| StockFetcher Forums · General Discussion · What ever happened to TRO or 13th_floor? | << 1 2 >>Post Follow-up |

| DVMayfied 8 posts msg #136814 - Ignore DVMayfied |

7/18/2017 1:03:25 AM Had a chance to read through some old forum posts. Seems Run Forest Run and Deadly Combo were quite popular for intraday trading a few years back. Curious to see if they are still viable and being traded. Haven't seen many posts from either of them for a while. Is there a chat room or blog they are running? |

| klynn55 747 posts msg #136816 - Ignore klynn55 |

7/18/2017 7:59:11 AM tro who knows, the 13 th floor disappearance was interesting, he appeared as a laidoff mechanic, schooled by muddy, he and muddy started a free chat, some say the chat evolved into the investorslive chat , was 13th ,, Nathan Michaud. now investors live is about 200 per month with a few hundred members, brilliant if true! the bait was cast , jigged for months, hook is set! big bucks. |

| four 5,087 posts msg #136833 - Ignore four |

7/18/2017 12:06:29 PM https://www.youtube.com/channel/UCR05xm7kdj5NVSxsoBbbiYQ the rumpled one |

| shillllihs 6,102 posts msg #136836 - Ignore shillllihs modified |

7/18/2017 12:17:31 PM They vanished during the downturn of 08. I think one of them lives in a fallout shelter in Oregon. According to the YouTube videos he makes, he rents dvds from the public library and buys pots & pans from second hand stores. I think the other went on to purchase the Chicago Bulls with some of his winnings but I may be mistaken. |

| Mactheriverrat 3,178 posts msg #136853 - Ignore Mactheriverrat |

7/18/2017 7:30:26 PM Last tracking of 13th_floor I had he was at Investorsunderground. like klynn55 said |

| pthomas215 1,251 posts msg #136855 - Ignore pthomas215 |

7/18/2017 9:36:44 PM Mac, is it any good? Im always up for looking at new systems. |

| Mactheriverrat 3,178 posts msg #136856 - Ignore Mactheriverrat modified |

7/18/2017 11:13:42 PM It brings up many good picks- IMHO. Just depends what ones trigger ( system) is for getting in any pick. A lot of filters bring up the same stocks over and over. In talking 13th_floor's Deadly Combo filter. |

| pthomas215 1,251 posts msg #136858 - Ignore pthomas215 |

7/19/2017 12:50:05 AM thanks mac. you got us going on all that guppy stuff and it has been great..my favorite guppy... |

| Mactheriverrat 3,178 posts msg #136871 - Ignore Mactheriverrat modified |

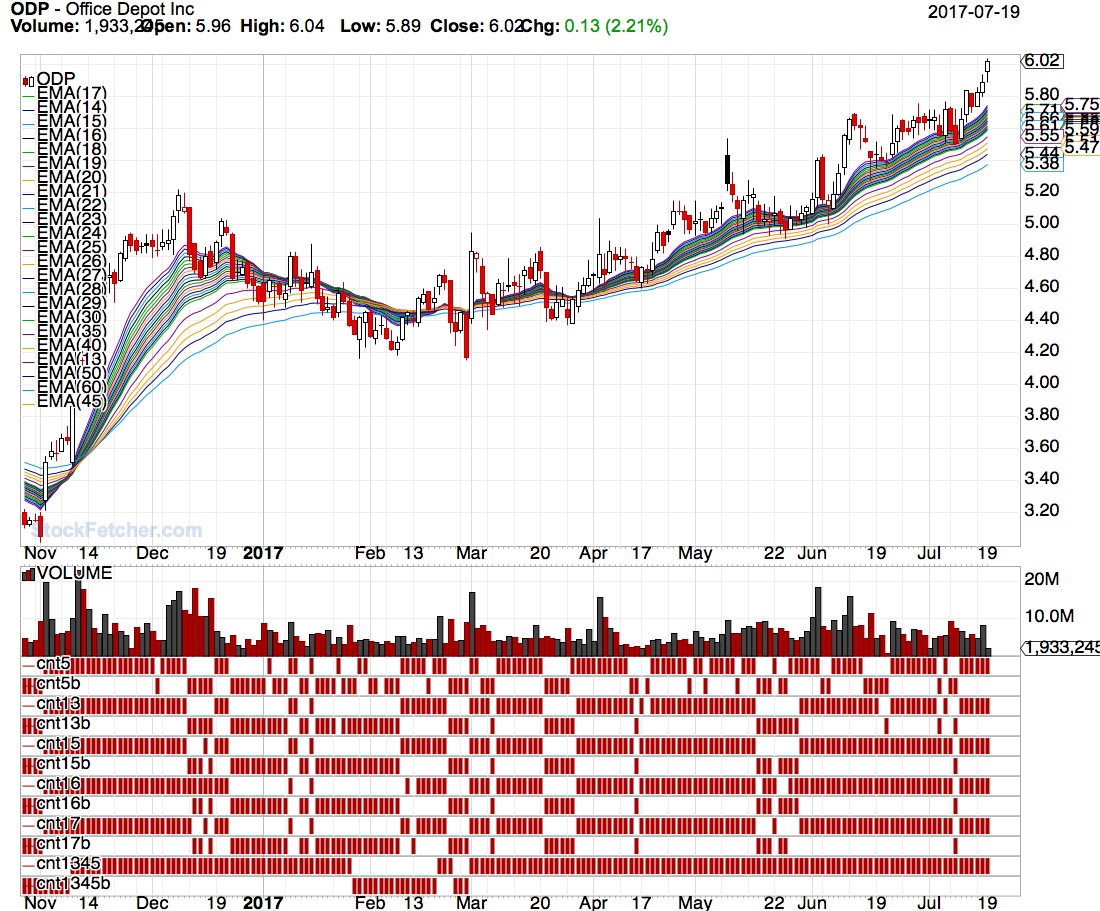

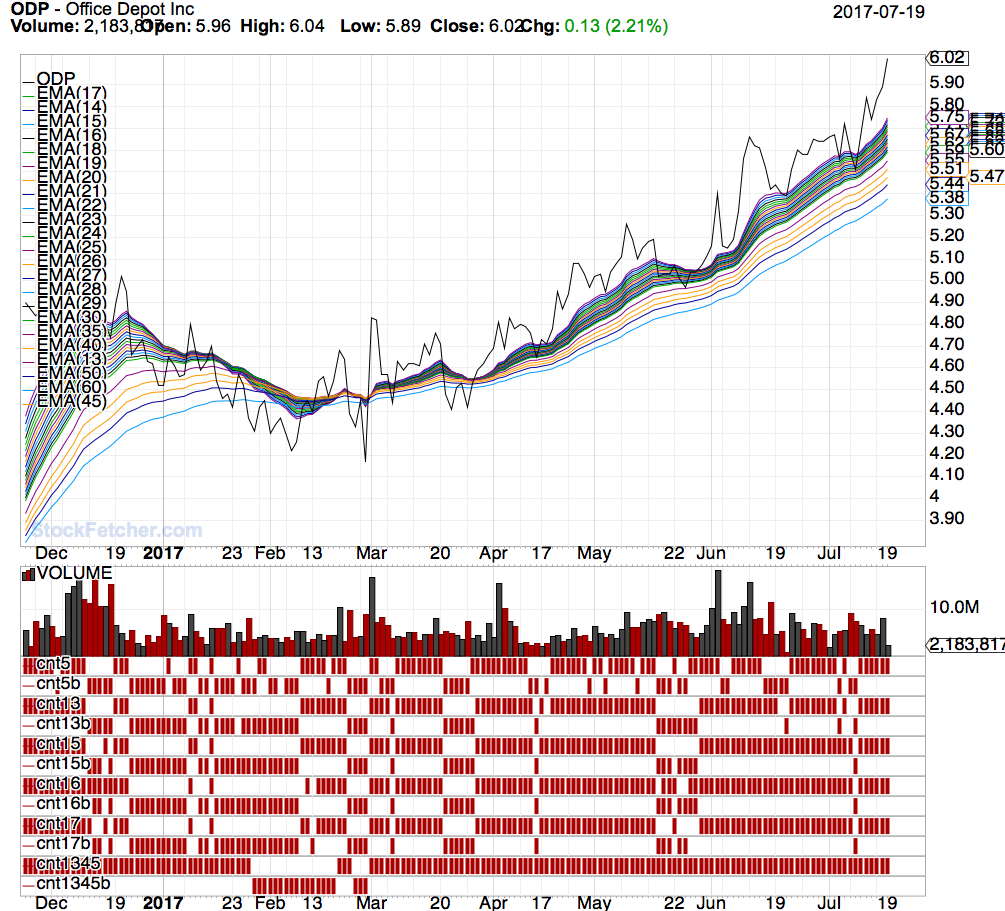

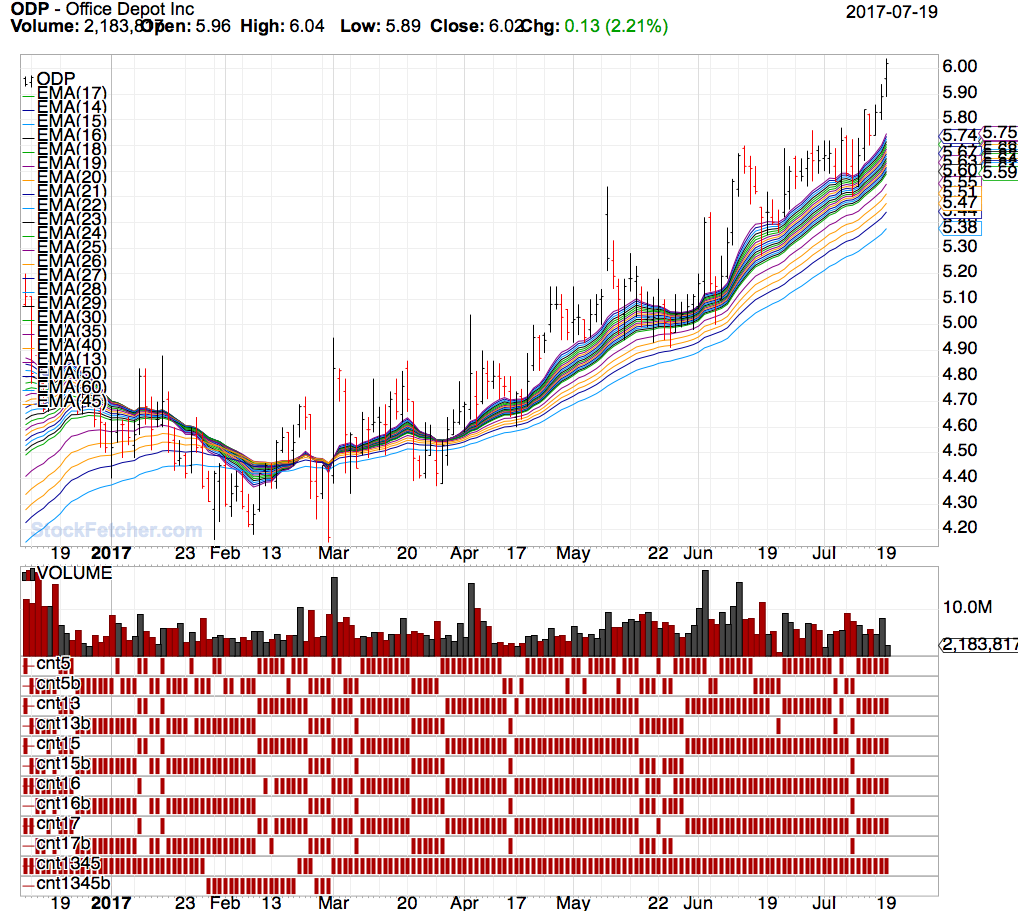

7/19/2017 11:56:06 AM I pay more attention to the longer term group. I'm playing around with the ema(13) to ema(17) as to short term trend with the ema(5) 1st day up as a good entry on a short term trend up using ema(13) to ema(17) on top of the longer Investor's group ( ema(30) to ema(60) trending up. ODP could be used as a example - Investor's group ( ema(30) to ema(60) trending up. ema(13) to ema(17) trending up nice and numerous ema(5) jumping in points  As no system is perfect but can be mess with to ones own liking. I using the ema(13) above the ema(45) as a new long term trend change. I don't even have the ema(5) plotted on this filter Same chart is line instead of candle's  Using OHLC on this same chart.  |

| Mactheriverrat 3,178 posts msg #136872 - Ignore Mactheriverrat |

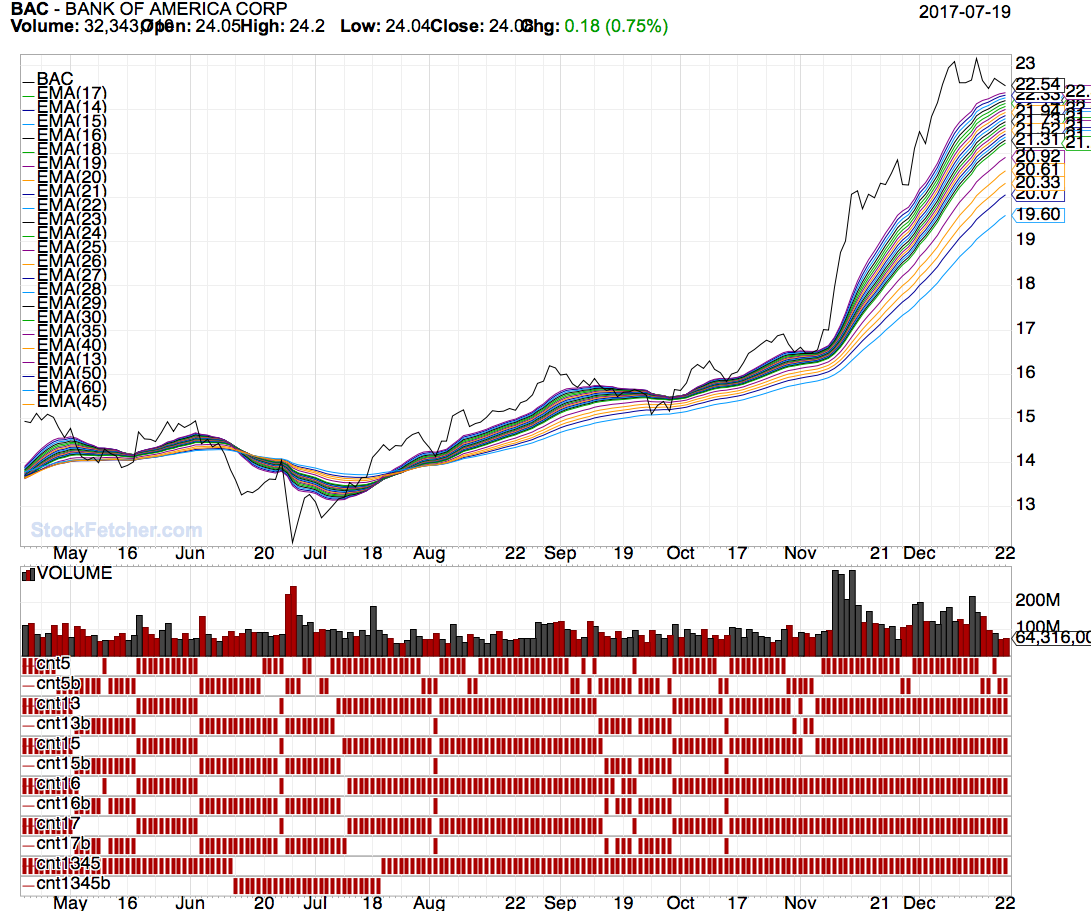

7/19/2017 12:07:00 PM Look what BAC did last year using this way of picking.  I think anyone here would have loved to been on that uptrend. |

| StockFetcher Forums · General Discussion · What ever happened to TRO or 13th_floor? | << 1 2 >>Post Follow-up |