase. My mind says...do not as I already have NUGT filled and plan says...the window is still there as it went from red to green (not part of my plan). I feel like a gerbil today! |

| pthomas215 1,251 posts msg #136688 - Ignore pthomas215 |

7/10/2017 11:50:42 AM TSLA buy more on the dip imho...heading back up... |

| lonehand 9 posts msg #136691 - Ignore lonehand |

7/10/2017 1:16:52 PM First as a disclaimer I know nothing and have no clue what is going to happen. I use charts to give me probabilities. they are not predictive. Anything can happen. I am just thinking out loud to give you perspective and is my opinion only. Trying to control your risk is your edge as an independent trader. Having a stop is essential to controlling risk. I have a hard (order in) stop on every trade. But If you are trading extremely volatile etfs or stocks any news can gap the stocks past your stop. Holding overnight or over the weekend your stop is not going to mean much. Holding SCO over the weekend or overnight is extremely risky. In the present state oil can spike 10 % (SCO down 30%) on mild news and 25 to 50 on a large event. Mild event: Nigerian oil workers strike. A trump tweet on oil tariffs. An email from a Saudi prince. Large events: Venezuelan Coup any attack on an oil producing country in the mid east ect ect. This is why I would not hold these instruments overnight. There is an additional roll over decay factor that comes into play. I Day trade high volume, low spread stock to prevent slippage when I'm stopped out. They have high ATR or beta for movement. X Materials proxy RRC Nat gas proxy Slca Oil proxy tvix volitility and any large cap stock with recent range expansion and 2x volume: YUMC, LB, cara My chart reading on TSLA is that it is a technically broken stock. It has a mean water fall pattern or H+S pattern. developing on daily. I feel it will see 250 before 350 |

| Kevin_in_GA 4,599 posts msg #136692 - Ignore Kevin_in_GA |

7/10/2017 2:24:59 PM Study this bit of code. /*DETERMINE THE MAXIMUM AMOUNT YOU ARE WILLING TO LOSE*/ SET{ACCOUNTSIZE, 25000} SET{RISKLEVEL, ACCOUNTSIZE*0.005} Here I have set up the code to put only 0.5% of your trading equity at risk on any given trade. All you need to do is set your account size at whatever the amount is that you can currently trade using this system. /*DETERMINE LIMIT ENTRY POINT*/ SET{LIMITENTRY, MIN(CLOSE, REVERSERSI(2,5))} Here we are using the limit entry at the price the would correspond to a RSI(2) of 5. If the stock is already below that value, you use the current close instead - that is why I use the MIN() function here as it automatically chooses the lower price of the two possible limit entries. /* VAN THARP POSITION SIZING - SET THE STOP LOSS AND SHARE SIZE BASED ON LIMIT ENTRY AND AMOUNT WILLING TO LOSE*/ SET{2ATR, 2 * ATR(20)} SET{STOPLOSS, LIMITENTRY - 2ATR} I use twice the value of the ATR(20) as the point for positioning the stop loss. Just a simple subtraction of this amount from the entry price - this should give the stock enough room to fluctuate normally without triggering the stop loss. /*DETERMINE THE NUMBER OF SHARES TO BE PURCHASED*/ SET{SHARESTOBUY1, RISKLEVEL/2ATR} SET{SHARESTOBUY, ROUND(SHARESTOBUY1, 0)} Just a quick comment here - SF code does not let you do more than 1 mathematical operation in any given SET{} statement. Here I have determined the required number of shares, then used the ROUND() function to make the output a whole number for ease in placing orders. When I place my orders I usually round to the nearest 5 shares since that is easier to actually get an order filled - odd amounts like 17 are harder to get filled than 15 or 20 shares. /*TOTAL AMOUNT OF EQUITY USED IN THIS TRADE*/ SET{POSITIONAMT, LIMITENTRY * SHARESTOBUY} /*PERCENT OF TRADING CAPITAL USED IN THIS TRADE*/ SET{POSITIONPCT1, POSITIONAMT / ACCOUNTSIZE} SET{POSITIONPCT, POSITIONPCT1 * 100} |

| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 2 3 4 5 ... 48 >>Post Follow-up |