| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 8 9 10 11 12 ... 29 >>Post Follow-up |

| xarlor 639 posts msg #151278 - Ignore xarlor |

3/18/2020 6:00:54 PM Spot on, sandjco. You understand trading. Notice that 8 of your 10 rules were emotion based? I like your second rule. Feeling "bad" for shorting a stock is breaking that cardinal rule: "Leave emotion out of trading." Usually we think of emotional trading as fear and greed, but it goes beyond that. For example, has anyone ever traded LMT or RTN and made money? How do you feel knowing you made money off a company who's sole purpose of existing is to kill human beings or at the very least project the threat of killing human beings? The correct answer should be, "*shrug* I was trading the chart, didn't care what letters were attached to it" I digress, I will leave you with another angle on shorting. This is a small excerpt from a much longer explanation from the book "Short Selling Strategies, Risks, and Rewards" by Frank J. Fabozzi: Short selling is un-American. It is done by rogues, thieves, and especially pessimists, who are, of course, the worst of the lot. It is a terrible, terrible thing and must be stopped in our lifetime. We should halt it, restrict it, or at the very least revile those who make it their vocation. The above sentiments are sadly not imaginary or rare. Rather, they genuinely reflect much of the investing public’s view of short selling. In fact, attacks have included proposals to make short selling harder (the existing “uptick rule” already makes it hard), or to make it impossible by banning it outright (presumably along with pessimism itself, and perhaps the infield fly rule). These criticisms and draconian proposals all increase in volume and seriousness when the stock market goes through a tough time. At such times many claim short sellers are the cause of the market’s decline. Finally, at the low point for stock prices, many members of Congress invariably reexamine whether shorting should be allowed, or more simply, consider just legislating that the Dow go up 50 points a day. ...opponents of short selling are not merely wrong. They are incredibly wrong, both factually and morally. Short sellers are among the heroes of capitalism and we owe them our thanks not our opprobrium. The opponents of short selling are either exceptionally economically challenged, or run to a natural tendency to ban anything they do not like. There’s a word for the political system favored by people like that and it is not democracy (but does rhyme with Motalitarianism). Extensive theory may be helpful, but it is not necessary, to understand why the ability to implement a pessimistic view (e.g., to sell short) improves market efficiency and thus makes the market safer for all participants. Without short selling, prices are in a sense uncapped. As valuations get excessive the only way to express a negative view is to go on a buying strike. It is analogous to a voter who disliked the incumbent, but found the only option was to stay home, as voting for the challenger was prohibited (again, we have seen systems like that in the world, but we are just not supposed to have one here). It seems quite intuitive that if we restrict the ability to express pessimistic views, prices will on net be biased towards the optimistic outlook. Of course the goal of efficient financial markets is to have prices reflect our collective best guess, somewhere between optimistic and pessimistic. It follows that overpriced stocks and stock markets, including incredibly destructive bubbles, are best fought by allowing all opinions to affect prices. For instance, the recent market/tech bubble would in all likelihood have been less egregious with fewer hurdles to short selling. To put it simply, widows and orphans are on net protected, not damaged by short sellers. ...While individual short sellers might differ, in aggregate, they are not shorting distressed companies to drive them to doom with misleading Internet chat. Rather, in aggregate, short sellers are the Praetorian Guard of the financial markets. These activities logically, and in fact, lead to a more stable market where bubbles (both in aggregate and in relative value) are fought by the short sellers (though as 1999–2000 shows, not necessarily fought enough), and not, like done by much of the rest of the investing world, simply ridden until the eventual ugly denouement. |

| sandjco 648 posts msg #151283 - Ignore sandjco |

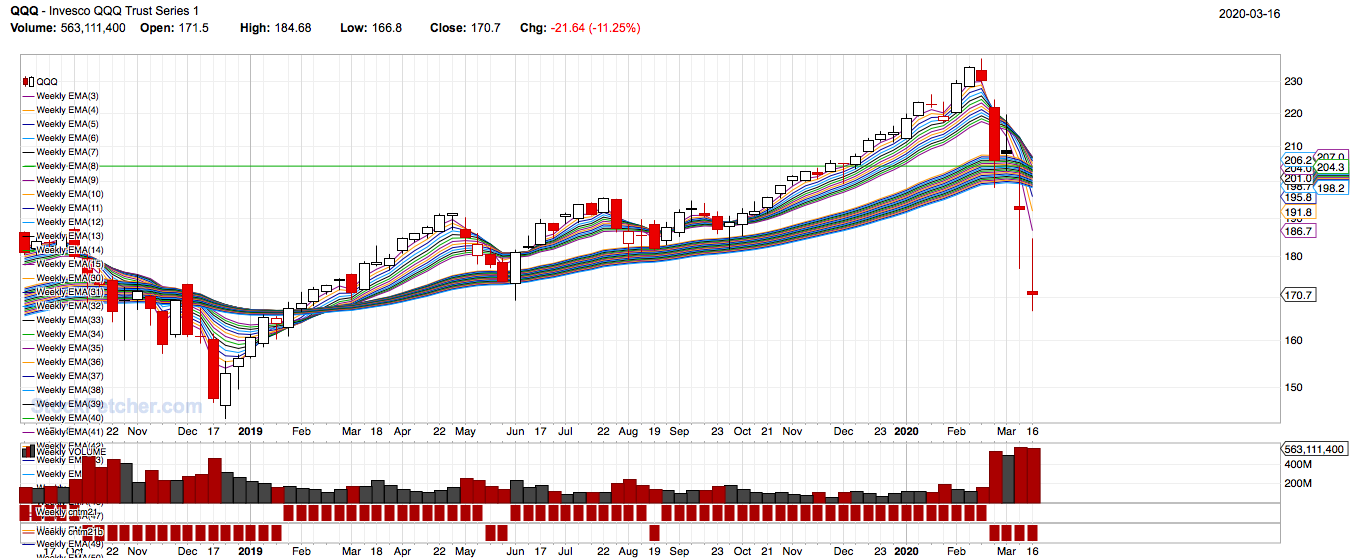

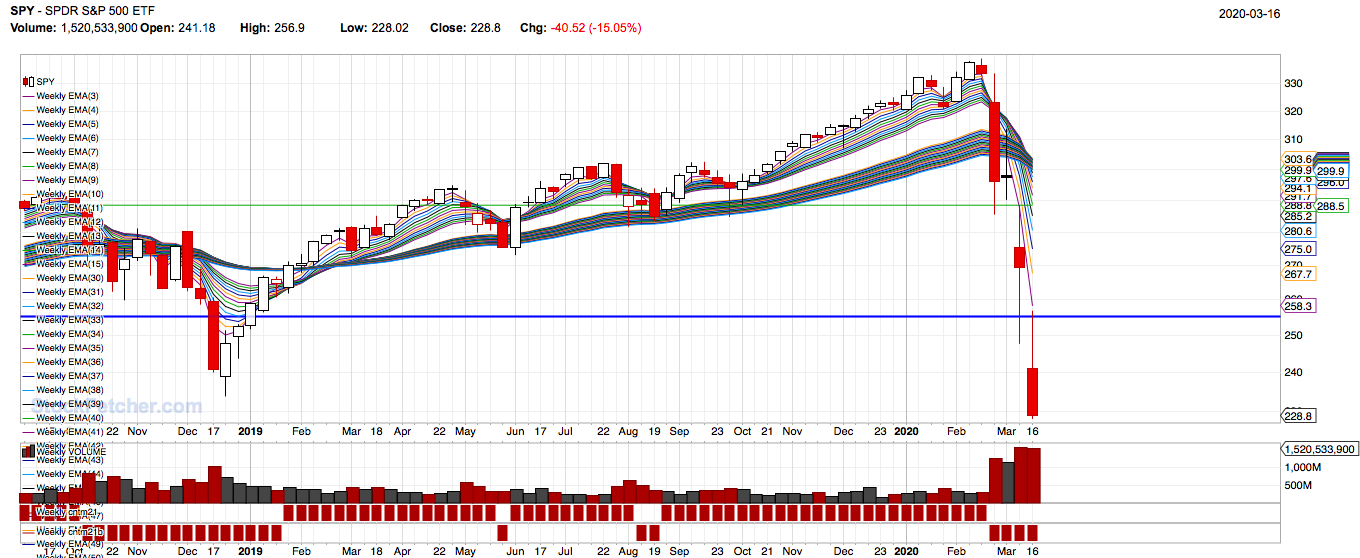

3/19/2020 1:27:49 AM Thanks Xarlor; the past month or this past year have been absolutely beyond what I've expected. I think my own perception of my perceived ignorance (if that makes sense) has kept me grounded and allowed me to figure out what my mistakes were early on (and I am sure I will continue to make them). Yes, there were "emotion" based "rules" there as I am not certain if I can truly pull the trigger "mechanically". Although, I must admit, that would be my goal. Thank you for sharing the article. I personally didn't see going "short" as bad per se...it was just my feeling of shorting stocks that have been really good to me that kinda felt weird. It was so weird shorting TSLA and/or buying puts on it when has been so good to me. However, I do understand the "yin" and "yang"...it is indeed necessary to keep the market honest. It was just a weird feeling as I don't think I've ever traded so many puts or shorted shares ever in my life than the last 5 weeks! It will be really interesting to see how this all unfolds. US is now 29/1M pop https://www.worldometers.info/coronavirus/#countries  So weird.. early March... This current haircut seems tame compared to Dec 2018 (China trade war which kinda became a non-event?) which was about 24% (will bring SPY to about 255 from 296 today). Longest correction apparently took 900 days to get over it. SPY $240. All the best and thanks for dropping by! |

| sandjco 648 posts msg #151360 - Ignore sandjco |

3/22/2020 9:53:55 AM The meltdown continues...      So far, for the whole month...strength has been used to get out of positions by the looks of it.  Oil..  Gold...  Bitcoin...  Financials...  TLT...  US now has 81 cases/1M pop vs China's 56/1M. https://www.worldometers.info/coronavirus/country/us/ - NY is the hardest hit. Will they close the Exchange to practice "social distancing"? - Rates cut; liquidity pumped - School's out...online! (interesting how this will maybe change the way education is delivered) - Remote work from home in vogue! (hmmm...will make employers aware that...) - Airlines getting bailed by the gov't.... - Layoffs happening - TB12 to Tampa! - Kenny Rogers RIP at 81 Meanwhile...interesting....In Essex.... getting arrested for stolen Toilet Paper...smh TP? So, when this is over..should I expect a line of ppl returning TP at Costco? |

| shillllihs 6,102 posts msg #151368 - Ignore shillllihs modified |

3/22/2020 8:13:42 PM Fascinating |

| svtsnakebitn 150 posts msg #151371 - Ignore svtsnakebitn |

3/22/2020 9:20:42 PM Hey Sandjco - I drew my resistance line from the black bar and the close on Friday powered through the resistance - looking for a gap up tomorrow and picked up TMF AH on Friday @ 38.25 |

| sandjco 648 posts msg #151388 - Ignore sandjco modified |

3/23/2020 9:39:23 AM svtsnakebitn 33 posts msg #151371 - Remove message 3/22/2020 9:20:42 PM Hey Sandjco - I drew my resistance line from the black bar and the close on Friday powered through the resistance - looking for a gap up tomorrow and picked up TMF AH on Friday @ 38.25 Good luck svtsnakebitn! I don't play AH ever. I am sorry as I have issues doing "drawings" lol.  The trend line you were referring to probably is the blue one? I had that in mind. My play was based on the red ones. This would be another perfect example of one chart but seen from 2 different approaches. I wouldn't be surprised if someone else played it short if it doesn't break. Interesting thing about the virus... 95% of current active cases are mild...but yet, subjectively, if I was judging it based on the news or social media, I would be led to believe it is a horror show out there. Yes, there will be a slow down. Yes, the streets have probably 90% less traffic and yes, I find it interesting people hoarding TP when I went to Costco (there was a fight too!). Question to the board: - is there a way to get more than 3 years of data (it doesn't have to show on the screen)? Say...5 or 7 yr hi and low? - is there a way to see monthly volume over the last 5 years? I remembered seeing or reading here that we can "fetch" data past 2 years but we just cannot display it or something like that. Stay safe! Kevin..if you are reading any of this....I thank you. I wished things were different. |

| svtsnakebitn 150 posts msg #151389 - Ignore svtsnakebitn |

3/23/2020 10:37:46 AM it was also based on TMV that broke through resistance.... dangit. Could've gotten back in this morning at 36.77... its back around $40 again! |

| sandjco 648 posts msg #151391 - Ignore sandjco |

3/23/2020 12:18:08 PM svtsnakebitn 34 posts msg #151389 - Remove message 3/23/2020 10:37:46 AM it was also based on TMV that broke through resistance.... dangit. Could've gotten back in this morning at 36.77... its back around $40 again! Hahahaha...if I had an option contract every time I said danggit for missing a run this year alone, I'd be a friggin rock star! There will always be another babe!  Only thing I don't like about the set up is that it went up too far too fast. Will probably sell 3/4 of my TLT today. On a totally unexpected (by me anyways) play that I was hoping to be able to build a bigger stake was...  Apr 150C busted a move already.... As always....good luck and your mileage may vary. |

| xarlor 639 posts msg #151393 - Ignore xarlor |

3/23/2020 3:41:02 PM sandjco, the post below is probably what you are remembering. https://www.stockfetcher.com/sfforums/?mid=149368 To your question, 7-year high and low: |

| xarlor 639 posts msg #151397 - Ignore xarlor |

3/23/2020 6:05:45 PM Correction above, 9YL and 9YH should say 7YL and 7YH. It's just a labeling error, the actual numbers are correct. Here is your second question about average volume in the last 5 years. I think I got the maths correct, but if not someone point it out! |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 8 9 10 11 12 ... 29 >>Post Follow-up |