| StockFetcher Forums · Filter Exchange · OPTIONS STRATEGY - SELLING WEEKLY PUTS | << 1 2 3 4 5 ... 7 >>Post Follow-up |

| Kevin_in_GA 4,599 posts msg #117800 - Ignore Kevin_in_GA modified |

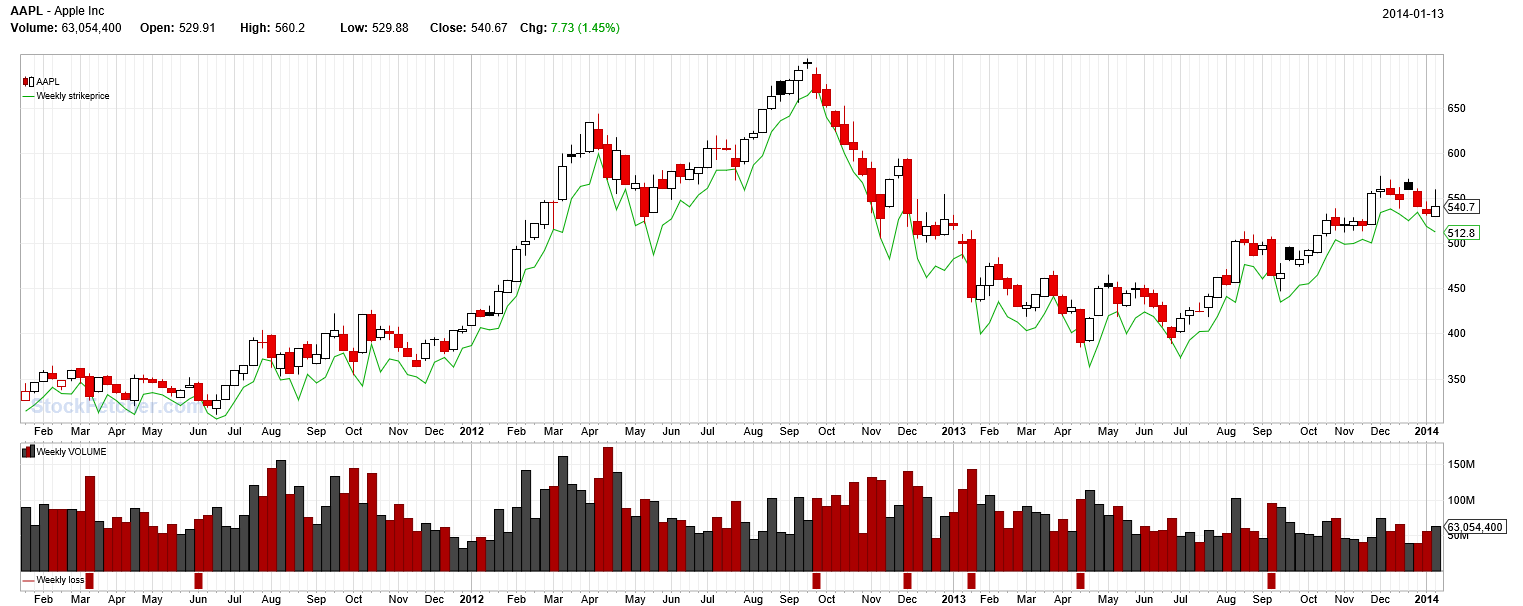

1/18/2014 6:26:39 PM I'm beginning to look more actively at options versus stocks, but with the intention of selling risk and using time decay to my advantage. Rather than look at multiple indicators and lots of possible stocks in which to invest - which is what I typically do - the approach described here is really quite simple (and thus I need at least several folks here to give me a reality check!). My evolving strategy is as follows: 1. Trade only on highly liquid weekly options - AAPL, GOOG, AMZN, PCLN, QQQ. They are by far the most heavily traded weeklies out there, and the bid/ask spreads are often as little as $0.02. There are plenty of buyers at almost every strike price. 2. Use theta decay as the main vehicle for profit - by selling the option instead of buying it, theta decay works to your advantage rather than against you. You accept a maximum potential profit in exchange for a higher likelihood of having the option expire OTM. The use of weekly options instead of monthly options significantly accelerates the time decay in your favor. 3. Sell puts at a strike price not likely to be reached prior to expiration - my thinking on this is to use a strike price that is one weekly ATR(5) below the current weekly close as the strike price for the next week's weekly options. So on Monday morning you sell puts for this week's options at the strike price that is 1 weekly ATR(5) below the previous weekly close. Statistically these expire worthless about 90% of the time. Here is the filter I am using: Backtesting this, you simply use "1 week ago" in the above filter to see if the put would have expired worthless or not (note there is a panel labeled "Weekly Loss" that shows a tick whenever the weekly close was below the strike price for the put). Here is the last three years for AAPL:  In this chart, you would sell a put at the strike price indicated by the green line (chart is a weekly chart, so you can see if by the end of the week the closing price was below or above the strike price). If it closed below there is a red box in the lower panel that indicates it. This goes back three years - you can see that the AAPL put expired worthless in 149 of 156 weeks (almost 95% of the time). Pretty good odds for such a short term play. One trade per week, which has a high probability of closing out profitably. The stats seem pretty compelling, which is why I want this idea challenged by others. I am just beginning to dip my toe into this pond, and plan to paper trade this approach using a TradeMonster account I set up specifically for this purpose. I would love to hear thoughts on this approach from more experienced options traders, and welcome critical thinking on how to make it better. Regards, Kevin |

| tedhill3470 1 posts msg #117803 - Ignore tedhill3470 |

1/18/2014 11:47:29 PM Kevin, I, too looked to options several months ago and got my feet wet with selling covered calls. In a rising market, making good money with cc's is relatively easy. Since I usually used the first strike OTM, I usually made the premium AND some capital gains on the stock. I next advanced to looking at weekly stocks that had at least a 1% profit, I wouldn't mind owning or selling the stock, and it paid a divided during the holding period. Those hat tricks are sweet, and the profit comes from the capital gains (if the price didn't drop too much in anticipation of the dividend), the premium and the dividend. A bit hard to find good ones, though. I tried to make sure that my downside protection was sufficient owing to the volatility of the stock, the stock was in a rising/neutral trend, and watched my indicators like a hawk to see if I should buy the calls back at any time. But that last sentence is the point of this post. Even as a rank amateur, even though I knew I had a lot to learn, I still managed to make $5K in about two months. I stayed away from selling puts because for some reason I just didn't understand them as well as I did selling calls. I stopped selling covered calls recently because (to me) things just got too frothy. If I understood selling puts I could be making good money on the way down, so I'm using the down time to continue my education about calls and puts, and to make sure I can answer the following questions: Is the stock in a downtrend/uptrend or rangebound? Which one is good for selling call? Puts? How do I repair an options play that goes bad? When should I roll forward an option? Roll down? Roll up? Why is a rangebound stock an excellent choice for an option play. Which indicators give me good notice when I'm in an option play? When is it a good idea to buy back your calls/puts? Why? Why you should be very happy with consistent 1% profit on weekly calls/puts. Ecstatic, actually. What is my actual strategy? (or strategies?) When do I sell STO OTM calls/puts? STO ITM calls/puts? Should I STO ATM calls/puts? What the heck do OTM, ITM, ATM and STO mean, anyway? What do I do when selling puts I get the stock put to me? When do I bail out of a covered call sale? What do I do if I bail out too late? Do I have any option repair strategies? How do I choose which stock to sell calls/puts on? Why are premiums so much higher for high volatility stocks? (Or, why the market makers pay you for taking on a lot of risk) What is the open interest in the stock strike price you're considering, and why it can be helpful. And a whole bunch more. Anyone who can't answer the majority of the above questions should really question their move into options. Frankly, drawing a line on a chart arbitrarily and basing your strike price on that line for such highly volatile stocks is NOT such a great strategy. I remember looking though all of the stock options books I've bought over the past several years asking myself, "Yeah, your demonstration is based on stock XYZ's strike price of $X.XX, but, darn it, WHY DID YOU CHOOSE THAT STRIKE PRICE?" Looking back, I think a good observation is that, when you can choose a strike price and know the reasons WHY you choose that price, and what to do before the trade goes bad, how you can tell as it goes bad, or after the trade goes bad, THEN you are at least somewhat qualified to start trading options. And to be able to answer the above questions a lot of self-education has to come first. 'Nuff said. Remember, I'm a rank amateur, just my opinion, and hope that someone who really knows what they're doing give a much better (and shorter) answer. If someone is bound and determined to use a "line in the sand drawn arbitrarily" to set strike prices with those stocks then at least paper trade or consider trying mini-options: There are six (I think) and they're listed at: http://www.cboe.com/micro/mini/ They are: Amazon Apple APDR Gold Trust SPDR S&P 500 Mini-SPX Index NASDAQ gives the prices for the mini-options right after the regular stock options i.e., GOOG GOOG7 http://www.nasdaq.com/options/ AAPL7, for instance allows options plays with only 10 shares. Goog7, etc. Good for those of us who don't have $115,000 sitting around waiting for a GOOG option play |

| Kevin_in_GA 4,599 posts msg #117806 - Ignore Kevin_in_GA |

1/19/2014 8:40:43 AM Lots of info here - thanks. I'll comment on only one line - If someone is bound and determined to use a "line in the sand drawn arbitrarily" to set strike prices with those stocks then at least paper trade ... The choice of strike price is critical in any options strategy, and in the proposed strategy it is anything but arbitrary. It is derived from the underlying stocks weekly volatility, and designed to insure a high probability of expiring worthless by the end of the week. I am not betting on the direction of the move as you had done, but rather betting that the probability of a large drop over a short time on these stocks is unlikely to occur, and the historical chart supports that premise. As long as it doesn't close the week below the strike price it expires worthless. I'll be paper trading this system mechanically for at least the next six months - I would never put my own funds into a new trading system without paper trading it forward for at least a few months, and this is no exception. I also look at the option pain (the price at expiration where the existing puts and calls would be worth the least total value). This price is where stocks often are "moved" by the market players to minimize their costs - this is like a magnet near expiration, so as long as you are below this point it adds some measure of safety to selling the put. You can find this info at http://www.maximum-pain.com/max-pain.aspx Tracking it here, the following puts will be sold at the open on Tuesday with expiration on 1/24: AAPL 520 PUT - current close is 540.67, option pain is at 547.50 AMZN 385 PUT - current close is 399.61, option pain is at 400 GOOG 1115 PUT - current close is at 1150.53, option pain is at 1120 PCLN 1130 PUT - current close is 1178.04, option pain is at 1175 The QQQ 85 put is awfully close to its current price, so I would not play that one (in there just in case folks are interested). |

| BarTune1 441 posts msg #117811 - Ignore BarTune1 |

1/19/2014 9:03:46 PM Note that, to employ this strategy, one would have to have an inordinate amount of capital/margin. Generally speaking, you'd need to have 30% of the amount required to acquire the underlying shares should the put be assigned. Being short one contract of the GOOG 1135 Put obligates you to buy 100 shares at $1,135; or $113,500 upon assignment. The margin requirement by your broker @ 30% would approximate $34,000 in cash for each contract written. Note also that your downside risk on the trade is also $113,500 per contract. A black swan would wipe you out. Typically, unless you are somehow otherwise covered (i.e., by being long another put via a spread), you probably shouldn't assume anymore $ risk on the position than what you would otherwise allocate to any other position in your portfolio. In other words, if your average position size was $100,000, it might be appropriate to write 1 contract. |

| Kevin_in_GA 4,599 posts msg #117812 - Ignore Kevin_in_GA |

1/19/2014 9:44:58 PM Good point - which is in part why I spent much of today reading up on credit spreads. It does reduce your margin requirement and potential losses, at the expense of roughly half to two thirds of your potential profit. Given the inherent volatility of options and the markets being at all-time highs, that is likely to be worth the cost. |

| mikea59 7 posts msg #117814 - Ignore mikea59 |

1/19/2014 11:02:43 PM Best off selling spreads rather than naked puts, or iron condors and such. The R/R on naked puts seems way out of whack to me. Perhaps look for high volatility, high priced stocks (not many to chose from), and do weekly spreads - you reduce the rewards, but limit your risk (max loss = Strike Price of Short Put - Strike Price of Long Put Net Premium Received), and greatly reduce capital requirements (huge). You still have theta work in your favor, get the high probability setup, take the trade off if you get to around 30% to 50% of max profit, or let it ride to expiration and avoid transaction costs for closing the trade. There's lots of people selling these kinds of strategies and these guys can show you how to do it for free (https://www.tastytrade.com/ý). If you think you might want to own a stock for the long term, then selling puts can be a decent strategy for getting a discount to the current price - I just worry about black swans as well. |

| alf44 2,025 posts msg #117815 - Ignore alf44 modified |

1/19/2014 11:07:29 PM . ... writing (ie. selling) NAKED PUTS / CALLS ... isn't even possible unless you're frickin' George Soros ! Your Broker won't ALLOW you to do it !!! Come On, MAN !!! --- Bull & Bear Credit Spread Strategies ... on the other hand ... could be a nice steady little income producing strategy !!! . |

| jimmyjazz 102 posts msg #117818 - Ignore jimmyjazz |

1/20/2014 11:05:33 AM I can sell naked puts. Not sure why you think that's unusual. I am in the camp that you're probably better off spreading the trade with a purchased put another strike out of the money. Now your risk is capped along with your reward. I don't think you'll see much difference wtih debit spreads, but you have alluded to the contrary. The main issue I see with debit spreads is that you need to close them out when things go well because both legs are in the money; hence, more commisions. Your broker might handle the wash, though. I prefer to purchase fairly deep ITM calls on stocks I am bullish on, and puts for those I am bearish on. Say, delta of 0.8 or so. They tend to move in a logical manner, whereas spreads can get crazy on the path to expiry. |

| jimmyjazz 102 posts msg #117819 - Ignore jimmyjazz |

1/20/2014 11:26:48 AM Here is an AAPL example for expiration this Friday: Sell JanWk4 $525 call Buy JanWk4 $522.5 call Net debit: $1.98 (split the bid and ask) Max profit = $52 (79.65% of trades) Max loss = - $198 (16.69% of trades) Other = -$73 (3.66% of trades, just averaging max gain and max loss) Your expectancy is $5.70 per contract. I'd trade 10 ($57), and my commissions would be $50 round trip. So, a net of $7 per 10 contracts. Chump change. No sense closing out legs that are OTM, though, so you could improve that commission number a bit. If I trade the credit spread: Sell JanWk4 $525 put Buy JanWk4 $522.5 put Net credit: $0.50 (split the bid and ask) Max profit = $50 (79.65% of trades) Max loss = -$200 (16.69% of trades) Other = -$75 (3.66% of trades) Your expectancy = $3.70 per contract. Trading 10, you're at $37. BUT your spreads will expire worthless almost 80% of the time, which saves $25 of commission per 10 contracts. That's actually a significant effect. Of course, you need margin to make this trade. |

| mahkoh 1,065 posts msg #117820 - Ignore mahkoh |

1/20/2014 12:56:50 PM You may want to look at return on margin (trade return / required margin) for selecting candidates. Be aware however that the higher this number the more volatility in the underlying the market expects, and usually not without a reason. And one other note: Weekly options start trading on Thursday. A substantial part of the decay you're looking to sell happens over the weekend. |

| StockFetcher Forums · Filter Exchange · OPTIONS STRATEGY - SELLING WEEKLY PUTS | << 1 2 3 4 5 ... 7 >>Post Follow-up |