| StockFetcher Forums · General Discussion · Pullback still in play | << 1 2 3 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #142172 - Ignore Mactheriverrat |

2/13/2018 5:52:01 AM IMHO Futures down 0445 C.S.T. |

| Mactheriverrat 3,178 posts msg #142193 - Ignore Mactheriverrat |

2/13/2018 3:16:18 PM Starting to get a few stocks pop up like BAC , JPM and others Pull back may be losing downward steam. |

| karennma 8,057 posts msg #142197 - Ignore karennma |

2/13/2018 6:16:35 PM Nibbled today. I think we're out of the woods. |

| pthomas215 1,251 posts msg #142200 - Ignore pthomas215 |

2/13/2018 7:23:46 PM SPY will go to 270, everyone will feel like we are out of the woods, then the bottom will fall out again. most likely. |

| c1916 77 posts msg #142202 - Ignore c1916 |

2/13/2018 9:32:05 PM I can't imagine we're out of the woods until we test last week's bottom and have it hold...at least once. |

| pthomas215 1,251 posts msg #142203 - Ignore pthomas215 |

2/13/2018 9:40:36 PM C1916, that is exactly what i was referring to. I believe that will happen. when the vix 4 hour chart looks decent again, we will begin to drop. |

| Mactheriverrat 3,178 posts msg #142206 - Ignore Mactheriverrat |

2/14/2018 1:37:39 AM I'm going to have to disagree that the bottom is fixing to fall out as the media Infidels try to tell us- weak hands and profit takers have done their fear sell off which more than due. A economy that is humming along and tax cuts ( I'm a little of mixed feeling about how we will pay for it but I will still take it) are giving people more money in their pockets. I see higher markets coming but more volatility than in the past year. |

| Mactheriverrat 3,178 posts msg #142207 - Ignore Mactheriverrat |

2/14/2018 1:47:50 AM 2/11/2018 2:39:22 PM Signs these Bear stocks are showing weakness Bear Market * Market goes to hell in a hand basket Symlist */ |

| Mactheriverrat 3,178 posts msg #142208 - Ignore Mactheriverrat |

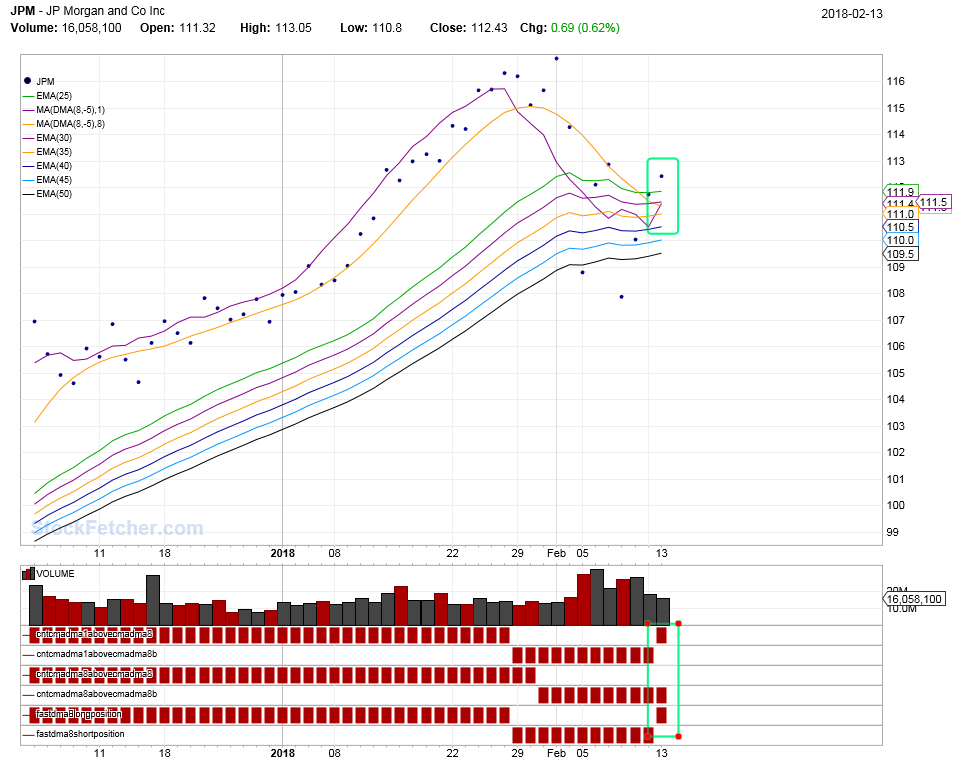

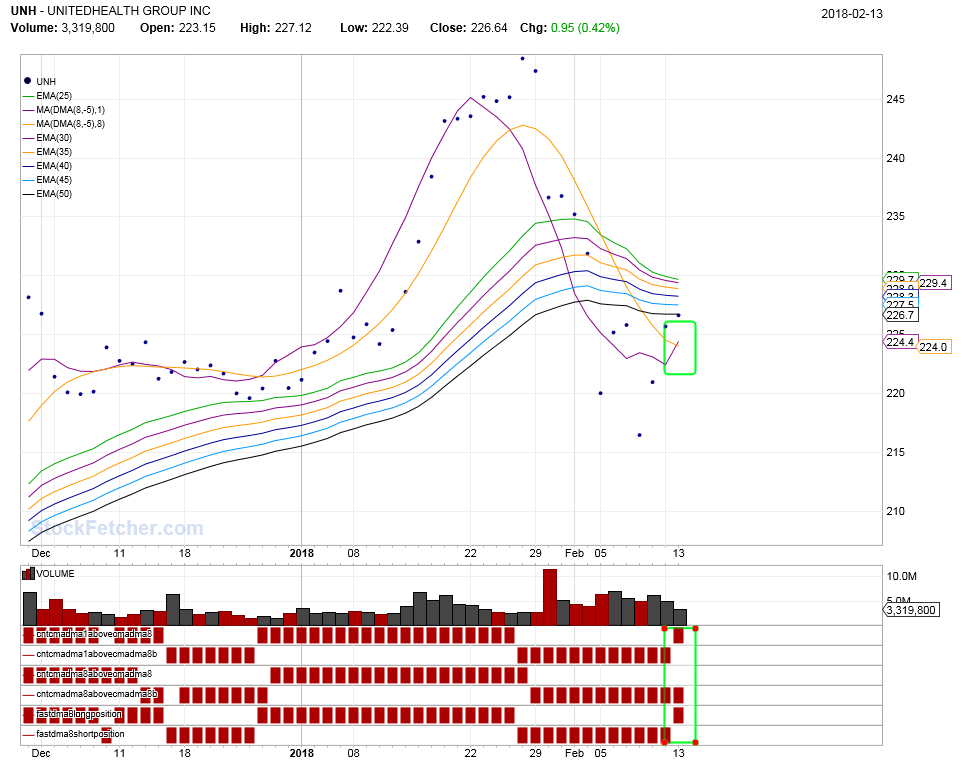

2/14/2018 2:06:53 AM Stocks like BAC,JPM and UNH showing first Bullish signs.    |

| karennma 8,057 posts msg #142212 - Ignore karennma |

2/14/2018 7:36:43 AM Mactheriverrat 1,448 posts msg #142208 - Ignore Mactheriverrat 2/14/2018 2:06:53 AM Stocks like BAC,JPM and UNH showing first Bullish signs. ================= ITA! And many others are showing signs of exhaustion (on the downside). |

| StockFetcher Forums · General Discussion · Pullback still in play | << 1 2 3 >>Post Follow-up |