| StockFetcher Forums · Stock Picks and Trading · Pattern Watching | << 1 ... 11 12 13 14 15 ... 20 >>Post Follow-up |

| Nobody 404 posts msg #159060 - Ignore Nobody modified |

5/12/2022 9:38:06 AM |

| styliten 343 posts msg #159061 - Ignore styliten modified |

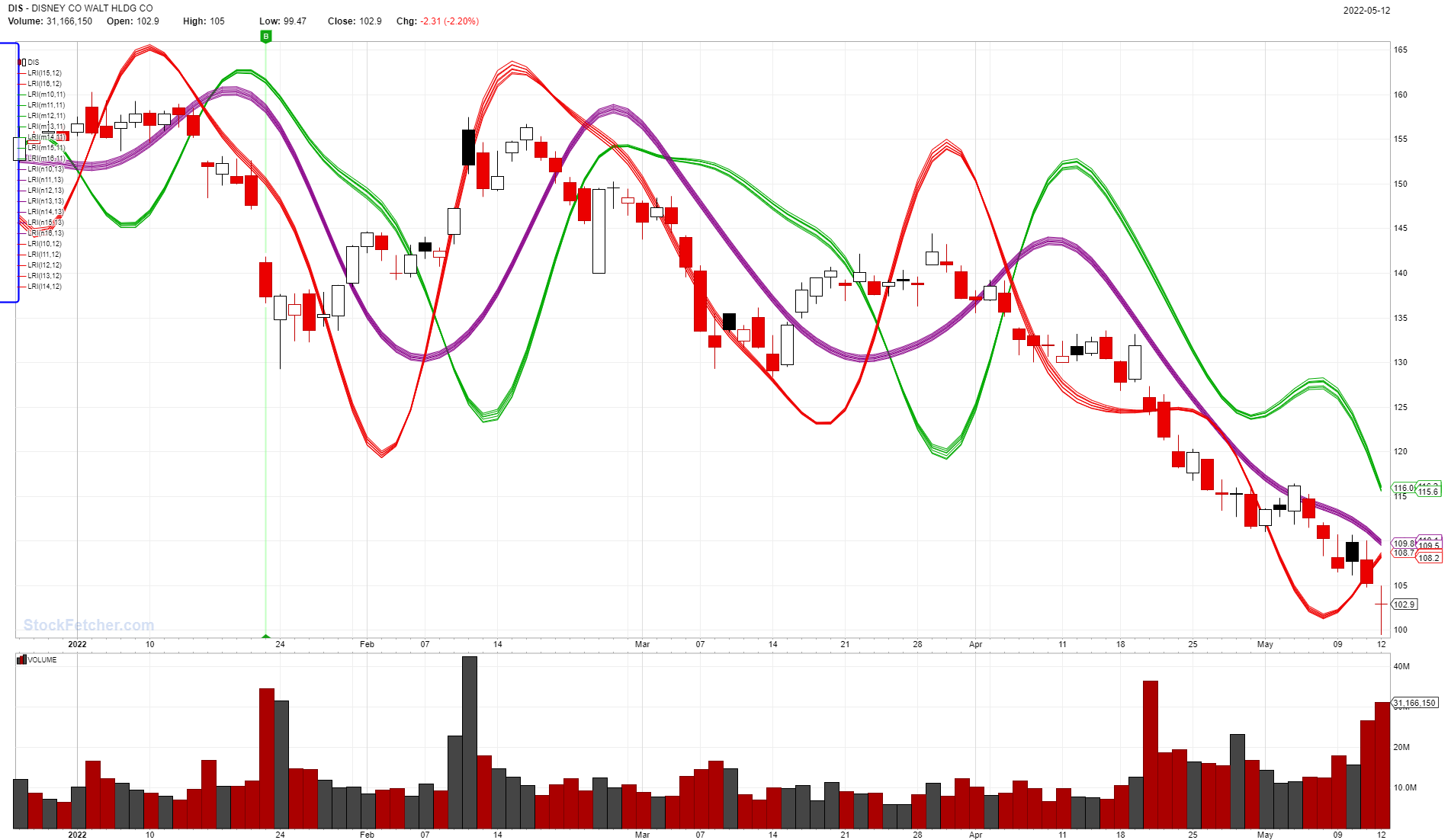

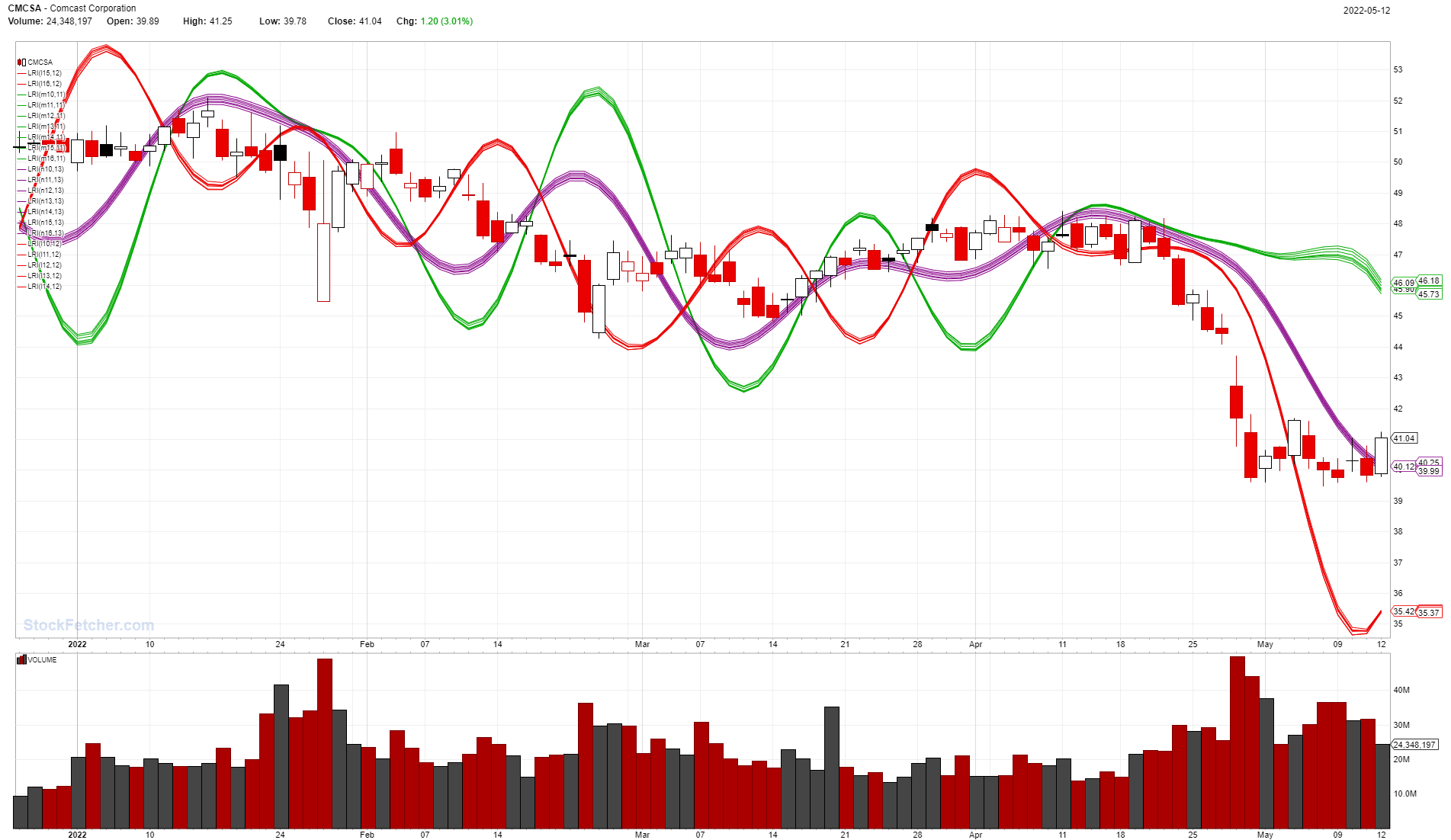

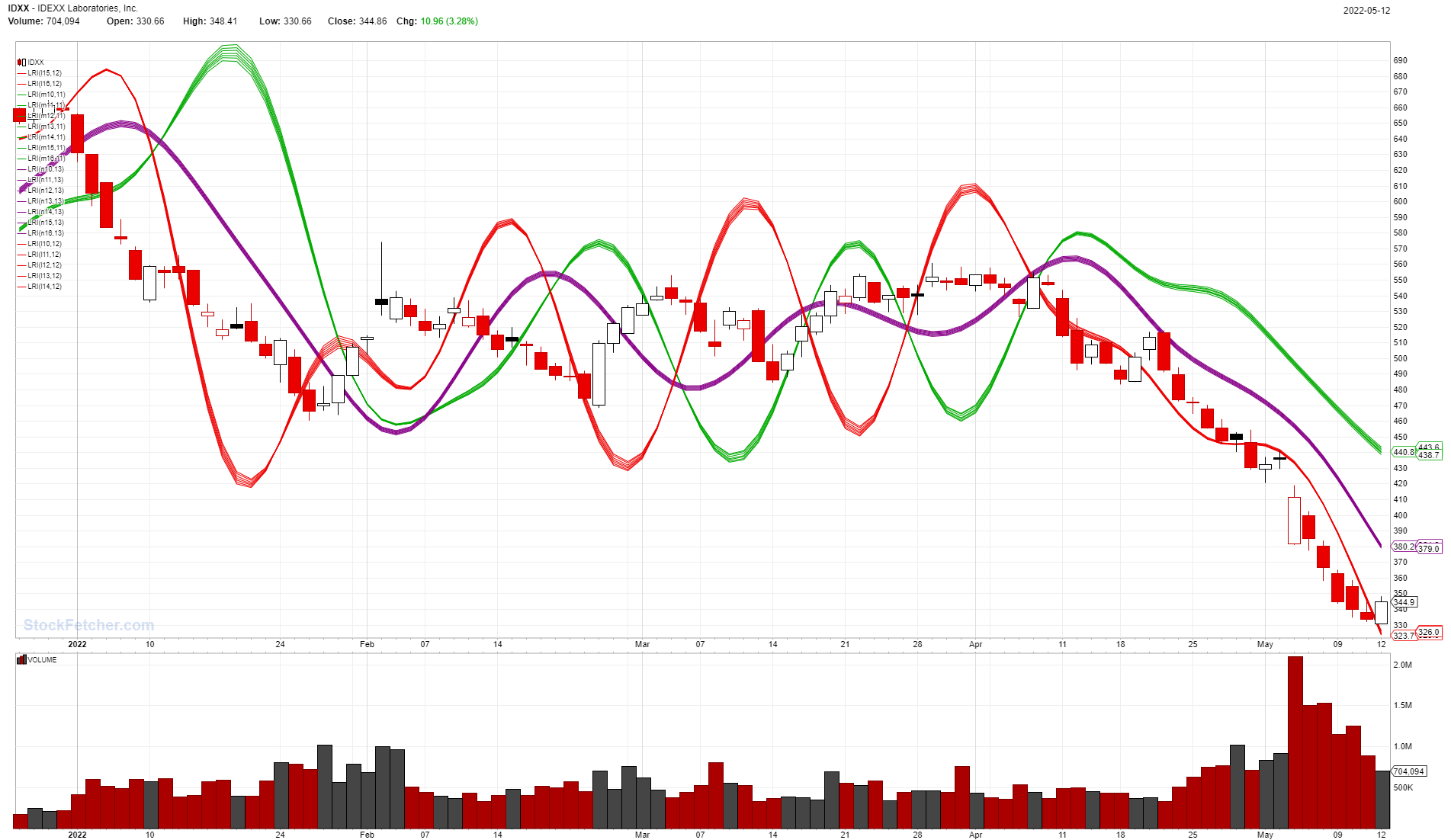

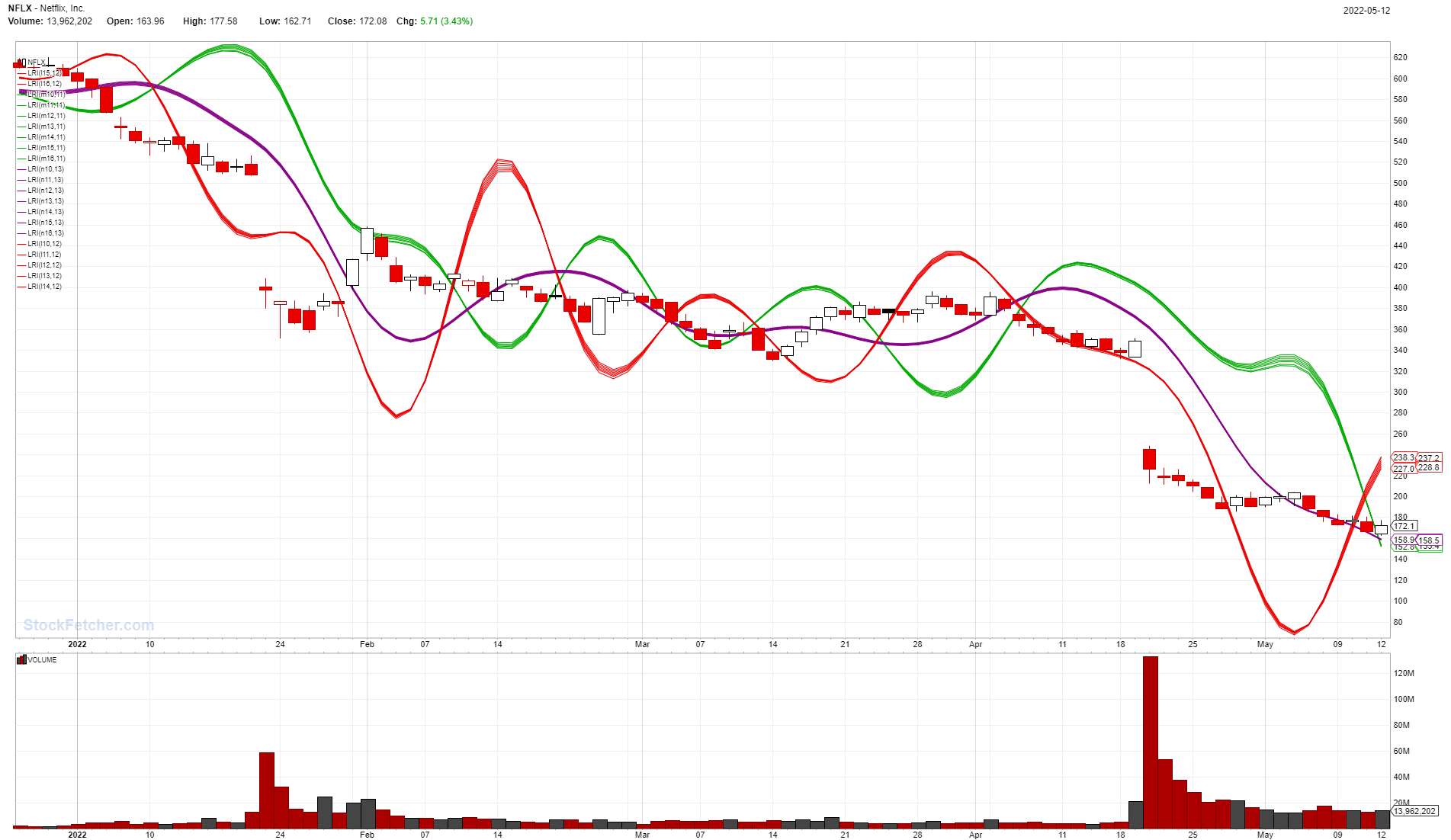

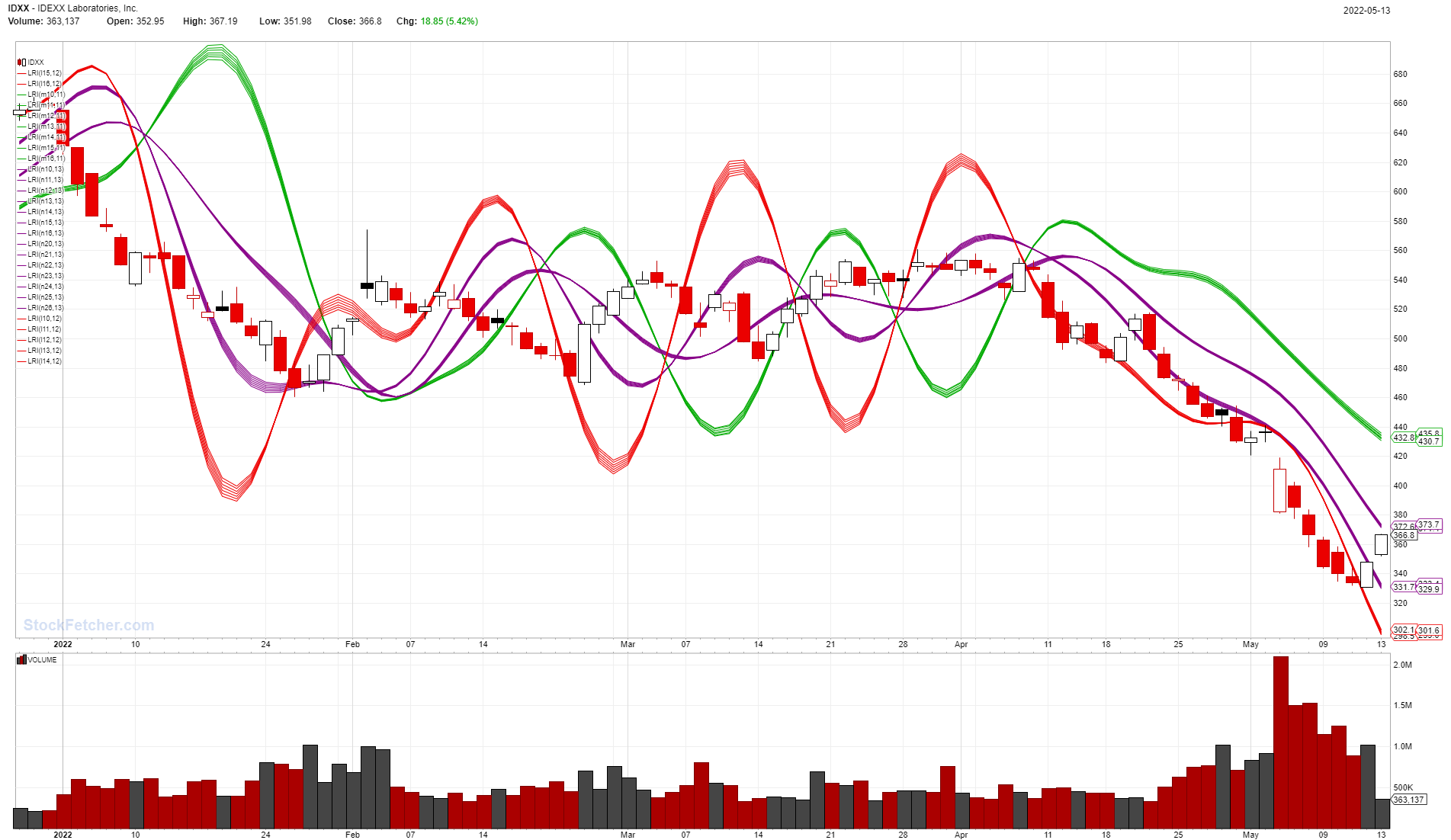

5/12/2022 3:48:49 PM Looks like DIS should rebound starting tomorrow:  Also, CMCSA, IDXX, ORLY, NFLX, REGN, among others, are starting to rebound:      |

| Nobody 404 posts msg #159063 - Ignore Nobody |

5/13/2022 9:34:54 AM Thank you styliten Always great to have feedback from a pro. Will keep eye on the others. |

| styliten 343 posts msg #159064 - Ignore styliten modified |

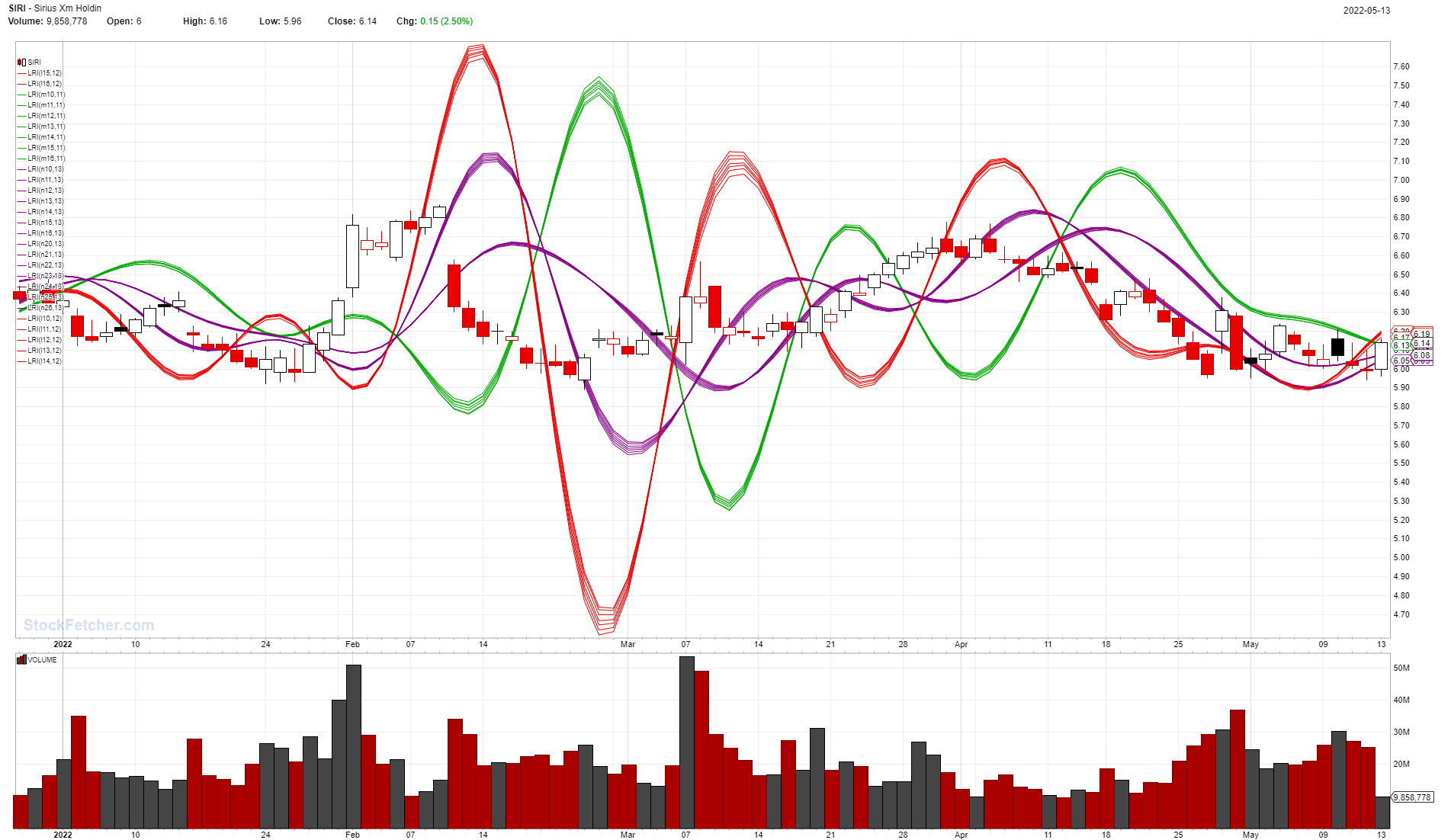

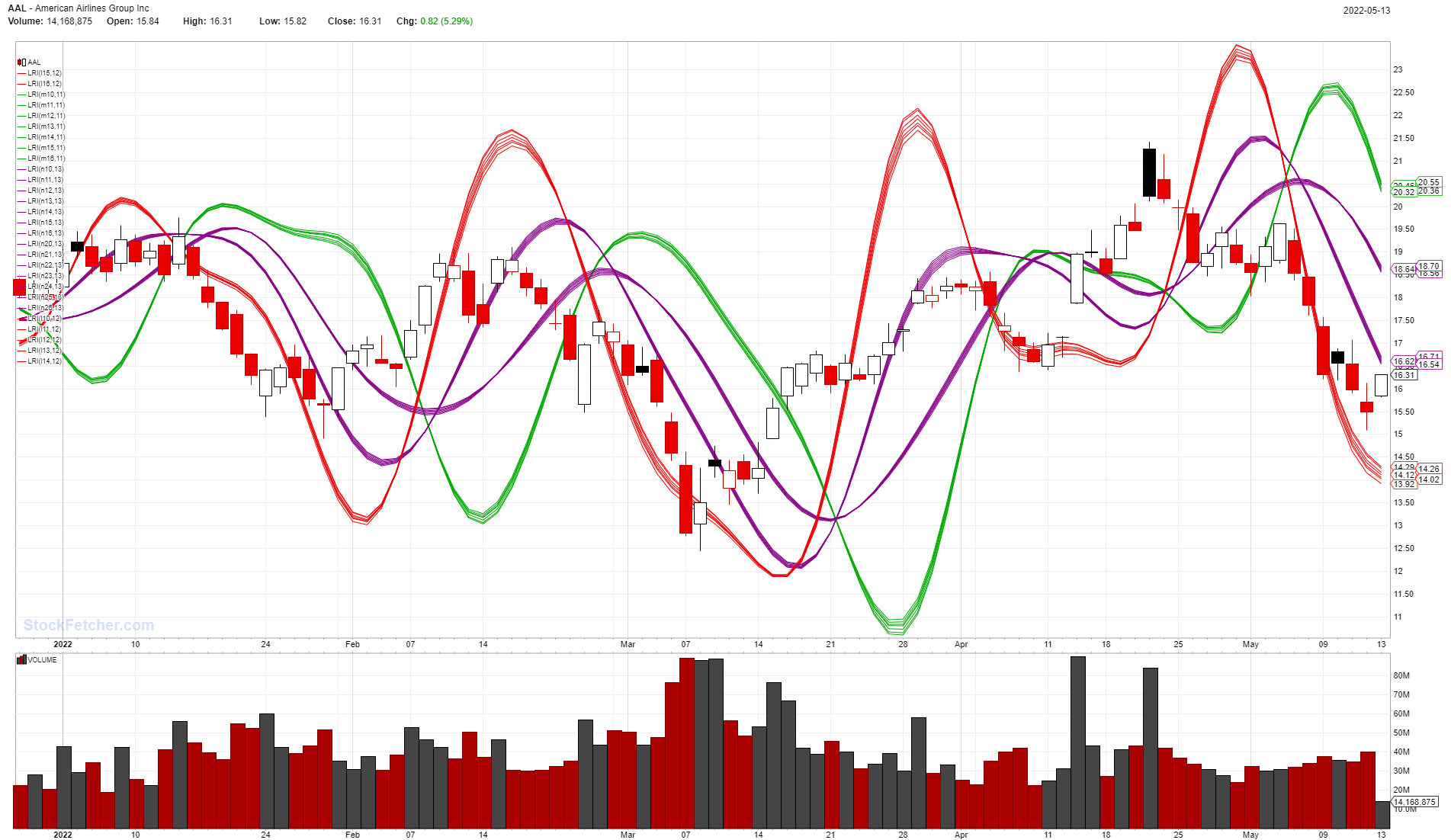

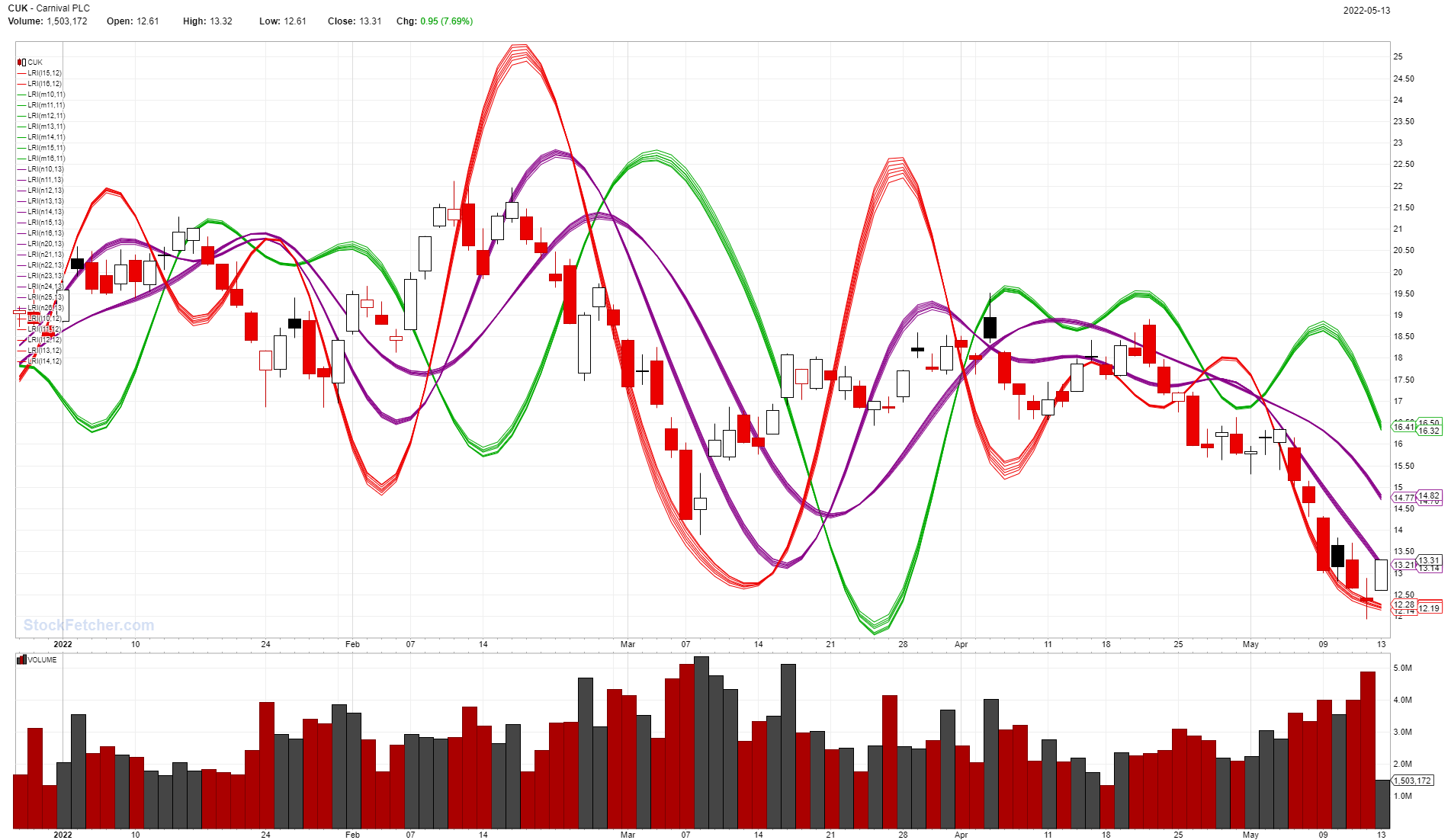

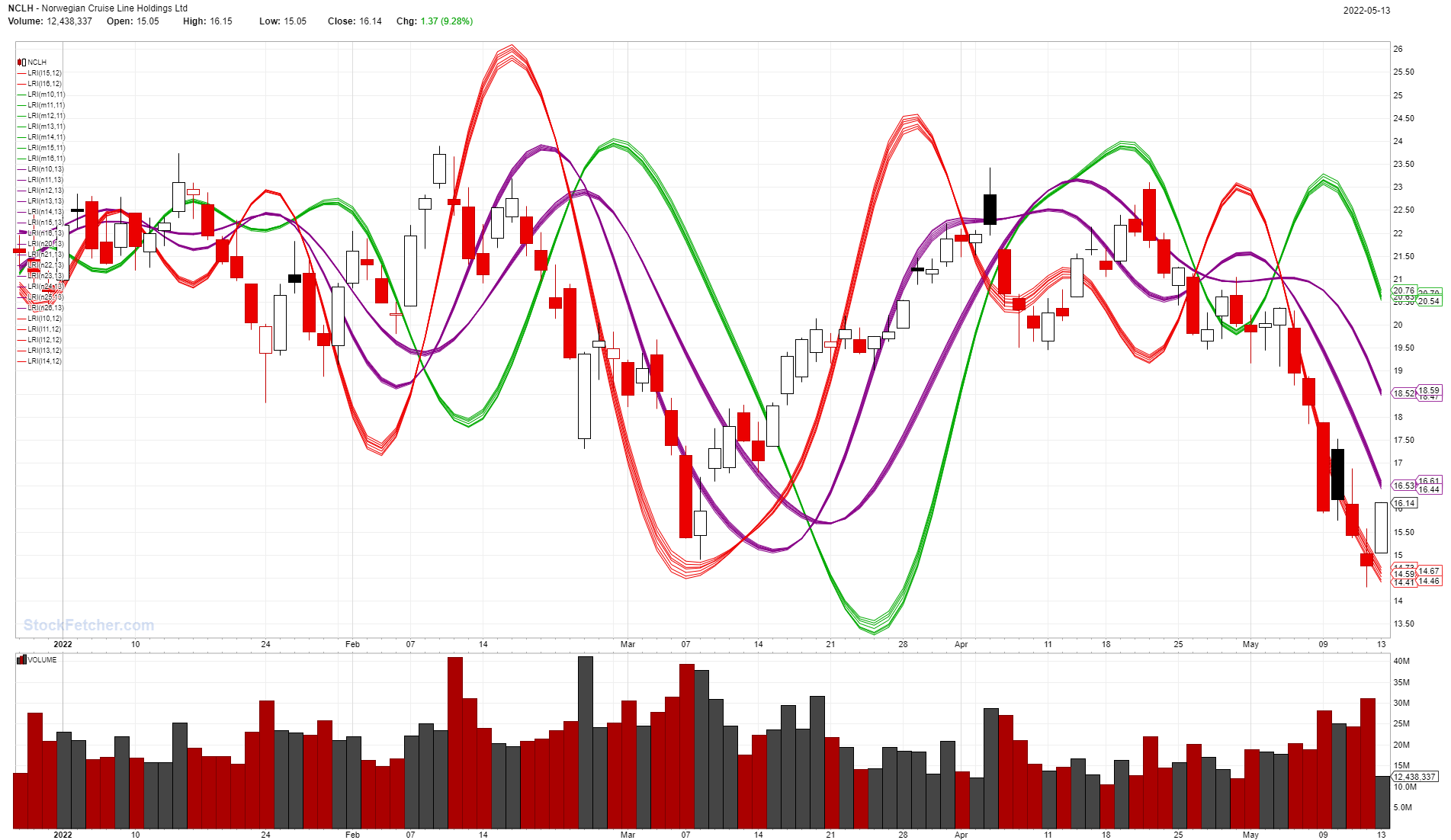

5/13/2022 12:27:05 PM @ Nobody, No pro here, but learning myself. As of Friday 5/13/2022, it looks like consumer discretionary is rebounding like crazy now, e.g. 1. SIRI & APP:   2. GT:  3. DASH:  4. TDOC,ISRG & IDXX:    5. UBER & LYFT:   6. BA, UAL, AAL:    7. SBUX & DIS:   8. CUK, CCL & NCLH:    ...... Need any more proof? |

| Nobody 404 posts msg #159088 - Ignore Nobody modified |

5/18/2022 10:23:39 AM Hi styliten Trust you're off to great start. Any thoughts on the below opportunity?

|

| styliten 343 posts msg #159090 - Ignore styliten modified |

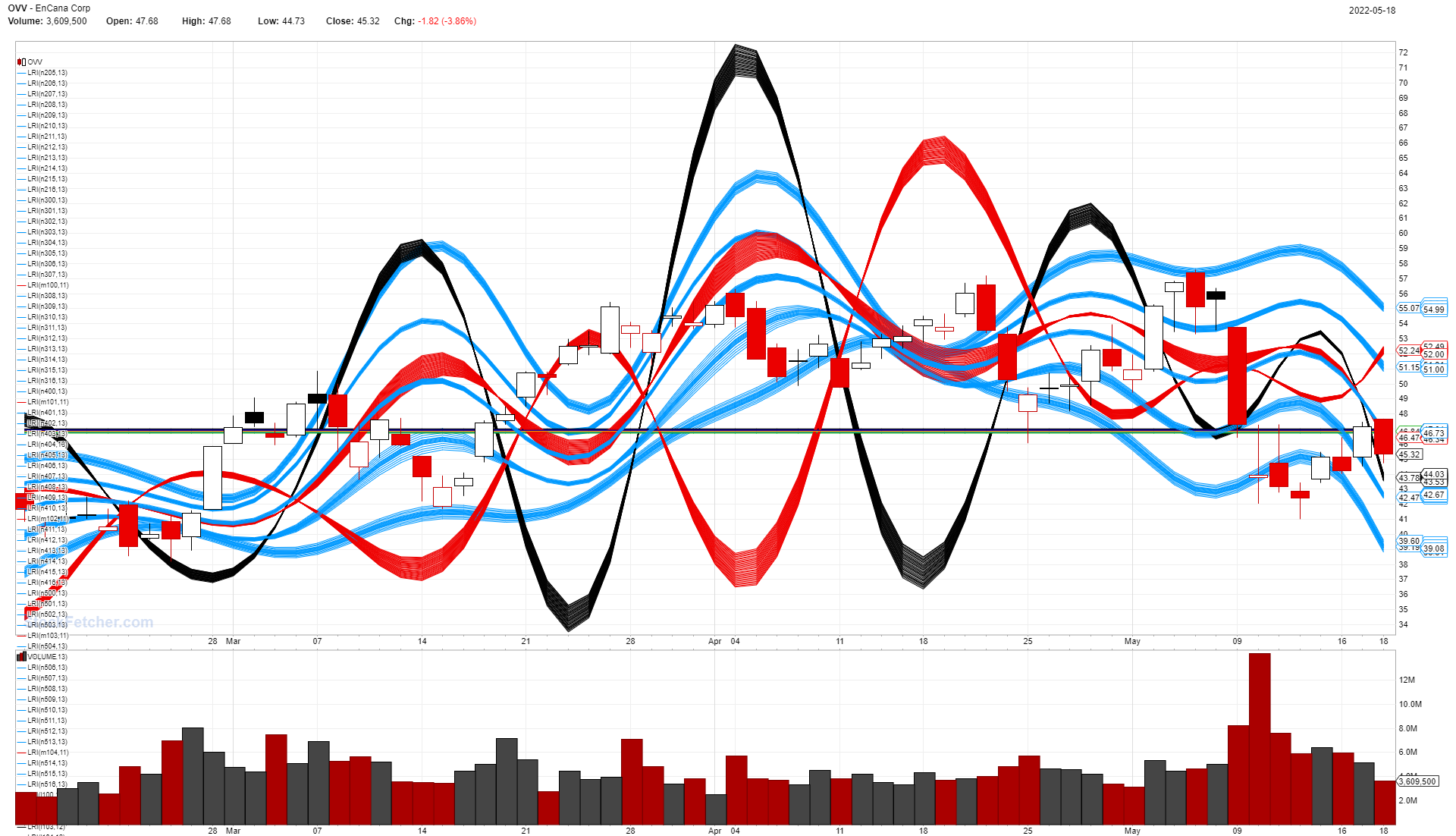

5/18/2022 11:50:55 PM @ Nobody, Who could say anything for certain in this kind of extreme volatility/market turmoil? In the last 4 or 5 trading sessions, OVV zigzagged: one day up and the next day down. When would it restore any stability? The best thing to do right now is perhaps just keep an eye on it:  The only saving grace today seems to be Six Flags:  Not sure why they are reviving, Are they raising their prices or are they forecasting larger crowds at their gate? Who knows? But the chart says they are up today (with larger than normal volume). |

| Nobody 404 posts msg #159093 - Ignore Nobody |

5/19/2022 8:47:58 AM Thanks styliten Will sit on side keep watch. Lots of insider buying on $SIX |

| styliten 343 posts msg #159096 - Ignore styliten modified |

5/19/2022 10:40:12 AM @ Nobody, Looks like the SF website is down since opening (no changes to the filter can be saved!) But, OVV did have a confirmed growth signal:  Apparently the embedded chart immediately above doesn't work at all during preview. So here is the IBB link of OVV as of this morning:

|

| Nobody 404 posts msg #159097 - Ignore Nobody modified |

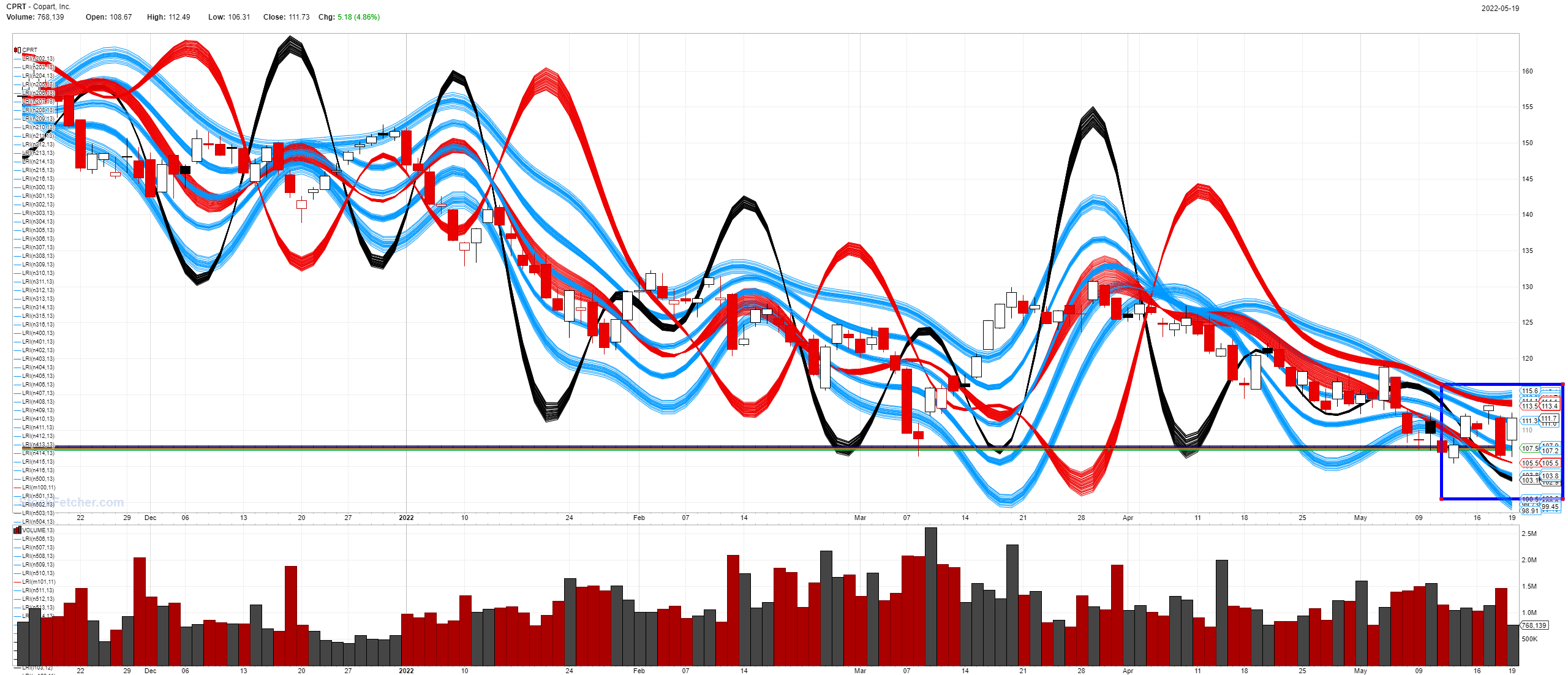

5/19/2022 1:27:57 PM styliten - you think this a good business to be in during current period Also - is a filter present that helps me find that pattern forming a fork like shape or maybe a dipper lol?

Copart, Inc. provides online auctions and vehicle remarketing services in the United States, Canada, the United Kingdom, Brazil, the Republic of Ireland, Germany, Finland, the United Arab Emirates, Oman, Bahrain, and Spain. It offers a range of services for processing and selling vehicles over the internet through its virtual bidding third generation internet auction-style sales technology to vehicle sellers, insurance companies, banks and finance companies, charities, fleet operators, dealers, vehicle rental companies, and individuals. The company's services include online seller access, salvage estimation, estimating, end-of-life vehicle processing, virtual insured exchange, transportation, vehicle inspection stations, on-demand reporting, title processing and procurement, loan payoff, flexible vehicle processing programs, buy it now, member network, sales process, and dealer services. Its services also comprise services to sell vehicles through CashForCars.com; U-Pull-It service that allows buyer to remove valuable parts and sell the remaining parts and car body; copart 360, an online technology for posting vehicle images; membership tiers for those registering to buy vehicles through Copart.com; and virtual queue to secure a place in line while visiting one of its locations. The company sells its products principally to licensed vehicle dismantlers, rebuilders, repair licensees, used vehicle dealers, and exporters, as well as to the public. The company was incorporated in 1982 and is headquartered in Dallas, Texas. |

| styliten 343 posts msg #159098 - Ignore styliten |

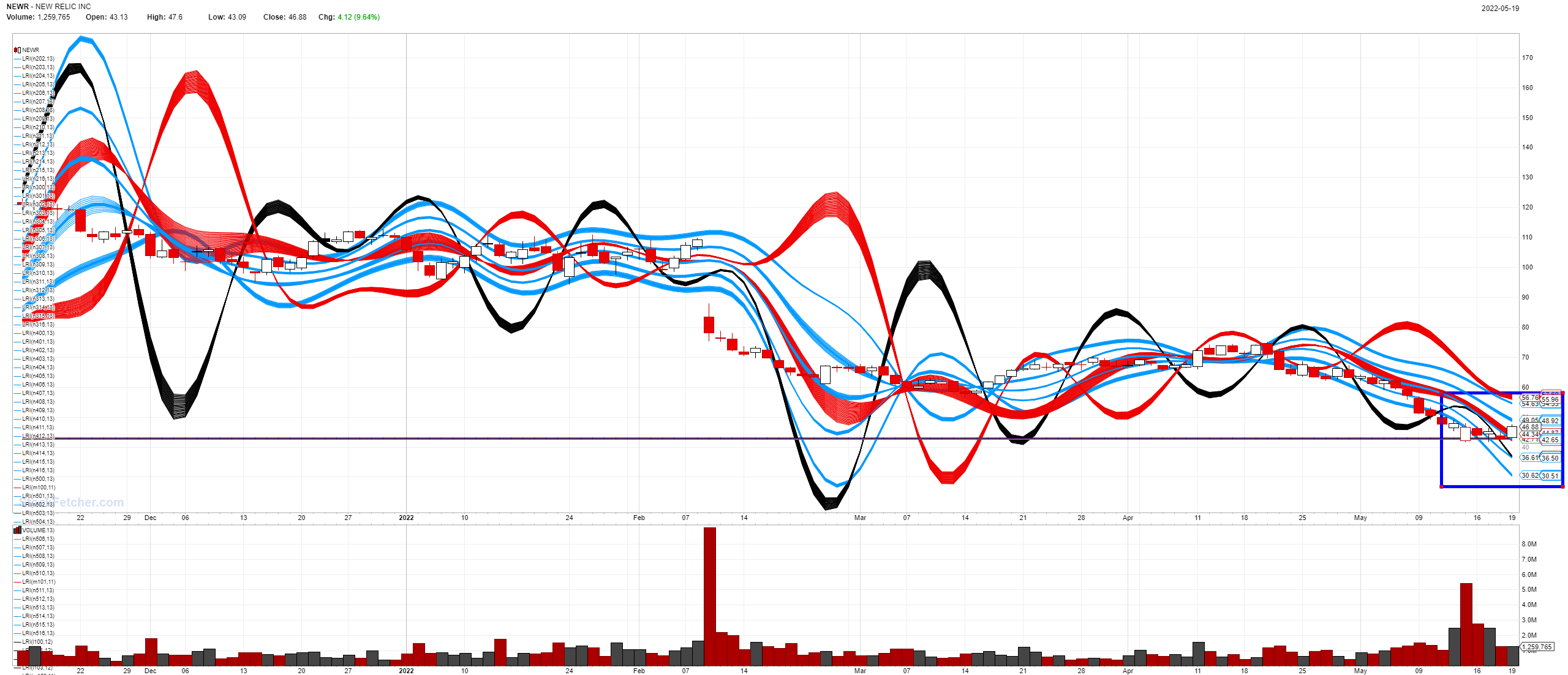

5/19/2022 1:44:08 PM @ Nobody, Your question is too hard/deep. If you are offered these 2 stocks today, which would you rather buy: 1. NEWR:  2. CPRT:  While both seem to be on the rise, NEWR does seem to have better timing overall. What do you see/think? |

| StockFetcher Forums · Stock Picks and Trading · Pattern Watching | << 1 ... 11 12 13 14 15 ... 20 >>Post Follow-up |