| StockFetcher Forums · Filter Exchange · MY XIV TRADING SYSTEM USING STRATASEARCH FILTERS | << 1 ... 31 32 33 34 35 ... 40 >>Post Follow-up |

| emwalker 35 posts msg #141423 - Ignore emwalker modified |

1/26/2018 3:46:06 PM Has anyone noticed that the market has been crushing it, while XIV is doing nothing? I keep looking at SPXL, and debating if that's where the trade should be, not XIV. Over the last month, SPXL is up 22% while XIV is up 1%. |

| Cheese 1,374 posts msg #141427 - Ignore Cheese modified |

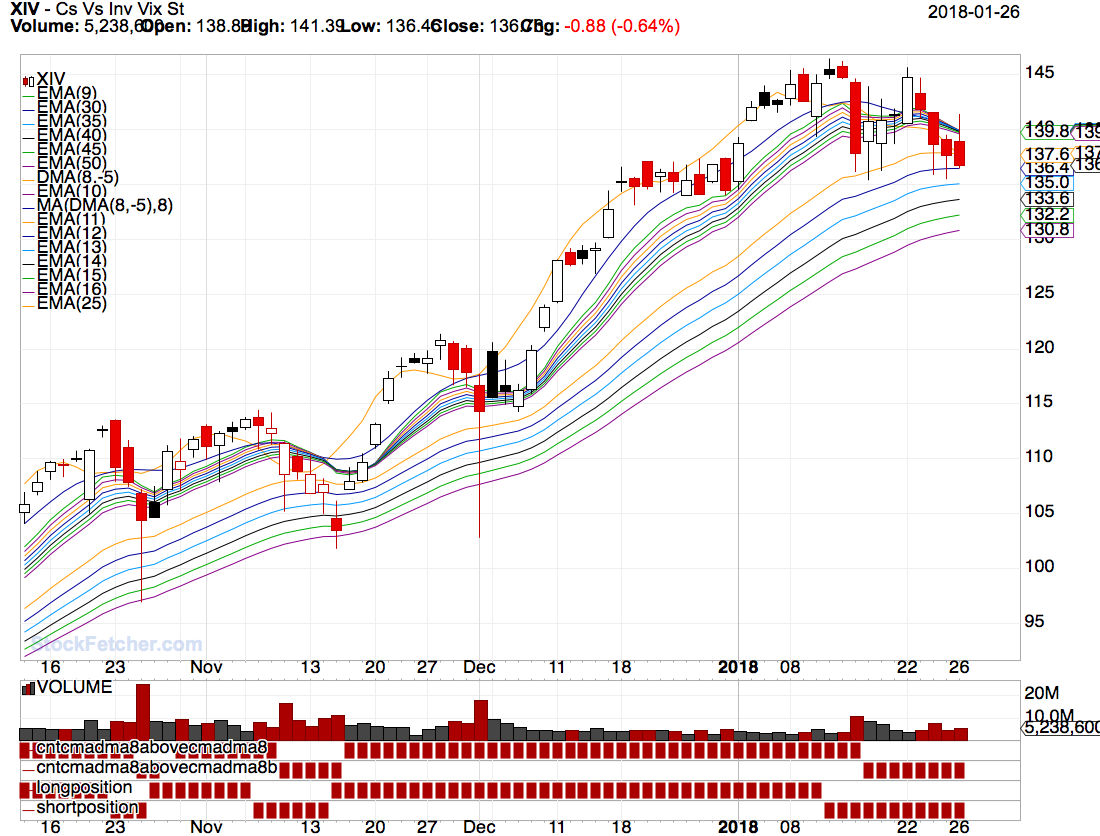

1/26/2018 8:16:36 PM A few people commented on Twitter about the disconnect between XIV and SPY (or UPRO), as well as between XIV and SVXY. In the past few days, SVXY was priced more fairly, while Credit Suisse allowed XIV to trade at over 2% premium. Earlier this morning Jan 26, 2018 some scalpers pushed that premium to over 4.4%. That premium then came off subsequently. Apparently, there were also some tax considerations as well, Also, some people bought protection for over the weekend as stock prices increased. Looking at XIV charts and filters by davesaint86 and MacTheRiverRat, it would appear that XIV is now resting on support of lower bollinger band(18,2).and Guppy investors group mMAs. What do I know. LOL, |

| pthomas215 1,251 posts msg #141428 - Ignore pthomas215 |

1/26/2018 9:30:39 PM Well, I think XIV has a total of 75% correlation with the S&P really, due to contango and backwardation issues. I use SSO, although i didnt reap the benefits today unfortunately. If you remember when Kevin went long on XIV the last time he ate 10 bucks or so initially and then it went on a run. I would think waiting until the price rests on the MA50 would be a buy signal. |

| Cheese 1,374 posts msg #141429 - Ignore Cheese |

1/26/2018 9:49:05 PM okay, thanks pthomas215 |

| pthomas215 1,251 posts msg #141430 - Ignore pthomas215 |

1/26/2018 10:14:50 PM youre welcome. |

| Cheese 1,374 posts msg #141438 - Ignore Cheese modified |

1/27/2018 12:09:22 PM In case anyone is interested According to a XIV discussion thread on Twitter explaining the drop in XIV premium: Credit Suisse created 2.5 million XIV notes on Friday Jan 26, a 25% increase over Thursday. After Friday close, the number of XIV notes is now back down to the level of Dec 27, 2017, which may alleviate the pressure of premium coming off. |

| Mactheriverrat 3,178 posts msg #141439 - Ignore Mactheriverrat |

1/27/2018 1:23:10 PM @chesse Been studying the slower cma(DMA(8,-5),8) average rather than the faster dma(8,-5),8) average  |

| tennisplayer2 210 posts msg #141440 - Ignore tennisplayer2 |

1/27/2018 5:31:55 PM Signals for 1/26/2018 Buy #13 Sell #30 Have a blessed weekend and good trading to all. |

| Cheese 1,374 posts msg #141442 - Ignore Cheese |

1/27/2018 6:14:27 PM Thank you, MacTRR and tennisplayer2 ! |

| emwalker 35 posts msg #141486 - Ignore emwalker modified |

1/29/2018 1:13:28 PM something for new traders who stumble upon this thread to think about... When considering if you want to follow this strategy or not, you should think about wash sales and your taxes. If you sell XIV for a loss, then buy it back again within 30 days (and you will if you're following this strategy), then you can't claim those losses on your taxes. So if you follow this strategy, you wont be able to claim any of the losses since you are constantly buying it, selling it, and buying again (within 30 days). In other words, you will pay taxes on every single gain, and you won't be able to reduce your total tax burden by claiming your losses. Someone correct me if I'm wrong. |

| StockFetcher Forums · Filter Exchange · MY XIV TRADING SYSTEM USING STRATASEARCH FILTERS | << 1 ... 31 32 33 34 35 ... 40 >>Post Follow-up |