| StockFetcher Forums · Stock Picks and Trading · BZUN WEEKLY buy signal | << 1 2 3 4 >>Post Follow-up |

| sandjco 648 posts msg #138263 - Ignore sandjco |

9/19/2017 9:01:51 AM Mac... I may be mistaken...the script on the last line above shows: Set{cntema60overema60b,count( eMA(30)< EMA(30) 1day ago,1)} draw cntema60overema60b Shouldn't it be eMA(60) < eMA(60) 1 day ago instead of 30? Thanks |

| Mactheriverrat 3,178 posts msg #138274 - Ignore Mactheriverrat |

9/19/2017 7:22:07 PM Great catch! SF won't let me change it so here is the updated version. Guess when I'm typing I get happy hand and posted it wrong- Again thanks for catching it. Submit |

| Mactheriverrat 3,178 posts msg #138275 - Ignore Mactheriverrat |

9/19/2017 8:04:05 PM Do a search on 1 month ago by % gain and see the energy that can be harnessed. |

| pthomas215 1,251 posts msg #138276 - Ignore pthomas215 |

9/19/2017 9:34:10 PM Mac, good stuff. do you know how to write SF code that would create that deep belly BZUN had? I know it's an odd question, but I think there is something to higher volume tech stocks that have that deep rounded belly shape. |

| Mactheriverrat 3,178 posts msg #138277 - Ignore Mactheriverrat modified |

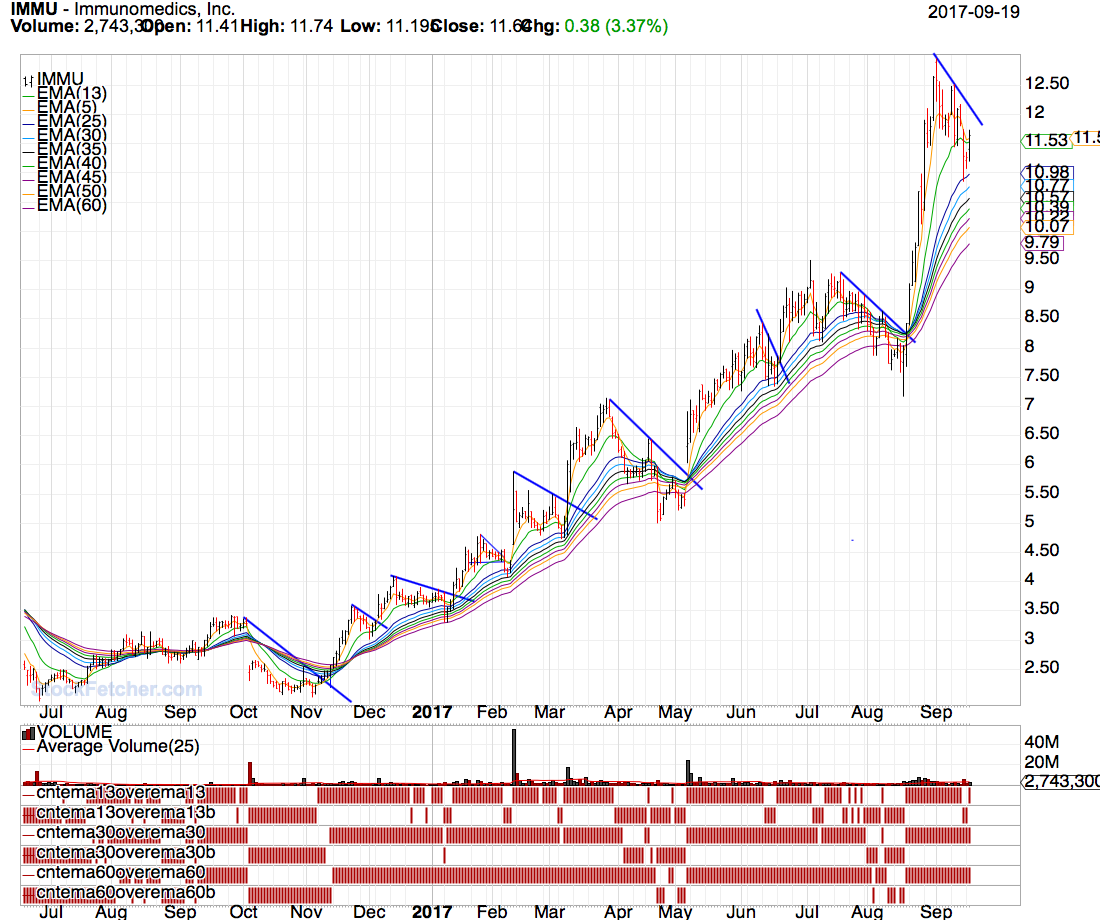

9/19/2017 11:19:18 PM @pthomas Don't know of any code. My idea is wait for a remount of the price to go above the EMA(13) which moves the ema(13) up from a day ago. Using * AxA is number of consecutive days EMA(13) above (+)/below(-) previous EMA(13) */ Then put it in a watch list symlist . Take IMMU . Remounted above the ema(13) and did move the ema(13) up from the day before but hasn't broke above the downtrend resistance line. Its on a watch list for tomorrow. My bet is if it can break above that down trend line then were off to the race's again on the longer term trend. If it doesn't then more short term downward pressure. The deal is that a lot of other treader's see this same setup using the same data.  Let me add the use of Trend lines is also important too. |

| pthomas215 1,251 posts msg #138279 - Ignore pthomas215 |

9/19/2017 11:44:05 PM Thanks John. definitely a great one to add to the watchlist. Like MU, price action will probably drop down to the EMA(13) and bounce off it and off to the races again. |

| Mactheriverrat 3,178 posts msg #138280 - Ignore Mactheriverrat |

9/20/2017 8:29:17 AM HTZ on watch list |

| pthomas215 1,251 posts msg #138283 - Ignore pthomas215 |

9/20/2017 10:11:57 AM do you like HTZ cause the weekly crossed, 2 day has come down a bit and the 4 hour is coming back up? |

| Mactheriverrat 3,178 posts msg #138294 - Ignore Mactheriverrat |

9/20/2017 8:48:52 PM HTZ had crossed above the ema(13) |

| Mactheriverrat 3,178 posts msg #138298 - Ignore Mactheriverrat |

9/21/2017 10:20:39 AM Nice so far on HTZ- |

| StockFetcher Forums · Stock Picks and Trading · BZUN WEEKLY buy signal | << 1 2 3 4 >>Post Follow-up |