| StockFetcher Forums · Filter Exchange · A NEW ^VIX TRADING SYSTEM | << 1 2 3 4 5 ... 49 >>Post Follow-up |

| StefanM 25 posts msg #130898 - Ignore StefanM |

9/6/2016 12:08:06 PM Yes of course, I understand you. Thank you .. :-) |

| Kevin_in_GA 4,599 posts msg #130900 - Ignore Kevin_in_GA modified |

9/6/2016 12:40:20 PM Weird day - the ^VIX index is up right now (+2.2%) but VXX is DOWN -1.78%. That is pretty crappy tracking if you ask me. I placed a limit order for 1000 shares of VXX at $34.00. Waiting to see of it fills. 14:55 PM - order filled at $34.00. |

| shillllihs 6,102 posts msg #130901 - Ignore shillllihs |

9/6/2016 12:43:55 PM All I could say about Tvix is, August 24, 2015 Vix spiked big, It took Tvix until sept 1st to spike to its high. Might just be delayed. Maybe 1 day when you find time, you can create an all in 1 SF. friendly watered down version of these. |

| Mactheriverrat 3,178 posts msg #130902 - Ignore Mactheriverrat |

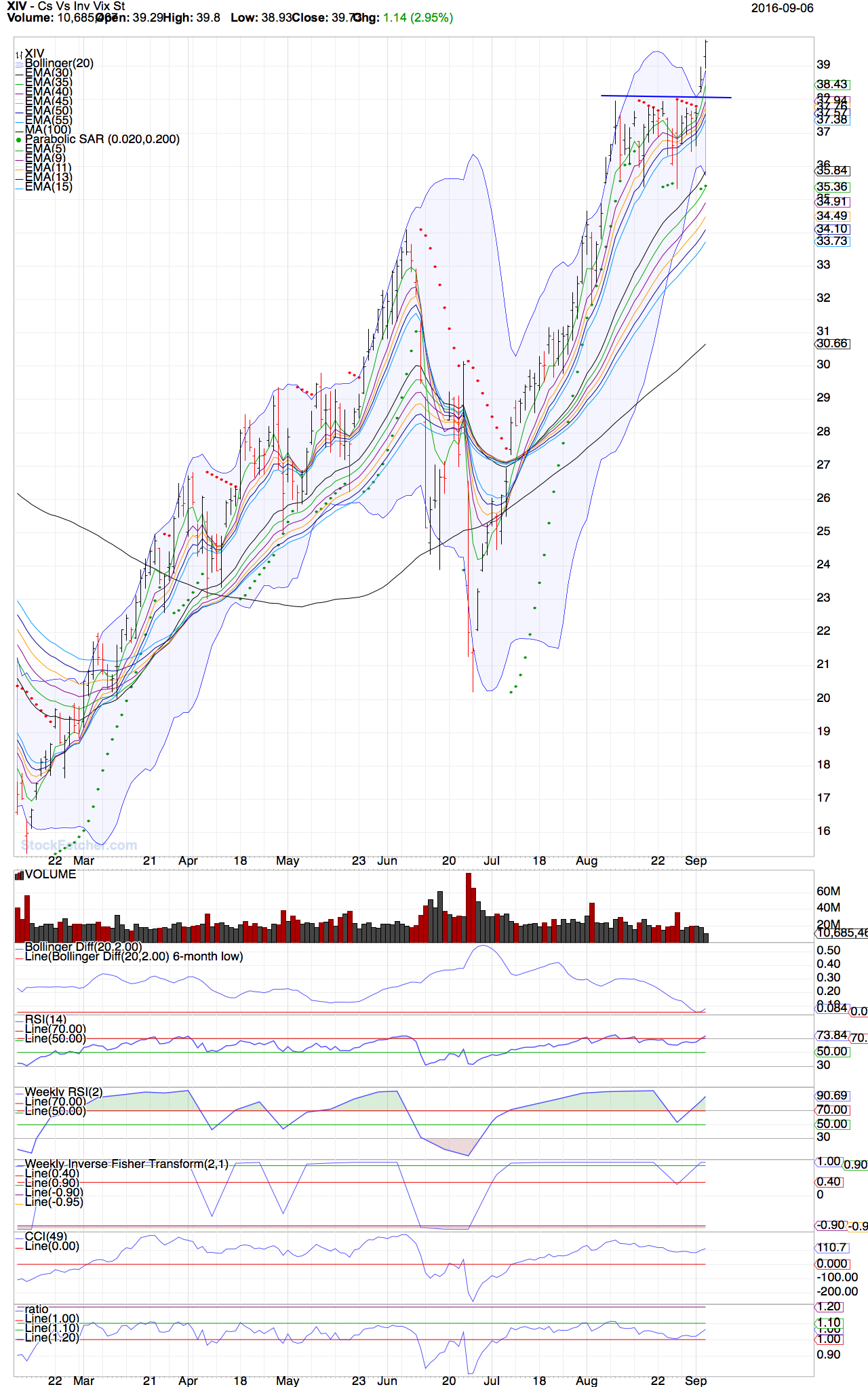

9/6/2016 2:30:28 PM So goes XIV , So goes SPY. XIV a few says faster than SPY. Just saying!  |

| Kevin_in_GA 4,599 posts msg #130910 - Ignore Kevin_in_GA modified |

9/6/2016 4:13:06 PM Looks like a new LONG entry signal from VIX LONG SIGNAL #2. Not sure if the open short position will trigger an exit - I will confirm both tonight with the Stratasearch nightly email of these signals. Right now I am holding 2 units of 1000 shares each (my chosen unit size). Therefore I do not need to enter another long position tomorrow if the signal is confirmed - you can act on this signal as you see fit. UPDATE: The Stratasearch filters are indicating no new positions. |

| mahkoh 1,065 posts msg #130915 - Ignore mahkoh modified |

9/6/2016 5:15:32 PM First of all, great work again Kevin! I would say that futures would be the trading vehicles that at least to some extent mimic VIX moves, but this obviously would not work for simultaneous long and short positions unless you choose different expirations for long and short trades. This comes with its own challenge, today's range for Sept futures was nearly 5 %, Oct expiration about 3 % and Nov expiration 2 % A better idea may be VIX options, although it is rarely a good idea to trade options at the open.There is some serious skew going on in these options. With VIX at 12.00 Sept 13 expiration's 12 strike has a bid/ask of 0.95 - 1.25 for the calls and 0.05 - 0.15 for the puts.The 12 calls give you 0.9 delta, if you want equal delta for the puts you'll have to go out all the way to the 16(!) strike. I think the best one could do is sell Sept 20 10 calls as proxy for short positions and buy Sept 20 10.5 calls if you get signals to go long. Deltas are over 0.99 for both and spreads 20 cents. It appears 10 is the the lowest available strike. On a side note: SF signals will not be valid until prices for VIX are updated. What you can do is add the following to the filters: add column ind(^VIX,close) If this column shows 0 SF uses yesterday's close and the signal is not yet valid. |

| BarTune1 441 posts msg #130923 - Ignore BarTune1 |

9/7/2016 9:50:58 AM Kevin, It might be useful to consider Larry Connors comments: http://tradingmarkets.com/recent/how_to_trade_volatility_-_part_1_vxx-1580168.html He suggests backtesting of the ^VIX is irrelevant in trading the VXX. Most of my systems for trading the VXX are based on signals based on the VXX. I have found ^VIX signals (extended) useful in trading the SPY. Perhaps you can find a way of trading the SPY, leveraged etfs or options on the SPY based on your ^VIX signals? |

| gmg733 788 posts msg #130944 - Ignore gmg733 |

9/7/2016 5:18:48 PM VXX is irrelevant in regards to ^VIX because VXX is based upon the futures contracts which have a cost to carry creating a drag on the instrument. Ie., it is a horrible long instrument unless you are 100% correct and you get a big move. From the prospectus (http://www.ipathetn.com/US/16/en/details.app?instrumentId=259118): Your ETNs Are Not Linked to the VIX Index: The value of your ETNs will be linked to the value of the underlying index, and your ability to benefit from any rise or fall in the level of the VIX Index is limited. The index underlying your ETNs is based upon holding a rolling long position in futures on the VIX Index. These futures will not necessarily track the performance of the VIX Index. Your ETNs may not benefit from increases in the level of the VIX Index because such increases will not necessarily cause the level of VIX Index futures to rise. Accordingly, a hypothetical investment that was linked directly to the VIX Index could generate a higher return than your investment in the ETNs. |

| Kevin_in_GA 4,599 posts msg #130945 - Ignore Kevin_in_GA |

9/7/2016 6:09:22 PM @GMG - thanks. I (perhaps like many others) thought that VXX tracked the VIX but clearly the above states that this is not really the case. Which leads to the following question - what DOES track the VIX and is tradeable? Futures or Options seem to be the only things that are directly linked? |

| Kevin_in_GA 4,599 posts msg #130946 - Ignore Kevin_in_GA |

9/7/2016 6:43:41 PM SIGNAL UPDATE: Buy-to-cover on the open ^VIX short entered on 8/29 (at 14.09, and closed today at 11.94 for a gain of 15.26%). The trade will be closed at the open tomorrow. The current Long position entered on 9/6 (from VIX LONG SIGNAL #1) is currently down -3.86%. |

| StockFetcher Forums · Filter Exchange · A NEW ^VIX TRADING SYSTEM | << 1 2 3 4 5 ... 49 >>Post Follow-up |