| StockFetcher Forums · Stock Picks and Trading · DNR | << 1 2 3 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #144463 - Ignore Mactheriverrat |

8/21/2018 4:04:15 PM |

| graftonian 1,089 posts msg #144472 - Ignore graftonian |

8/22/2018 9:32:40 AM DNR up 5% this morning!!! |

| Mactheriverrat 3,178 posts msg #144480 - Ignore Mactheriverrat |

8/22/2018 9:38:05 PM Its a good uptrend !!! |

| BenH 32 posts msg #144487 - Ignore BenH |

8/23/2018 8:06:18 PM DNR , it did rally back at the end of the day. im noticing other oil ones are starting to come around. WFT is making some up moves on lower volume. ENPH seames to have filled that gap and is consulidating. lets see if DNR can keep it up. Good Luck |

| Mactheriverrat 3,178 posts msg #144488 - Ignore Mactheriverrat |

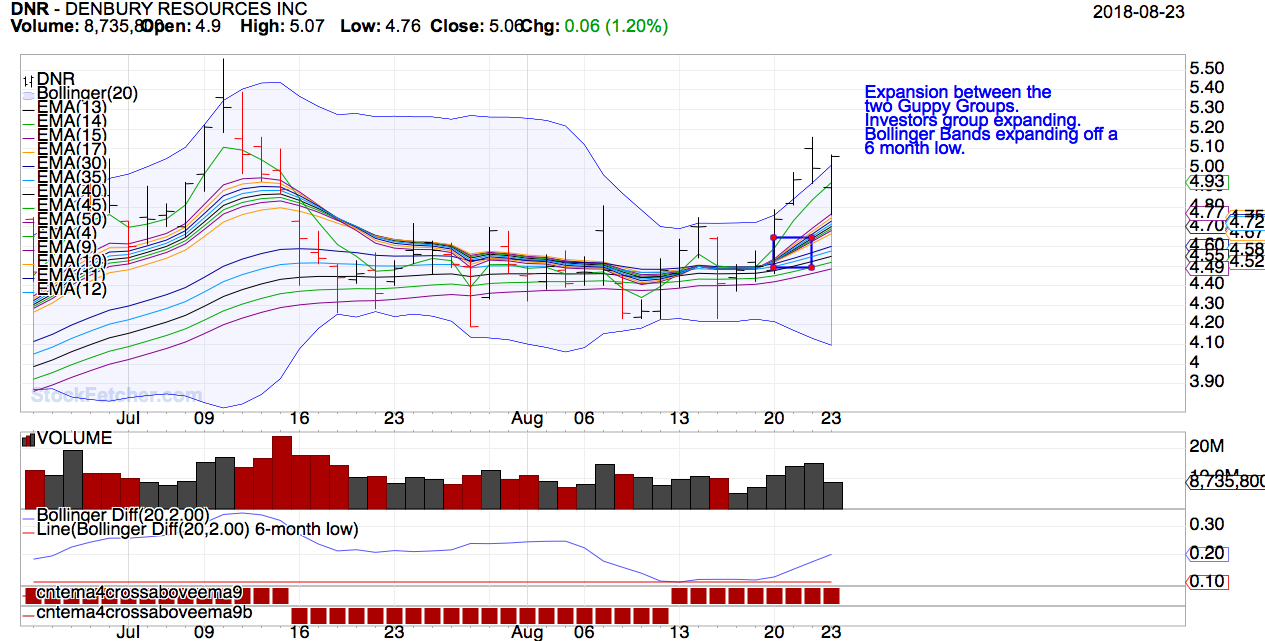

8/23/2018 9:40:55 PM DNR has a nice uptrend going. Price may are may not go up every day. Its the catching of the trend that counts.   |

| ron22 255 posts msg #144489 - Ignore ron22 |

8/24/2018 8:48:41 AM Good morning everyone. What is a good trigger for an exit strategy on DNR? Thank you for your help. |

| Mactheriverrat 3,178 posts msg #144492 - Ignore Mactheriverrat |

8/24/2018 12:57:29 PM So far a ema(4) cross ema(9) is a good trigger . ----------------------------------------------------------- Set{cntema4crossaboveema9,count( eMA(4) > eMA(9) ,1)} draw cntema4crossaboveema9 Set{cntema4crossaboveema9b,count( eMA(4)< EMA(9) ,1)} draw cntema4crossaboveema9b * 49 is number of consecutive days ema(4) above (+)/below(-) previous EMA(9) */ set{49b,days( ema(4) is above EMA(9) ,250)} set{49a,days( ema(4) is below EMA(9) ,250)} set{49, 49a - 49b} and add column 49 {49} do not Draw 49 |

| graftonian 1,089 posts msg #144500 - Ignore graftonian modified |

8/26/2018 10:25:49 AM Exit strategies. There must be enough opinions to start a whole new thread. I am using "close crossing below the Hull(30) moving average, but that is too sensitive and I try to temper the indicator with MACD,Stochastics, and the old eyeball.. I knocked out the following script to compare Macs suggestion with mine. I sure wish we had the capability to do back testing like in the good old days. |

| ron22 255 posts msg #144502 - Ignore ron22 |

8/26/2018 11:12:02 AM Mac and Graf, thank you both very much for your exit strategy feedback. Enjoy the rest of the weekend and good trading next week. |

| graftonian 1,089 posts msg #144503 - Ignore graftonian |

8/26/2018 11:21:51 AM Ron, Thanx. I forgot to mention the Guppy Count Back Line. |

| StockFetcher Forums · Stock Picks and Trading · DNR | << 1 2 3 >>Post Follow-up |