| StockFetcher Forums · Stock Picks and Trading · CLVS on watch for Monday. | << 1 2 3 4 5 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #134402 - Ignore Mactheriverrat |

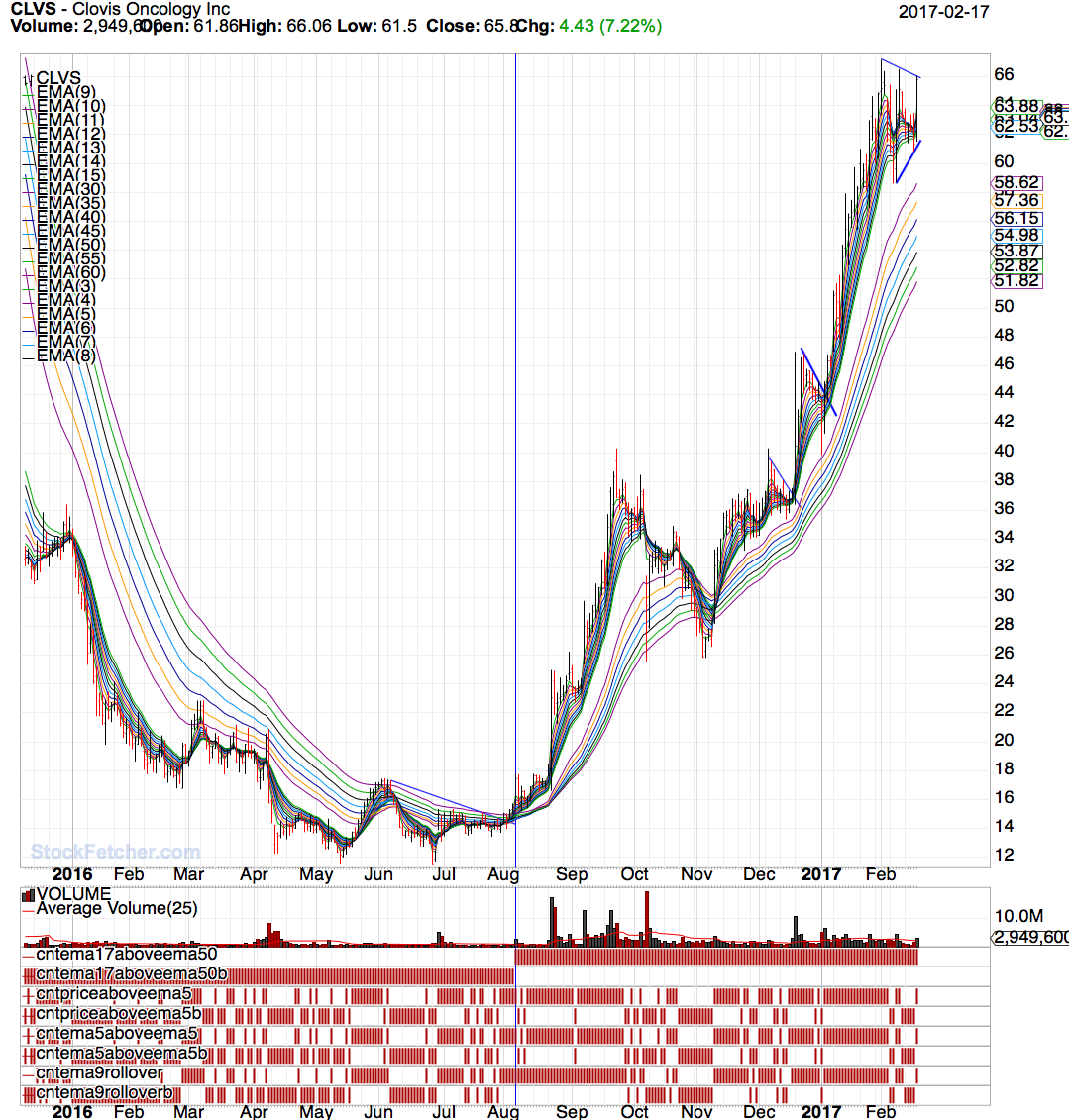

2/19/2017 12:18:57 AM Breaks above current resistance line it could be off to the race's.  |

| graftonian 1,089 posts msg #134405 - Ignore graftonian |

2/19/2017 11:19:32 AM CLVS is on my radar, just has to show a little more strength. Beware, earnings on 22nd. |

| graftonian 1,089 posts msg #134406 - Ignore graftonian |

2/19/2017 11:33:04 AM Mac, here is a list of stocks my breakout filter returned for Monday. Any of them on your "short list"? XOMA,FCEL,NVAX,IPI,RTK,MRNS,IVC,CGI,CHGG,CMRE,OCLR,ABUS,ROKA,SND,ZNGA,ENIC,EXAS,HRTG,VSLR,JASO,OFG,BRKL,SPLS,SEA,NRZ,KZ,INF,CUZ,PID,EWK, If I had to choose, I'd put OCLR at the top of the list. I have not figured a way to sort this long list, any suggestions? Thanks, and and enjoy the long (Warm) week-end. |

| Mactheriverrat 3,178 posts msg #134408 - Ignore Mactheriverrat |

2/19/2017 2:13:10 PM Roger on the earning watch on CLVS . If better she will bounce up . To swing traders (short term average's ) on waiting and Investor's like hedge funds, teacher's investment funds,big trading house's like MS,JPM, GS are still holding. The longer term average's (Investors) are spread apart and showing no signs of weakness. To me that means the big boys are looking for CLVS to fall and the trader's (swing trader's) are standing on the curb with sideways movement. If good earnings we could see a gap up , then a few days of profit taking , the another climb up off the gap up. -------- To me ZNGA NAVX JASO are stocks waking up with possible trend changes OCLR EXAS MRNS CHGG are stocks trending up and buy on dips The others to me are too low ADR(30) , too low volume , or etf. I try to use a ADR(30) above 3.00 , volume above 150000 ( that really too low also) no etf, and NO otcbb . IMHO! that's not saying that one could drop the ADR(30) to say 1.30 and get stocks like BAC,MS,JPM to pop up on the radar, |

| Mactheriverrat 3,178 posts msg #134409 - Ignore Mactheriverrat modified |

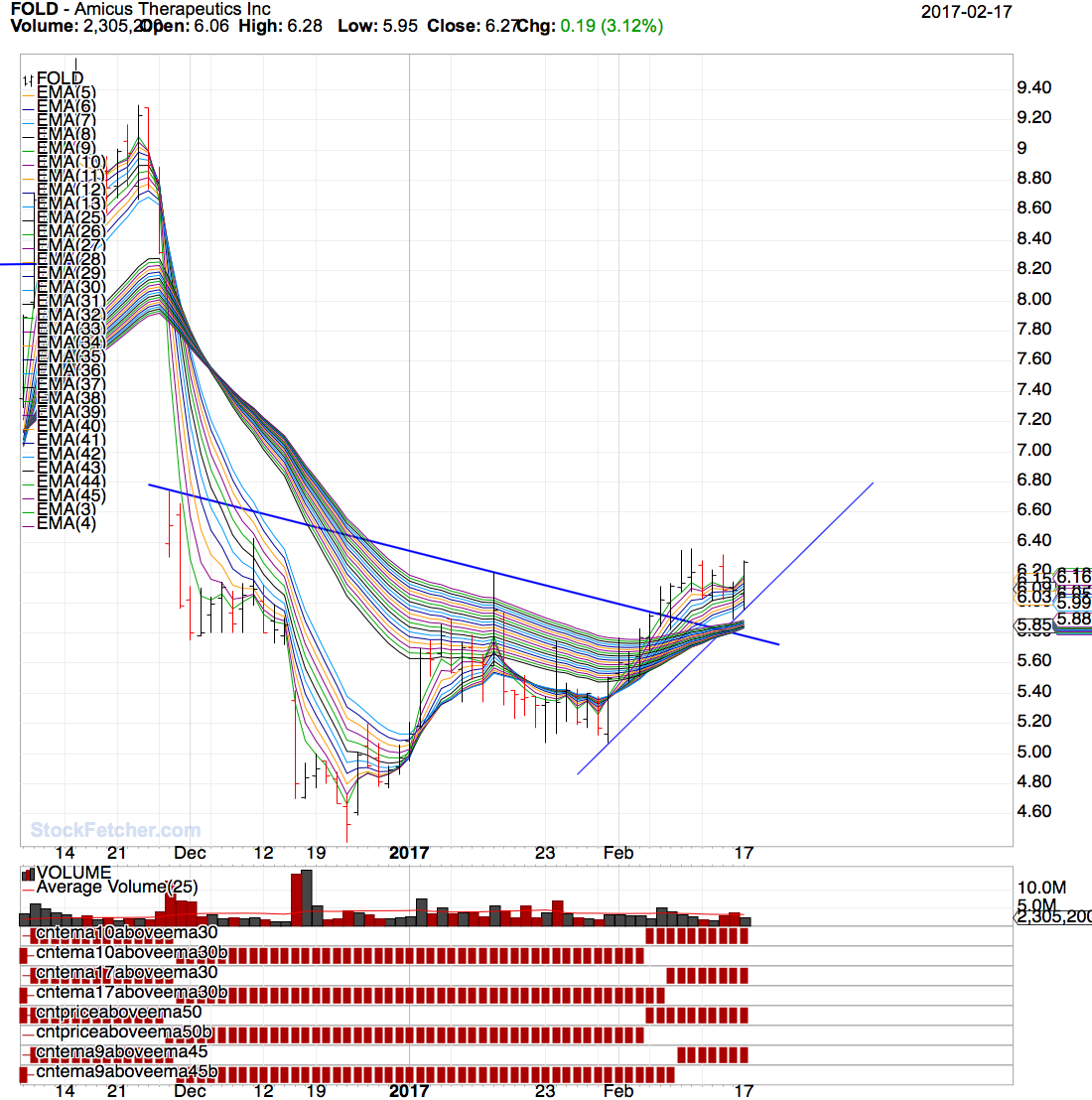

2/19/2017 2:21:53 PM CLVS on watchlist FOLD - holding a position A trend line change, compression of short term averages with them crossing above the longer term averages. Longer term averages compressing as in long term Investors wanting in now.  P.S. This is using the standard Guppy MMA 's which I changed a little bit but one shouldn't do that if using the true Guppy trading system. |

| graftonian 1,089 posts msg #134410 - Ignore graftonian |

2/19/2017 6:51:02 PM mac, thanks for the help. "The others to me are too low ADR(30) , too low volume , or etf. I try to use a ADR(30) above 3.00 , volume above 150000 ( that really too low also) no etf, and NO otcbb " I'll add that to the filter to shorten the list up. Also would you sort on ADR?. |

| Mactheriverrat 3,178 posts msg #134415 - Ignore Mactheriverrat modified |

2/19/2017 9:47:06 PM 13th_floor always sorted highest to lowest. Some like lower ADR with higher volumes on stocks like C,BAC,MS,JPM. I'm still playing with what a good volume would be. To your looking for a trend to catch from the breakout or a up trending stock thats rebounding with the ema(3) first day up. from a pullback. Ive been reading this book and I'm about 2/3 they way through it. I am going to read it a couple of times. IMHO- It has helped me see better of a understanding of Guppy GMMA averages. The reviews really don't do it any Justice IMHO. I like it. Its starts why people won't sell a losing position from not using a plan, buying a rally in a downtrend while the longer averages still moving downward meaning the big boys are still in a selling mode , the use of the 2 different groups of averages, when a price breaks above a trend line, breakout conformations, stop lose, the difference of the real trend of longer moving averages (investors) verse the smaller group of averages (swing trader's). Trend trading by Daryl Guppy Just look at CLVS when the trend started back in Aug 2016. How many times could one have got in on weakness of the shorter group of swing traders while the longer term group of averages of Investors just keep buying on their weakness. |

| Mactheriverrat 3,178 posts msg #134421 - Ignore Mactheriverrat |

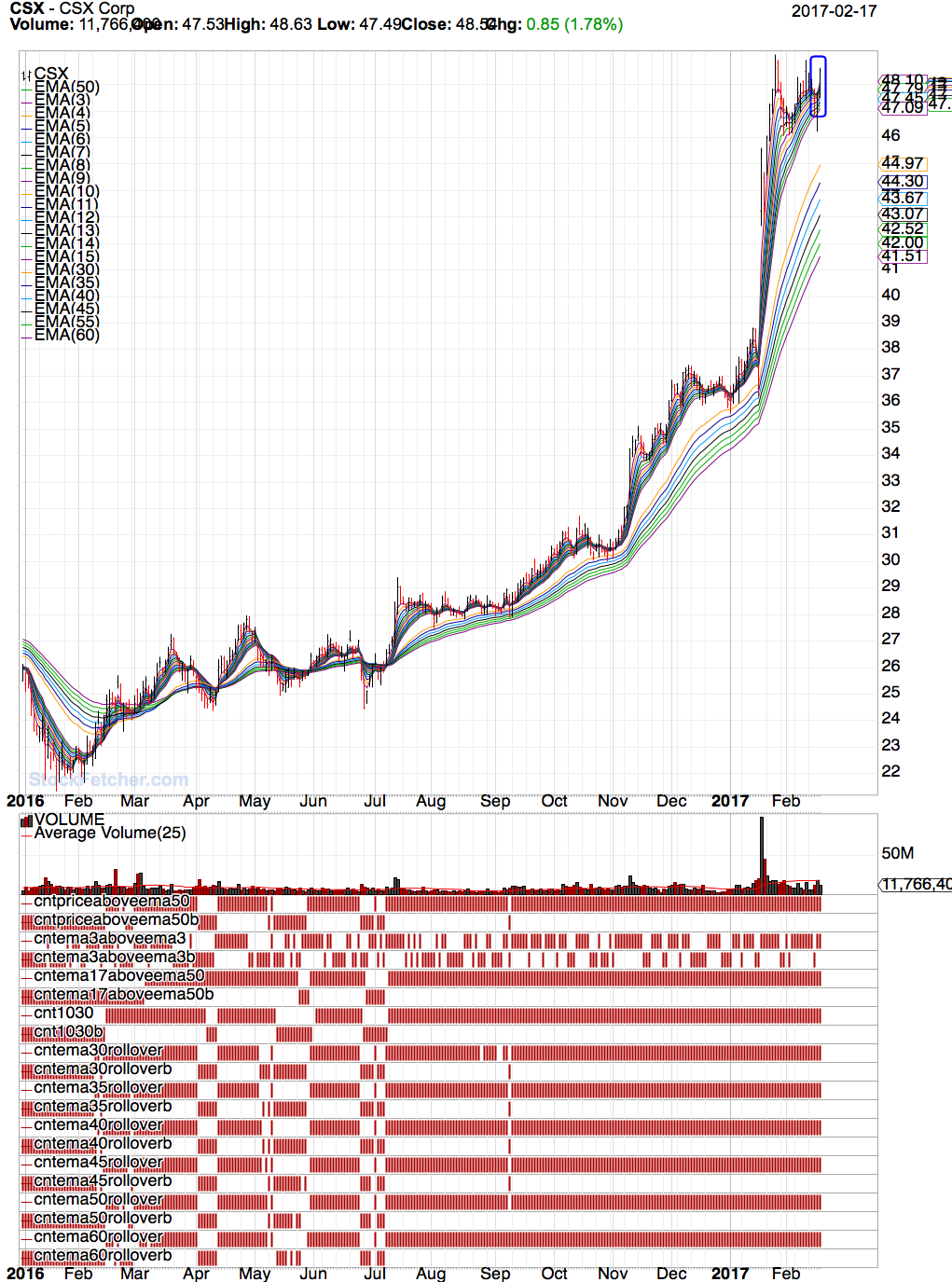

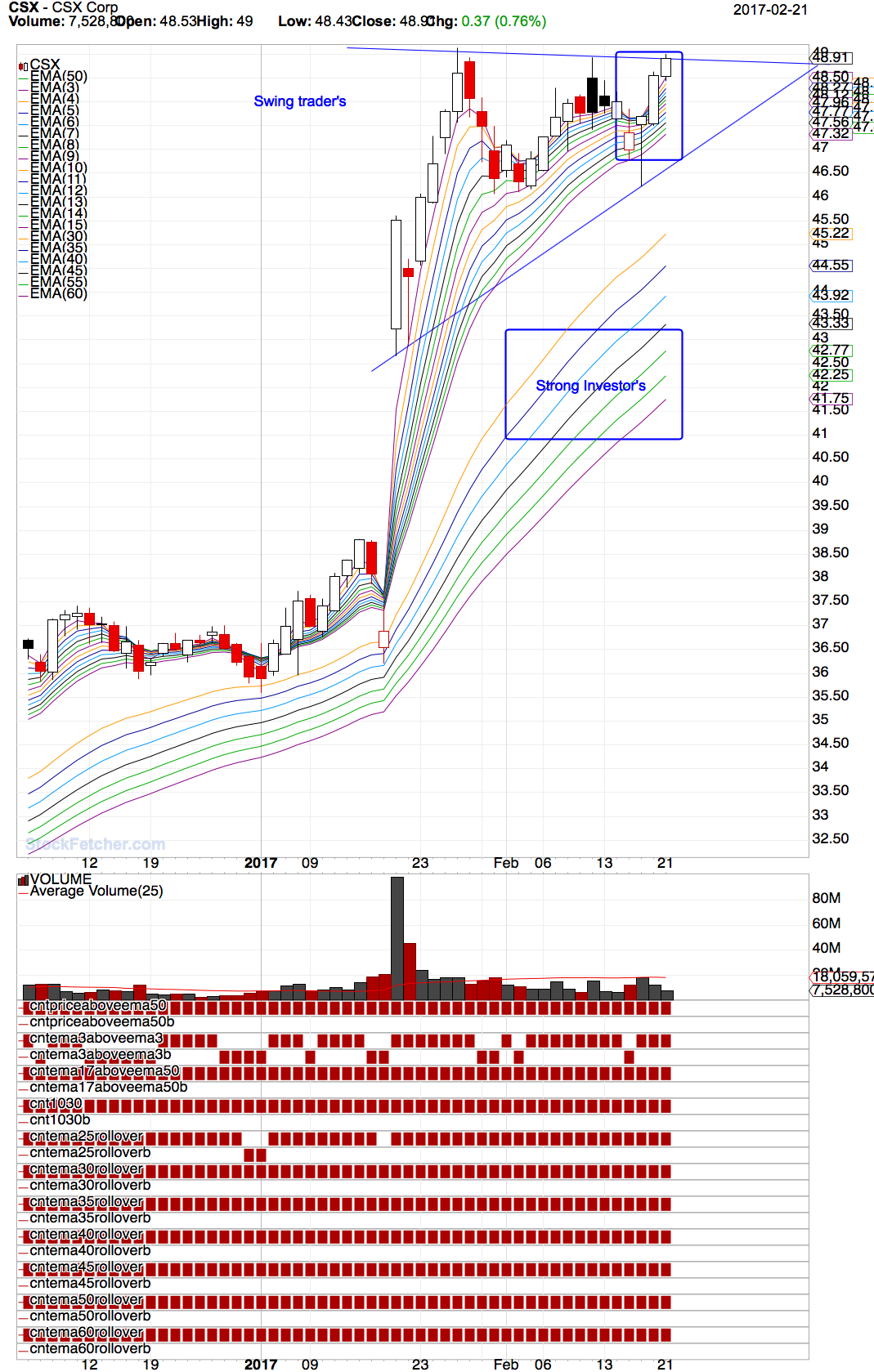

2/20/2017 1:14:12 PM Kind of a off shoot from the CLVS thread ADR(30) at 2.55 Here's a good setup that is primed to go higher. CSX  |

| pthomas215 1,251 posts msg #134433 - Ignore pthomas215 |

2/21/2017 10:39:19 AM mac, are you liking CLVS at the newly minted discounted price?? |

| Mactheriverrat 3,178 posts msg #134447 - Ignore Mactheriverrat |

2/21/2017 10:37:04 PM CLVS - everyone is waiting on earnings CSX- Starting to run at resistance and knocking on the door.  |

| StockFetcher Forums · Stock Picks and Trading · CLVS on watch for Monday. | << 1 2 3 4 5 >>Post Follow-up |