| StockFetcher Forums · Stock Picks and Trading · GameStop Do you have a filter that found it? When? | << 1 2 3 4 >>Post Follow-up |

| miketranz 979 posts msg #155552 - Ignore miketranz |

2/2/2021 5:06:04 PM |

| Nobody 404 posts msg #155554 - Ignore Nobody modified |

2/2/2021 9:36:13 PM Sir miketranz On the above filter you posted - I look at $OCGN and few others ... age old question how to catch those flat liners bit earlier ? Totally separate ticker flat Lining $AIV or $OVID  Thank you |

| Cheese 1,374 posts msg #155555 - Ignore Cheese |

2/2/2021 10:52:01 PM Ed, This filter by graftonian told us what to do with GME along the way. Are you looking for something more than this? Looking forward to the results of your analysis. Thanks. For advanced subs: For basic subs, I use Kevin's partial STC |

| Mactheriverrat 3,178 posts msg #155556 - Ignore Mactheriverrat modified |

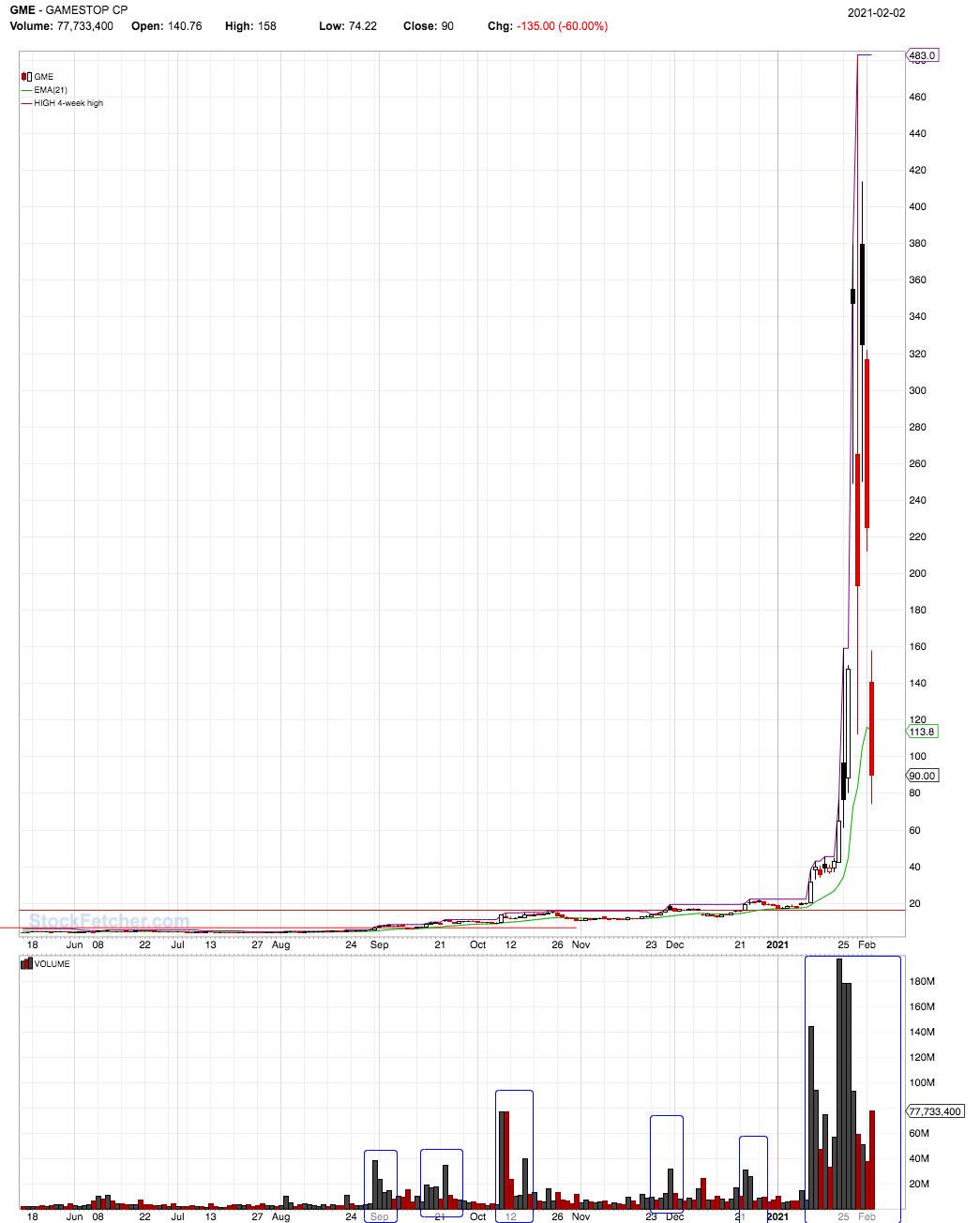

2/2/2021 10:54:57 PM The markets remembers every thing. When GME showed up back in early Sept on the this Filter a Symlist could have been used as in drawing resistance levels . Then it popped up a few more time's before really breaking out on the 1-13-2021. Each time it hit high 20 day high that above average volume's happened. Then like I said on 1-13-2021 it broke resistance and it took off. Every time that it hit a new high off of resistance that the above average happened Volume = other traders. Finally the sellers lost all steam and it took off like a shooting star. Submit  |

| Cheese 1,374 posts msg #155561 - Ignore Cheese |

2/3/2021 1:06:27 AM Good explanation, John(Mac). |

| miketranz 979 posts msg #155564 - Ignore miketranz |

2/3/2021 9:03:05 AM Nobody,look for stocks making a new 6 month low under $5,make up a watch list.Look to see which ones move in a flat line with low rsi.You're basically stalking stocks moving sideways which have not triggered a breakout.I would look also at volume/accumulation.This is a tedious process.ATOS would make a good model.AMC is also a good example.I'm sure someone on here has the smarts to come up with such a thing.It's really amazing the filters they come up with.A big thanks.Best,Miketraz... |

| miketranz 979 posts msg #155566 - Ignore miketranz |

2/3/2021 9:55:26 AM TTNP |

| Nobody 404 posts msg #155569 - Ignore Nobody |

2/3/2021 10:35:01 AM Thank You miketranz |

| xarlor 639 posts msg #155570 - Ignore xarlor |

2/3/2021 10:46:14 AM @miketranz and Nobody Kinda, sorta? This one catches ATOS and AMC and others along the way. |

| miketranz 979 posts msg #155578 - Ignore miketranz |

2/3/2021 2:30:42 PM APRE |

| StockFetcher Forums · Stock Picks and Trading · GameStop Do you have a filter that found it? When? | << 1 2 3 4 >>Post Follow-up |