| StockFetcher Forums · Filter Exchange · To Mike Tranz- Your filter & my Alzheimers | << 1 2 3 >>Post Follow-up |

| karennma 8,057 posts msg #134435 - Ignore karennma modified |

2/21/2017 11:59:15 AM miketranz 690 posts msg #133672 - Ignore miketranz 1/10/2017 8:28:04 PM Try this:SHOW STOCKS WHERE THE CLOSE REACHED A NEW 52 WEEK HIGH WITHIN THE LAST 10 DAYS AND PRICE IS BETWEEN .25 AND 25 AND AVERAGE VOLUME (90) IS GREATER THAN 100000 AND VOLUME IS GREATER THAN 100000 AND STOCK PRICE IS 100 % GREATER THAN 52 WEEK LOW AND WHERE CLOSING PRICE GAINED MORE THAN 26% IN THE LAST 26 WEEKS AND RSI (2) IS BELOW 20 Best of luck,Miketranz... ===================== Hi Mike, I saw your filter and tweaked it with some of my parameters. When nothing came up, I kept backdating until I got some picks - the BEST one being NVDA, so I bought it.. immediately. So, what does this have to do w/ my Alzheimers? After I bought it, I realized, I'd backdated to 02-13-17. TODAY is the 21st! (SMH - eyeroll) :>/ Edit: That's a great filter, BTW. Thanks for posting. |

| selfhigh05 23 posts msg #134437 - Ignore selfhigh05 |

2/21/2017 1:37:11 PM care to share the filter? |

| pthomas215 1,251 posts msg #134438 - Ignore pthomas215 |

2/21/2017 2:05:35 PM karen, be careful with NVDA. it is indeed the technology chip of the future but resistance is in the mid 90's really. |

| karennma 8,057 posts msg #134439 - Ignore karennma |

2/21/2017 2:36:39 PM pthomas, I know what you mean. I remember 18 yrs. ago, telling a friend, I'd bought INTC and CSCO and that I was "set for life". ** NOT!! ** ( believe both were in the 3 digits at the time.) |

| karennma 8,057 posts msg #134440 - Ignore karennma |

2/21/2017 2:40:04 PM selfhigh05 5 posts msg #134437 - Ignore selfhigh05 2/21/2017 1:37:11 PM care to share the filter? ==================== The filter is above my comment. Just cut n' paste it. He said it was a DARVAS filter. Can't go wrong with that. :>) |

| johnpaulca 12,036 posts msg #134446 - Ignore johnpaulca |

2/21/2017 10:01:56 PM clickable.... |

| nibor100 1,102 posts msg #134449 - Ignore nibor100 |

2/22/2017 3:04:44 AM I recently read Darvas "How I Made $2,000,000 In The Stock Market" and most of the rules of this filter and the 17 stocks returned by the filter don't seem to mesh with his box theory approach described in his text. A couple of examples: Darvas seemed to buy stocks as they were making new highs and moving into a new 'Darvas Box' and the 17 stocks returned by this filter today are moving down not up. I'm fairly certain he never mentioned using RSI(2) While this filter may be excellent in today's market could someone explain what makes it based on the Darvas approach? Thanks, Ed S. |

| Mactheriverrat 3,178 posts msg #134450 - Ignore Mactheriverrat modified |

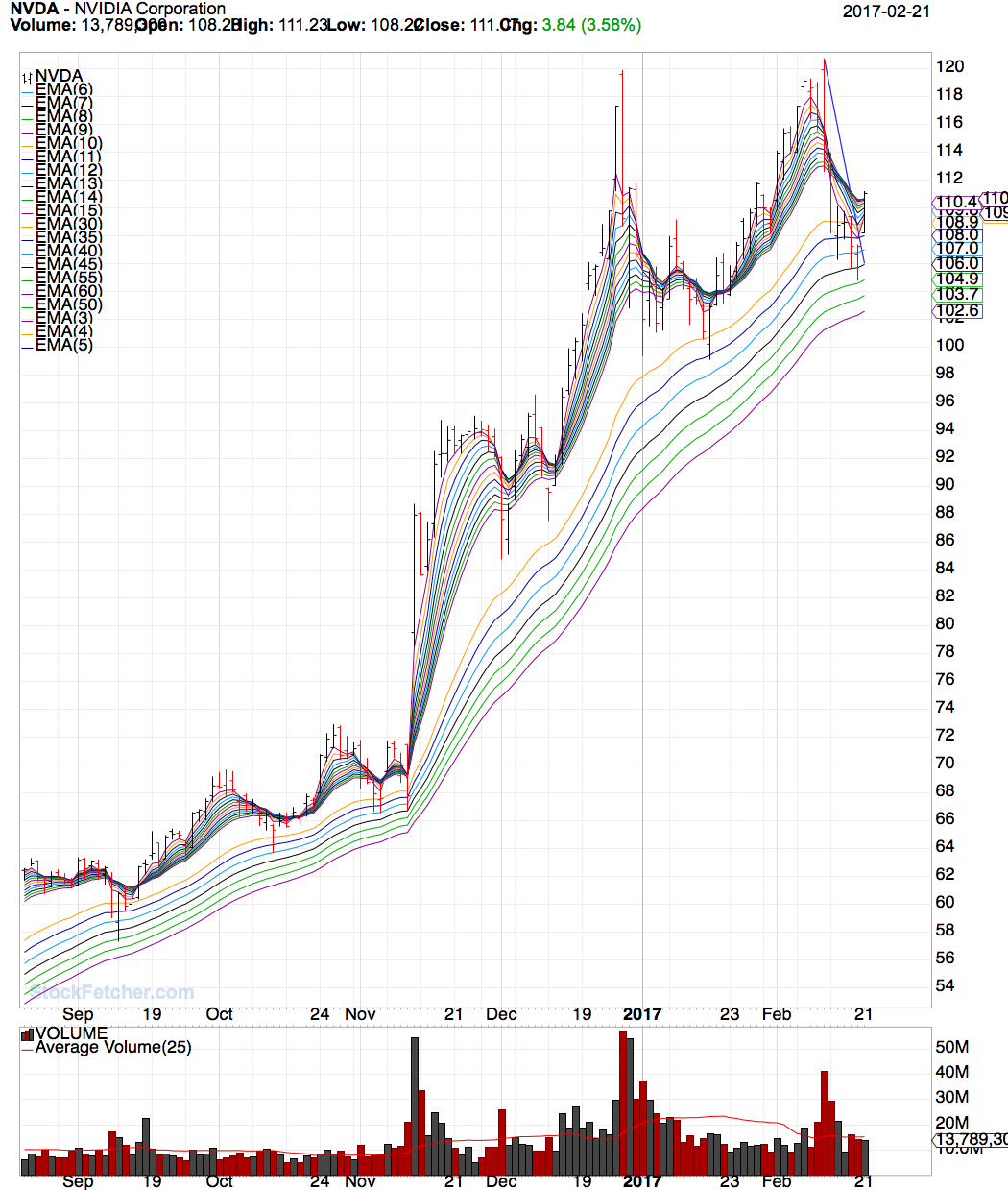

2/22/2017 4:04:46 AM Most strange the book I just finished reading Trend trading by Daryl Guppy Trend trading by Daryl Guppy. un-said suggestion of not using any indicators from mad to rsi to what ever. His guppy approach was very interesting the last couple of chapters were about Darvas box. Now its time to re-read the book again to sink in some more. My take on NVDA Longer averages still wide but there was some profit taking this last drop. shorter averages are starting to compress again after downtrend line was broken. Now watch if the greedy longer averages come in .  |

| karennma 8,057 posts msg #134452 - Ignore karennma |

2/22/2017 7:05:14 AM nibor100 30 posts msg #134449 - Ignore nibor100 2/22/2017 3:04:44 AM Darvas seemed to buy stocks as they were making new highs and moving into a new 'Darvas Box' and the 17 stocks returned by this filter today are moving down not up. Thanks, Ed S. =================== Ed, U might want to run the filter again and look a 3-month chart. As per the filter: "SHOW STOCKS WHERE THE CLOSE REACHED A NEW 52 WEEK HIGH WITHIN THE LAST 10 DAYS" . |

| karennma 8,057 posts msg #134454 - Ignore karennma |

2/22/2017 7:32:55 AM NVDA just paid a dividend this morning, so I expect it to go down. |

| StockFetcher Forums · Filter Exchange · To Mike Tranz- Your filter & my Alzheimers | << 1 2 3 >>Post Follow-up |