| StockFetcher Forums · General Discussion · The Money flow trading system | << 1 2 3 4 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #156590 - Ignore Mactheriverrat modified |

4/13/2021 11:40:46 PM As of 4-13-21 with volume above 300000 , no etf, no otcbb there were 1389 stocks that SF showed that were in downtrending stage 3 mode. one stock like PLUG. Let a correction , market pull back or let a sell off happen like that of February of 2020. And this whole way of trading will kick in on a lot of stocks. |

| davesaint86 726 posts msg #156594 - Ignore davesaint86 |

4/14/2021 9:44:25 AM Mac, How is his trading strategy different Stan Weinstein's trading strategy? Is it basically a faster version of it? Davesaint |

| Cheese 1,374 posts msg #156596 - Ignore Cheese modified |

4/14/2021 10:10:16 AM @ John(Mac) Thank you for your posts and videos. my notes of GP's money flow system in your first video OHLC chart type EMA(5) EMA(10) MA(20) MA(200) RSI(14) TSI(25,13,7) MAC(12,26,9) and histogram Slow Stochastics %K(14,3) Support and Resistance your notes of GP's updated money flow system EMA 5 EMA 10 MA 20 RSI 14 Macd Histogram. Macd TSI I would like some clarification: 1. How does he define money flow ? 2. How does he define Stage 1,2,3,4 ? |

| Mactheriverrat 3,178 posts msg #156598 - Ignore Mactheriverrat |

4/14/2021 2:08:18 PM @davesaint86 Yes Stan Weinstein's trading strategy was the weekly using the 30 moving average and basically a faster version of it. Like he said it isn't exact moving average on daily charts. Now looking back i was buying some stock that were way over brought rsi. He has a weekly youtube he does but I'm impressed by what he giving and yes he's does have a few books one can buy and a 30 day boot camp for I think for $99 dollars. @Cheese Money flow inn't a indicator but the process by which he's catch's stock that are turning around. Stage 1 = End of down trend Stage 2 = Uptrending Stage 3 = starting of sideways movement. Stage 4 = Not to long and trying ti " catch a falling knife"'. |

| Mactheriverrat 3,178 posts msg #156599 - Ignore Mactheriverrat |

4/14/2021 2:14:25 PM His $25 kindle book that he sell needs to be updated with his current he uses. EMA(5) EMA(10) MA(20) MA(200) RSI(14) TSI(25,13,7) MAC(12,26,9) and histogram - Which you can't just have histogram on SF. Slow Stochastics %K(14,3) Support and Resistance I'm back with stock charts.com with the $14.95 plan I think it is. I just use SF for the scans right. Stockcharts of which I go to at some point again with the $24.95 is which you have more acesss to more indicators, scans, different folder of scans and watch lists. |

| klynn55 747 posts msg #156601 - Ignore klynn55 |

4/14/2021 5:28:12 PM from the first video, he advocates buying or shorting big name stocks at rsi 14 extremes , he likes buying stocks at rsi14 below 30 because they have always gone up. the actions of stocks in march 2021 sort of back up his theory or perhaps he is merely taking advantage of those stock actions back then, and another condition of extreme rsi readings are the stock prices is also ranged although when i applied a squeeze chart to the the ranging stocks the squeeze indi did not fire ! |

| Nobody 404 posts msg #156604 - Ignore Nobody |

4/14/2021 7:33:16 PM Thank you Mactheriverrat scan with close below MA200 - saw interesting opportunities |

| Nobody 404 posts msg #156605 - Ignore Nobody modified |

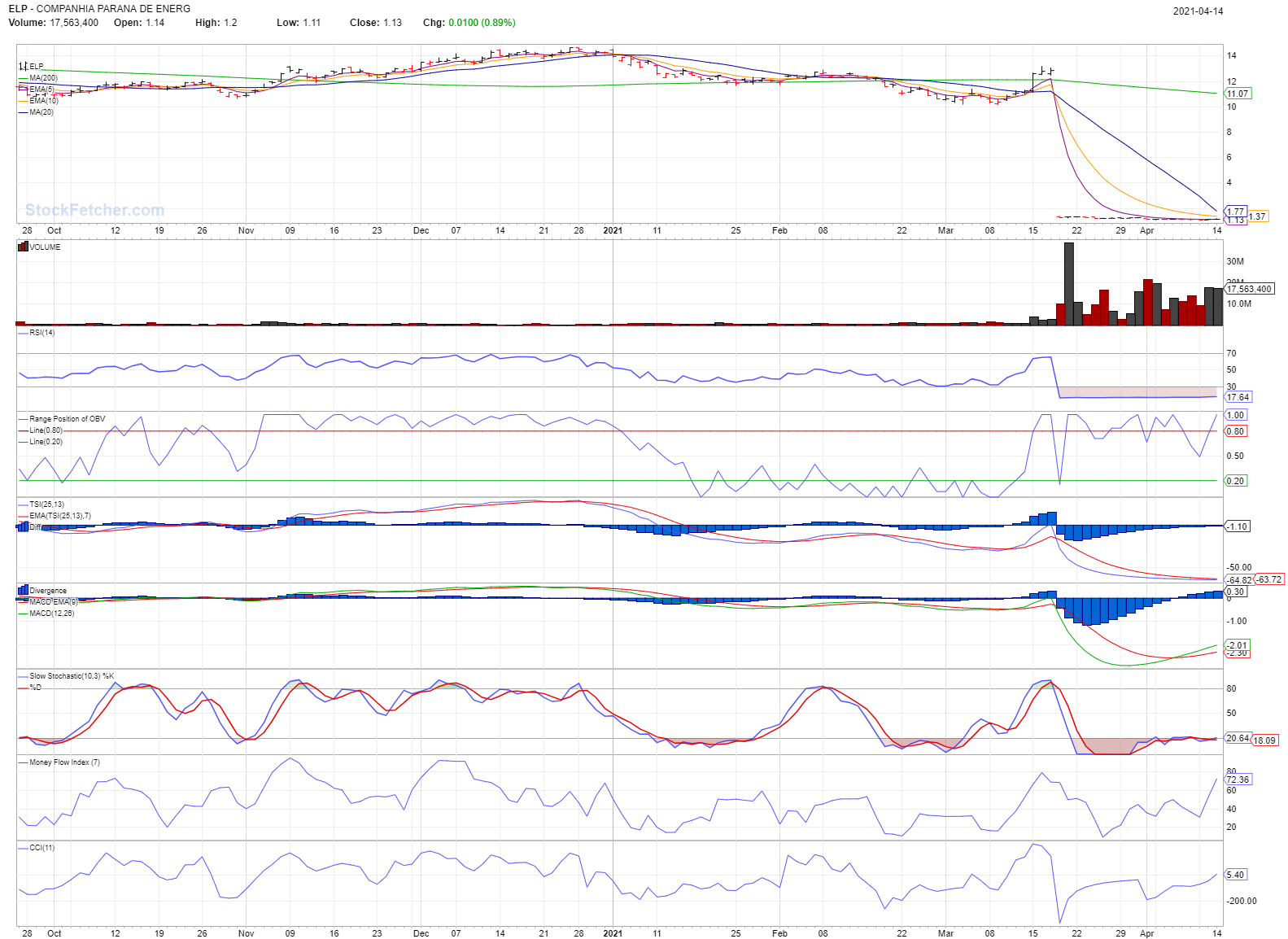

4/14/2021 7:45:23 PM Mactheriverrat Does this fit as tradable candidate?

|

| miketranz 979 posts msg #156607 - Ignore miketranz |

4/14/2021 9:45:48 PM Here's my take.You gotta love this guy,I mean he's for real.His presentations are not just interesting,there down right entertaining.As for his methodology,he's basically attempting to buying low/sell high,utilizing rsi (14).His buy trigger/execution point of entry is a crossover ma (20) from below.He references the initial break out/crossover as a stage 1 and goes on to the different stages in the stocks movement.He uses stop losses which is a plus.But wait,there's more.He takes advantage of high yield securities to further boost his return.This is pretty basic elementary stuff.Who wouldn't want to buy low/sell high? Larry Connors did extensive statistic backed studies on rsi,which is know for a fact works a certain percentage of the time.I felt the clips sent a positive message,a clear cut strategy,one that I would possibly use under the right circumstances.Send me a book.Best,Miketranz... |

| Mactheriverrat 3,178 posts msg #156609 - Ignore Mactheriverrat |

4/14/2021 11:38:30 PM @nobody NO!!! |

| StockFetcher Forums · General Discussion · The Money flow trading system | << 1 2 3 4 >>Post Follow-up |